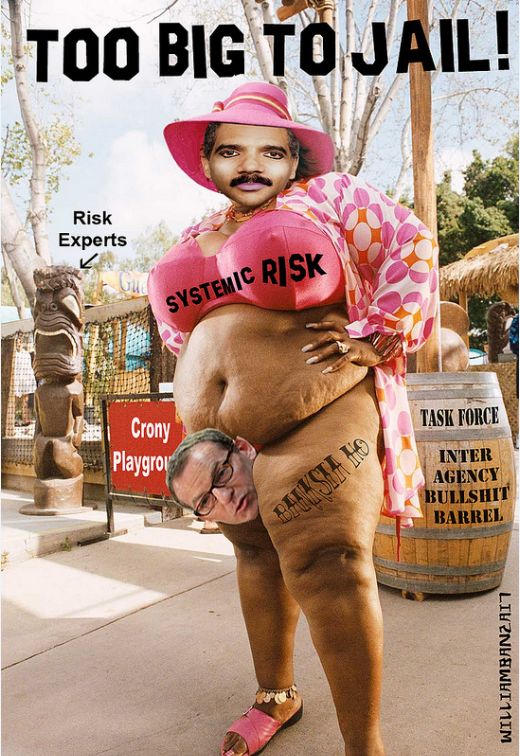

THIS IS NOT A JOKE: Lanny Breuer Named Vice-Chairman Of Covington & Burling, Will Head White Collar Criminal Defense Division

How can he return to Covington if he never left?

The revolving door is wide open and Mr. No Punishment For Wall Street just walked in wearing diamonds and a fur coat. He'll be well prepared for the job, which he himself highlights below in one of the most ridiculous quotes you will ever read.

We couldn't make this shite up if we tried.

---

Not an Onion headline.

Breuer Returning To Covington & Burling After Four Years Of NOT Prosecuting Wall Street

Bloomberg

After four years leading U.S. government efforts to prosecute financial crime, Lanny Breuer is returning to private practice where he’ll help expand his old law firm’s white-collar criminal defense practice.

Breuer, who this month left his job as head of the Justice Department’s criminal division, will become the vice chairman of Covington & Burling LLP, the firm he’s spent parts of 19 years with over the course of his career.

His return to private practice ends a term in which the division secured some of the largest criminal settlements in the department’s history, even as it faced criticism for not bringing cases against Wall Street executives over the 2008 financial crisis.

The 54-year-old Breuer rejoins Covington’s Washington office in a newly created role. As vice chairman, he said he plans to spearhead the development of a large practice covering white-collar defense, civil-litigation and crisis-management.

“I now have such an intuitive and nuanced sense of how the Justice Department, how the government, makes important decisions,” Breuer said in an interview yesterday at the firm’s Washington office. “I believe I can help companies and individuals act appropriately.”

Breuer has a two-year “cooling off” period where he isn’t allowed to set foot in the Justice Department or work on issues he oversaw while leading the criminal division. He said he’s allowed to advise clients on new matters and will have “an ethics officer on speed-dial” while navigating his return to Covington, the only place he’s worked in private practice.

Former Major League Baseball star Roger Clemens and former Citigroup Inc. Chief Executive Office Charles Prince are also among his previous clients, according to the disclosures.

Lawmakers also faulted him for failing to notify superiors of problems during a bungled federal gun operation known as Fast and Furious. Breuer was admonished by Holder after he acknowledged in 2011 that he knew discredited “gun walking” tactics were used in an operation prior to Fast and Furious and didn’t alert his superiors or take steps to prevent them from being used again.

Continue reading at Bloomberg...

---

This short clip is why Lanny resigned from DOJ:

Best clip from The Untouchables. Full story inside.

Check this: Eric Holder, Lanny Breuer Linked To Banks Accused Of Foreclosure Fraud

Brilliant:

SATIRE: Lanny Breuer On Wall Street Fraud

Full story on Breuer's resignation:

Wall Street Shill Lanny Breuer Done At DOJ

Apr 3, 2013 at 1:21 AM

Apr 3, 2013 at 1:21 AM

Reader Comments (13)

-----------

Covington renewables.

http://www.cov.com/industry/energy_natural_resource/renewables_cleantech/

http://www.huffingtonpost.com/2012/01/20/eric-holder-banks-lanny-breuer_n_1218452.html

Place your bets on Holder ever disclosing those names. He won't because (1) he's a corporate gelding and a tool, not a man of his word, (2) those "experts" are either clients of or partners at Covington & Burling who (3) have co-opted the DOJ, which means a good part of executive branch authority lies outside the government, and (4) Grassley and Brown are part of a bad charade that includes a fake resistance to it all from weakling senators who in the end will obey orders and do nothing to compel the disclosure of the experts' names.

That is all.

You did a fantastic job creating the clip. I posted it here.

http://dailybail.com/home/spoof-lanny-breuer-on-wall-street-fraud.html

Nicely done.

Traitorous pig fucker Breuer.

http://www.washingtonpost.com/business/regulators-ignored-complaints-months-before-taking-action-against-600m-ponzi-scheme-in-nc/2013/03/30/6fd138bc-993d-11e2-b5b4-b63027b499de_story.html

Happy Easter!

http://rjmoeller.com/wp-content/uploads/2012/09/Jesus-Money-Lenders.jpg

http://www.globalresearch.ca/you-can-legally-bribe-a-government-official/5465490

Janine Jackson interviewed investigative reporter Lee Fang about Washington’s revolving door for the July 24 CounterSpin. This is a lightly edited transcript.

Janine Jackson: When Eric Holder first joined law firm Covington & Burling in 2001, he was coming from a stint as deputy attorney general under Bill Clinton. So it’s no wonder that when Holder went to the Obama administration as attorney general, the folks at Covington kept his seat warm.

LF: Yeah, that’s right. You know, a few years ago, Reuters had a great investigation that showed that Covington & Burling has not only represented the big banks—Bank of America, CitiGroup, JP Morgan, Wells Fargo—but they played a really special role in the foreclosure crisis, helping these banks set up a mortgage company that helped create a document trail. When banks have attempted to foreclose on companies and they have to produce these documents showing that they have a chain of title, then this third party company, known as MERS, produced these documents, in many cases falsified these documents, and Covington’s role, actually, in the late ’90s—they provided the legal documentation to create MERS on behalf of Fannie Mae and Freddie Mac...

And indeed, for many, Holder’s seamless slide from theoretically prosecuting big banks to defending big banks from prosecution is a common-sense phenomenon only the hopelessly naïve would bother to decry. He’s a lawyer, what do you expect? was the substance of many a comment –of what comment there was, because, again, this latest glimpse of the porous tissue between regulator and regulated went down as no news at all for most of the press.

Our next guest does find that revolving door newsworthy. Investigative journalist Lee Fang has been talking about money and politics for years; he’s a co-founder of RepublicReport.org and writes at The Nation as well as The Intercept. He joins us by phone from the Bay Area.

Lee Fang: Hey, Janine. Thank you so much for having me.

JJ: Well, tell us first, if you would, a little bit about Covington & Burling. Who are they and who are some of their clients?

JJ: Well, tell us first, if you would, a little bit about Covington & Burling. Who are they and who are some of their clients?

LF: Covington & Burling is a Washington, DC, law firm that also engages in lobbying; it’s got an extensive practice that hires former members of Congress, their staff, former federal officials—including of course, Eric Holder—and it represents major corporations. So the firm has helped negotiate settlements for corporations that have been accused of wrongdoing, they’ve also helped secure legislation for their corporate clients and they’ve done a number of regulatory and lobbying acts that help provide their clients with special access to politicians.

JJ: And some of those clients have included some of the largest banks.

JJ: Well, in thumbnailing Holder’s tenure as attorney general, folks like the New York Times said, “His Justice Department wrested huge fines from banks, including JP Morgan Chase, Barclays and CitiGroup,” but seen another way, Holder by some lights didn’t so much try and fail to prosecute big banks as succeed in protecting them.

LF: That’s right. As the inspector general of the Justice Department found, under Holder the Justice Department actually deprioritized mortgage fraud in their US attorney offices in New York, California and elsewhere. So there was a systemic attempt to shift the blame for the mortgage and financial crisis in 2008. Instead of the big banks, there were only criminal prosecutions of some small-time lenders and mortgage professionals, but the big banks that really had the responsibility behind the financial crisis, there was no effort to make any criminal referrals that we know of publicly and, of course, there were no prosecutions of any of the large banks responsible for the crisis.

JJ: Well, when you talk about Eric Holder going from Covington & Burling to the White House back to Covington & Burling back to the White House back to Covington & Burling, the response from many could be summed up, I think, as “duh.” I mean, some of us don’t forget 1992 Hillary Clinton saying, “For goodness sakes, you can’t be a lawyer if you don’t represent banks.”…

=============

More DB links here Re; Covington and Burling:

http://dailybail.com/home/eric-holder-covington-burling-and-mers.html

http://dailybail.com/home/corzine-cronyism-bombshell-high-ranking-doj-lawyers-and-ag-e.html

Swiss bank's donations to Clinton Foundation increased after Hillary intervention in IRS dispute

http://www.foxnews.com/politics/2015/07/30/ubs-donations-to-clinton-foundation-increased-after-hillary-intervention-in-irs/

Donations to the Clinton Foundation by Swiss bank UBS increased tenfold after Hillary Clinton intervened to settle a dispute with the IRS early in her tenure as secretary of state, according to a published report.

According to the Wall Street Journal, total donations by UBS to the foundation grew from less than $60,000 at the end of 2008 to approximately $600,000 by the end of 2014. The Journal reports that the bank also lent $32 million through entrepreneurship and inner-city loan programs it launched in association with the foundation, while paying former President Bill Clinton $1.5 million to participate in a series of corporate question-and-answer sessions with UBS Chief Executive Bob McCann…

...UBS' legal battles with the U.S. government date from 2007, when a whistleblower told the Justice Department that UBS had helped thousands of Americans open secret accounts to avoid U.S. taxes. In 2009, the bank paid a $780 million fine and turned over the names of 250 account holders to U.S. authorities as part of a deferred-prosecution agreement.

However, that same year, the IRS requested that UBS turn over the names of U.S. citizens who owned 52,000 secret accounts worth an estimated $18 billion. The bank maintained that doing so would be a violation of Swiss privacy laws. The Journal reports that UBS enlisted the Swiss government to settle the matter. Clinton, recently sworn in as secretary of state, first met with her Swiss counterpart, Foreign Minister Micheline Calmy-Rey, in March of 2009.

...Under the terms of the deal, which was announced by Clinton and Calmy-Rey July 31, UBS would turn over information about 4,450 account-holders, a fraction of the 52,000 sought by the IRS.