U.S. Debt Default Would Not Be The End Of The World

Dean Baker:

The NYT had a piece on the implications of the United States hitting its debt ceiling and running the risk of defaulting on its debt. The article exclusively presented the views of people who portrayed hitting the debt ceiling and defaulting on the debt as being an end of world scenario.

It would have been useful to present the view of people who do not consider a default on the national debt to be the worst possible outcome. While there can be little doubt that a default on the U.S. debt would lead to a financial crisis and would likely permanently reduce the role of the U.S. financial industry in world markets, it is also likely the case that the United States would rebound and possible rebound quickly from a default.

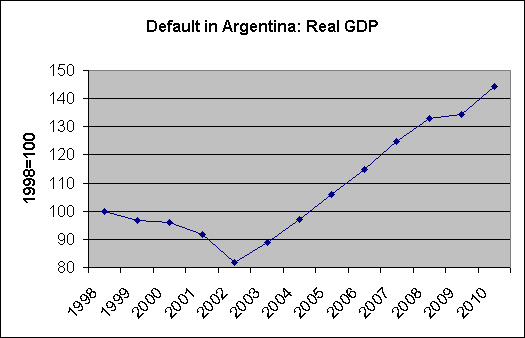

The experience of Argentina may be instructive in this respect. Argentina defaulted on its debt at the end of 2001. Its economy fell sharply in the first quarter of 2002 but had stabilized by the summer and was growing strongly by the end of the year. By the end of 2003 it had recovered its lost output. Its economy continued to grow strongly until the world recession in 2009 brought it to a near standstill.

While there can be no guarantee that the U.S. economy would bounce back from the financial crisis following a default as quickly as did Argentina, it's unlikely that U.S. policymakers are too much less competent than those in Argentina.

Readers should be made aware of the fact that countries do sometimes default and they can subsequently recover and prosper. Many people may consider the short-term pain stemming from a debt default to be preferable to the long-term costs that might come from policies adopted to prevent default.

For example, if Congress were to approve a Medicare plan along the lines proposed by House Budget Committee Chairman Paul Ryan, this would be subjecting tens of millions of middle class retirees to a retirement without adequate health care insurance and potentially devastating medical bills. Plans being put forward to cut Social Security could have similar consequences. Compared to these outcomes, a financial crisis and the subsequent slump that follows may seem like a relatively small cost.

It is also worth noting that two of the people whose views were presented in this article, Jamie Dimon, the CEO of J.P. Morgan (JPM) and Robert Rubin, a former top executive at Citigroup (C), are both individuals whose situation is likely to make them view a debt default as an end of the world event. Both institutions would likely not survive a debt default. For the people whose wealth depends on the health of Wall Street financial firms, a default on the U.S. debt is probably one of the worst conceivable events in the world, however this group is a tiny minority of the U.S. population.

###

Why We Must Freeze the Debt Limit

By CATO Economist Jagadeesh Gokhale

Excerpt

They all assert that failing to increase the debt limit could sharply undermine the economic recovery.

But that view could be wrong. A temporarily frozen debt limit could instead signal U.S. lawmakers' resolve to get our fiscal house in order. It may even reassure investors about long-term U.S. economic prospects.

With the national debt at $14.27 trillion and rising, Congress must soon approve an increase in the legal debt ceiling — now at $14.29 trillion — so that the Treasury can continue conducting the nation's fiscal operations.

Given the imbalance between obligations and revenue from taxes and other sources, the Treasury would technically be in default within a matter of weeks if it fails to obtain the legal authority to issue additional Treasury securities. Government officials fear that this outcome will cause financial markets to seize up and impede the economy's fragile recovery.

Ordinarily, a Treasury default would have a considerable negative effect on international financial markets. This could be heightened now — given the potential for an early end to the Fed's QE2 asset purchase program and continuing speculation about when (not if) the Fed will begin increasing its overnight borrowing rate.

Some private investors are already shorting Treasuries in anticipation of a decline in their prices. Others fear that if the debt limit is not increased soon, the expected gradual withdrawal from Treasury securities — the normal response during economic recoveries as investors begin to tolerate greater investment risks — may turn into a stampede.

How valid are these concerns? Not very.

Freshman House Republicans, however, insist that their mandate is to rescue the nation from the negative outlook that S&P is predicting could eventually cause a real debt default.

In contrast, the current prospect of a technical default, from failing to increase the debt limit, would not be due to any real national insolvency. Given today's low interest rates, the federal government could easily raise the resources needed to meet today's contractual government obligations.

The correct description for the technical default from Congress' failure to increase the debt limit, therefore, should be "a temporary suspension of fiscal operations to promote a more prudent fiscal course."

http://www.cato.org/pub_display.php?pub_id=13031

Apr 21, 2011 at 9:27 AM

Apr 21, 2011 at 9:27 AM

Reader Comments (10)

http://money.cnn.com/2011/04/19/pf/taxes/fraudulent_tax_returns

http://latimesblogs.latimes.com/washington/2011/04/ron-paul-is-not-a-birther.html

What REALLY Happens If We Default?

http://www.zerohedge.com/article/dean-baker-lets-just-default

Social Security isn't really broke our government is the crooks steal the money people are FORCED to pay. Putting in the stock market though like this article suggests is laughable.

http://www.dailyfinance.com/2011/04/15/social-security-isnt-broke-but-we-still-ought-to-fix-it/

The key domino in getting the world to accept a global fractional reserve currency is China.

Don't misunderstand, global currency is 100% suicide and will lead to an effective one world government by the oligarch banking families.

The private central bank in China is rumored to be 50/50 rather than 100% Rothschild owned as it is in the other 192 of 197 countries. Therefore, it is slighly harder to implement the private fractional reserve global currency in China than elsewhere in the Rothschild empire, excluding Iran, Sudan, North Korea and Cuba.

George Soros (Swartz) has the job of selling the Evelyn Rothschild (Bauer) plan for defacto global autocracy as instead being the salvation of the economic crisis.

event - reaction - solution

debt suffocation - fear of devaluation - global fractional reserve currency (world government)

Once the China domino falls, the door will be wide open to implement a private global currency in 193 countries. It will be touted as "gold backed" instead of "fiat", but actually will only be fractionally gold backed at less than 1:100.

More importantly it will be a private currency - meaning that Rothschild and the oligarch banking families will be able to create money autocratically with out input from the people of the world who use it.

This 'gold backed', fractional reserve, private global currency will be lent out to governments and individuals with usury. Thus ensuring literal debt slavery from cradle to grave for individuals and countries.

As the life blood of any society, Rothschild will hold everyone and every country in the palm of his hand. And once implemented, anyone who dares to oppose him can be taken off the grid with the flick of a key stroke.

Worse than heroin. As bad as cancer. Manifest dictatorship disguised as "economic freedom". Orwellian doublespeak - 100%.

Don't do it, ever.

http://www.newsmax.com/DougWead/ron-paul-israel-garybauer/2011/04/11/id/392440#ixzz1JFpw963B

Mouser a lot of people don't know that the Russians stopped a one world govt. years ago lol they didn't play along.

China has problems billions

China Inflation And Wage Protests Spread, Turn Violent

http://www.zerohedge.com/article/china-inflation-and-wage-protests-spread-turn-violent

I so wish it would happen -- if only to show Tim Geithner for the lying tool he really is.