What Wall Street Owes You (By Janet Tavakoli)

Janet Tavakoli is a Daily Bail reader. This is her most recent opinion piece as submitted to CNN.

By Janet Tavakoli

Goldman Sachs Group Inc. announced record earnings Tuesday of $3.44 billion for the second quarter of 2009. Goldman's stock price leapt 77 percent for the first half of 2009, and closed Tuesday at $149.66 a share.

Without an ongoing series of front- and backdoor bailouts financed by U.S. taxpayers, most of Goldman's record profits would not have been possible.

In April 2009, Goldman Sachs' CEO, Lloyd Blankfein, who received record salary and bonus compensation of $68.5 million in 2007, said that bonus decisions made before the credit crisis looked "self-serving and greedy in hindsight." Now, they look self-serving and greedy with foresight.

Goldman set aside $11.4 billion for employee compensation and benefits, up 33 percent from last year. That's enough to pay each employee more than $390,000, just for the first six months of this year.

In June, Goldman bought back its preferred shares, repaying $10 billion it received from the government's Troubled Asset Relief Program, or TARP, and setting it free of limits on executive compensation and dividends.

But pay is not the key issue. U.S. taxpayers deserve a large cut of the profits, not the chump change -- less than a half-billion dollars -- they got from preferred shares in the company and the relatively small amount they could get from warrants in its stock.

U.S. taxpayers should insist that a large part of Goldman's revenues and profits belong to the American public. TARP money was just part of a series of bailouts and concessions that allowed Goldman to prosper at the expense of a flawed regulatory system.

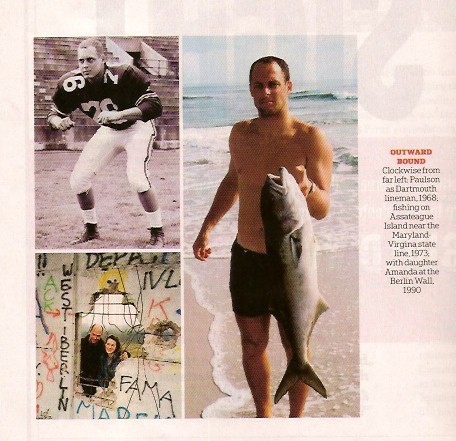

In March 2008, Goldman, a primary dealer in Treasury securities, was among the beneficiaries of a massive backdoor bailout by the Federal Reserve Bank. At the time, Henry Paulson, former CEO of Goldman Sachs, was treasury secretary.

In an unprecedented move, the Fed created a Term Securities Lending Facility, or TSLF, that allowed primary dealers like Goldman to give non-government-guaranteed "triple-A" rated assets to the Fed in exchange for loans. The trouble was that everyone knew the triple-A assets were not the safe securities they were advertised to be. Many were backed by mortgage loans that were failing at super speed.

The bailout of American International Group, or AIG, ballooned from $85 billion in September 2008 to $182.5 billion. Of that money, $90 billion was funneled as collateral payments to banks that traded with AIG. American taxpayers may never see a dime of their bailout money again, but Goldman saw plenty.

Goldman may be the largest indirect beneficiary of AIG's bailout, receiving $12.9 billion in collateral, including securities lending transactions, from AIG after the government bailed out the insurance company.

Read the whole article HERE.

Bonus Video of Janet's most recent CNBC appearance.

Janet Tavakoli, of Tavakoli Structured Finance, and Joel Telpner, of Mayer Brown, debate whether over-the-counter derivatives should be abolished.

Janet is author of Dear Mr. Buffett

Read a recent interview with Janet about her experience with the Oracle.

More of Janet with C-Span's Brian Lamb

DailyBail

DailyBail

Updated to reflect CNN Source.

Reader Comments (5)

http://watch.bnn.ca/#clip193973

If you're wondering where your comment went , I deleted it along with Janet's. I originally posted the entire article (because that's how she submitted it to me and it was what I thought she wanted) but it was copyrighted to CNN which I obviously didn't realize. And I called her the guest author because again that's what I thought she wanted..

It's all been sorted out.

...and a beauty.....I have such a crush on her. </blush>