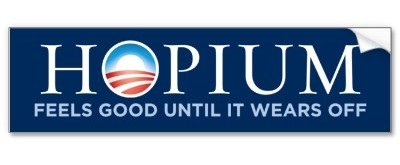

SMOKING HOPIUM: San Fran FED Research Director Predicts 4% GDP Growth In 2011

Dude is stoned.

WASHINGTON (MarketWatch) -- Economic growth has moved from "moderate" to "modest territory," according to John C. Williams, director of research for the San Francisco Fed, which compiled the Beige Book. Still, Williams says a double-dip recession is "highly unlikely" and expects the economy to grow between 3.5% and 4% in 2011. He added that inflation has fallen surprisingly little given the experience of past recessions, which he attributes to anchoring of inflation expectations, and therefore said the risks of sustained deflation or unacceptably high inflation "appear remote."

#

Meanwhile:

WASHINGTON (Reuters) - Projected U.S. economic growth for the rest of this year and next was revised down for a third month in a row by a panel of about 50 economists.

The latest Blue Chip Economic Indicators report on Thursday said the weaker outlook for second-half 2010 growth stemmed from lower expectations for consumer spending, business investment and private construction.

"Growth in the current quarter now is expected to be little better than the disappointingly soft advance registered last quarter," the survey said. Gross domestic product grew at a meager 1.6 percent annual rate in the second quarter, less than half the first quarter's 3.7 percent rate.

But the economists' group said that, after the mid-year soft patch, it saw a gradual improving trend setting in with growth slightly surpassing trend rate in the second half of 2011.

Blue Chip defines GDP trend growth at about 2-3/4 percent a year.

"For all of 2010, real GDP now is forecast to increase 2.7 percent on a year-to-year basis, 0.2 of a percentage point less than a month ago and 0.6 of a point less than predicted in June," the survey said.

Its consensus forecast for real GDP growth in 2011 was cut by 0.3 of a percentage point from a month ago to 2.5 percent.

#

John C. Williams, Director of Research, Federal Reserve Bank of San Francisco

Speech -- Sep. 8, 2010

Sailing into Headwinds: The Uncertain Outlook for the U.S. Economy

Thank you very much for coming today. This afternoon I'll be talking about the economy—where it's headed and my thoughts about why it hasn't done better. I should stress that my remarks represent my own views and not necessarily those of my Federal Reserve colleagues.

My title is "Sailing into Headwinds: The Uncertain Outlook for the U.S. Economy." You'll notice that I use the word "sailing," not "sinking." Given the very real economic disappointments we've experienced lately, it's important to keep in mind that we are making forward progress. Our economy continues to expand, even if the pace is slow. For those of you who are familiar with sailing, it's like beating to the windward with a very stiff breeze in our face. You don't get there fast and the voyage is rough, but eventually you do reach safe harbor.

I am confident we will find safe harbor, even if we feel a little seasick right now. Certainly we have experienced lackluster growth over the past several months and we face significant risks that could hold back the tempo of recovery. But the situation is much improved from the depths of the recession. The private sector is adding jobs and a truly terrible financial crisis is largely behind us. To keep things in perspective, think back to where we were just two years ago, when the financial system was on the brink of collapse, banks were fighting for their lives and some of Wall Street's most prominent names disappeared. We've come a long way since then. Meanwhile, Federal Reserve policies remain highly supportive of growth, our trading partners are recovering, and the confidence of businesses and consumers is gradually returning.

I won't pretend that some very serious problems aren't still with us, but I see a double dip into recession as highly unlikely. Instead, I expect the recovery to gradually gain momentum, which will fuel a slow return to health of the job market. Inflation should remain subdued and I think that both unacceptably high inflation and sustained deflation are very unlikely.

I'll talk about the economy in greater depth shortly. But first I'd like to try to demystify for you if I can the institution I work for—the Federal Reserve. You undoubtedly know that we are part of the government and that we conduct monetary policy. But, beyond that, there's much confusion about who we are, and what we do and don't do. The Fed is the nation's central bank, which means that we control the amount of money in the economy. In practice, we do this by adjusting the money supply to make the overnight interest rate that banks charge each other for loans what we want it to be. This, in turn, influences other interest rates and financial conditions more generally. And interest rates are one of the keys to how much people will spend and invest, which directly affects how fast the economy grows. All else equal, when rates are low, consumers and businesses are more willing and able to finance consumption and investment. High interest rates have the opposite effect, damping consumption and investment.

In the world of central banks, the Fed is a unique institution. When Congress created it in 1913, lawmakers wanted to make sure that it remained close to the communities it served. The Washington, D.C., Beltway didn't exist then, but you might say that Congress wanted to ensure that the Fed didn't get caught up in the inside-the-Beltway mentality. So, in addition to creating the Federal Reserve Board in Washington charged with overseeing the Federal Reserve System, it also chartered 12 regional Fed banks in cities across the country. The Reserve Banks are hybrid public-private institutions, with private-sector boards of directors. In fact, I and my colleagues at Reserve Banks are not government employees, but instead part of the private sector. Bank employees perform a variety of functions, including the supervision of banks, distribution of currency to financial institutions, and administration of the payments system. This structure allows the Fed to maintain close ties with local businesspeople and community leaders.

---

Of note yesterday:

NEW YORK (MarketWatch) -- The Treasury Department sold $21 billion in 10-year notes on Wednesday at a yield of 2.67%, the lowest since January 2009. Bidders offered to buy 3.21 times the amount of debt sold, compared to an average of 3.38 times at the last four comparable sales. Indirect bidders, a group which includes foreign central banks, bought 54.7%, compared to an average of 40% of the last four sales. Direct bidders, a class which includes domestic money managers, purchased another 6.9%, versus 14.3% on average. After the auction, the broader bond market remained lower, pushing yields up. Yields on 10-year notes /quotes/comstock/31*!ust10y (UST10Y 2.73, +0.07, +2.71%) rose 5 basis points to 2.65%.

DB here. How much did the Fed purchase for its own account? And, how much was purchased by banks with access to free money from the Fed?

Sep 9, 2010 at 12:50 PM

Sep 9, 2010 at 12:50 PM

Reader Comments (8)

John Williams

Executive Vice President and Director

"People have a constitutional right to burn a Koran if they want to, but doing so is insensitive and an unnecessary provocation -- much like building a mosque at Ground Zero," said the former Alaska governor.

http://www.breitbart.com/article.php?id=CNG.b4764205bad504ae78f7ea68148cb528.b81&show_article=1

So organizers went around campus and recruited more students to fill the seats.

http://www.cleveland.com/open/index.ssf/2010/09/tri-c_students_recruited_to_fi.html

HILARIOUS...

The United States slipped from second to fourth in the survey, behind Switzerland, Sweden and Singapore. It had fallen from first place the year before.

http://www.washingtonpost.com/wp-dyn/content/article/2010/09/08/AR2010090807266_pf.html

http://www.institutionalinvestor.com/banking_capital_markets/Articles/2660510/Paradise-Lost-Why-Fallen-Markets-Will-Never-Be-the-Same.html?p=1

Sep 8th 2010, 20:49 by R.A. | WASHINGTON

EMERGING markets have had a good decade. Rapid growth in China and India has pulled hundreds of millions of people out of poverty, sustained expansion has spread from Asia, where rapid catch-up has a long history, to South America, where halting growth and economic retrenchments were more the norm. These impressive expansions survived the recent downturn; while developed economies struggle to find their footing, China, India, and Brazil are closer to overheating.

http://www.economist.com/blogs/freeexchange/2010/09/emerging_africa

http://abcnews.go.com/Politics/Blotter/fbi-retaliation-koran-burning/story?id=11587779

http://www.dailymail.co.uk/news/article-1310344/First-Lady-Michelle-Obama-shows-moves-sports-field.html#ixzz0z3LBG4Qy

Great photos...i was very impressed...