The VERY Tiny Benefit of QE2 for Mortgage Holders

After 6 weeks of QE2, mortgage rates are higher.

This analysis from the WSJ was before the recent rise in rates caused by the deficit-raping Obama tax cuts. So the net effect is likely closer to zero at this point, though it was never going to be a game-changer for the economy, as shown below.

---

WSJ - $20 is the typical mortgage holder’s potential monthly savings as a result of the Federal Reserve’s latest effort to bring down long-term interest rates.

The country’s 53 million mortgage holders shouldn’t expect too much from the Fed’s latest bond-buying spree.

Interest rates on mortgages are one of the channels through which the Fed’s second round of quantitative easing — in which the central bank aims to spend some $600 billion on Treasury bonds — is supposed to boost the economy. By pushing down rates, the stimulus makes buying a home more attractive, and also allows homeowners to improve their finances by replacing their existing mortgages with new, cheaper loans.

But while $600 billion sounds like a lot of money, the added benefit for mortgage holders will likely be tiny. That’s in part because many of them can’t or won’t take advantage of the lower rates, and in part because the savings for those who do will be minimal.

Most people who are able to refinance their mortgages have long had the opportunity to do so. In the three months before the Fed first signaled its latest round of stimulus, the interest rate on a 30-year fixed-rate mortgage averaged 4.61%. That’s one percentage point below the rate about 56% of the nation’s mortgage holders are currently paying, according to mortgage-data provider LPS Applied Analytics.

Continue reading at the WSJ...

---

###

Related reading...

Dec 20, 2010 at 4:05 PM

Dec 20, 2010 at 4:05 PM

Reader Comments (5)

http://dailybail.com/home/deficit-giveaways-turn-obama-gop-tax-cut-bill-into-christmas.html

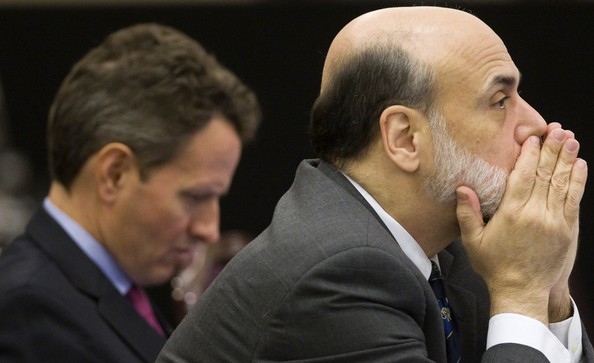

RED ALERT: Bernanke Is Out Of Bullets, But Not BOMBS

michael pento...

http://blogs.wsj.com/economics/2010/12/15/iphone-adds-19-billion-to-us-china-trade-deficit/

http://blogs.wsj.com/economics/2010/12/15/tax-deal-could-be-feds-savior/

http://blogs.wsj.com/economics/2010/12/15/economists-disagree-on-future-path-of-inflation/

excellent summary of opposing opinions...