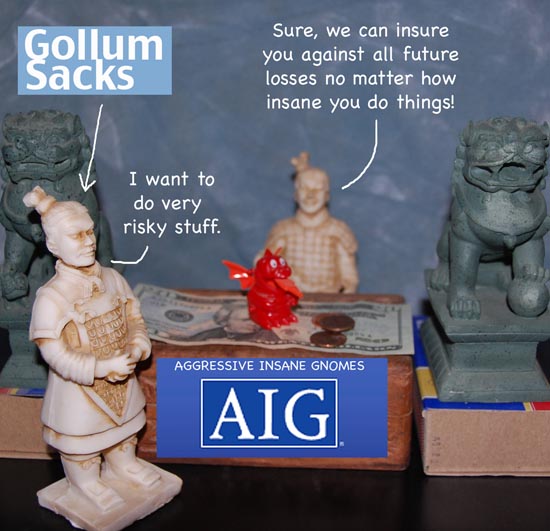

Show Us The AIG Emails (NYT Op-Ed From Eliot Spitzer, Frank Partnoy & William K. Black)

AIGFP Henchman Joseph A. Cassano

Op-ed originally appeared at the New York Times

We end this extraordinary financial year with news that the Treasury is in discussions with American International Group about selling the taxpayers’ 80 percent ownership stake in that company. The government recently permitted several banks to break free of its potential oversight by repaying loans made during the rescue. But with respect to A.I.G., the Treasury should not move so fast. There is one job left to do.

A.I.G. was at the center of the web of bad business judgments, opaque financial derivatives, failed economics and questionable political relationships that set off the economic cataclysm of the past two years. When A.I.G.’s financial products division collapsed — ultimately requiring a federal bailout of $180 billion — those who had been prospering from A.I.G.’s schemes scurried for taxpayer cover. Yet, more than a year after the rescue began, crucial questions remain unanswered. Who knew what, and when? Who benefited, and by exactly how much? Would A.I.G.’s counterparties have failed without taxpayer support?

The three of us, as experienced investigators and prosecutors of financial fraud, cannot answer these questions now. But we know where the answers are. They are in the trove of e-mail messages still backed up on A.I.G. servers, as well as in the key internal accounting documents and financial models generated by A.I.G. during the past decade. Before releasing its regulatory clutches, the government should insist that the company immediately make these materials public. By putting the evidence online, the government could establish a new form of “open source” investigation.

Once the documents are available for everyone to inspect, a thousand journalistic flowers can bloom, as reporters, victims and angry citizens have a chance to piece together the story. In past cases of financial fraud — from the complex swaps that Bankers Trust sold to Procter & Gamble in the early 1990s to the I.P.O. kickback schemes of the late 1990s to the fall of Enron — e-mail messages and internal documents became the central exhibits in our collective understanding of what happened, and why.

So far, prosecutors and regulators have been unable to build such evidence into anything resembling a persuasive case against any financial institution. Most recently, a jury acquitted Bear Stearns employees of fraud related to the collapse of the subprime mortgage market, in part because available e-mail messages suggested the employees had done nothing wrong.

Perhaps A.I.G.’s employees would also be judged not guilty. But we would like to see the record to find out. As fraud investigators, we would like to examine the trading patterns of A.I.G.’s financial products division, and its communications with Goldman Sachs and other bank counterparties who benefited from the bailout. We would like to understand whether the leaders of A.I.G. understood that they were approaching a financial Armageddon, and whether they alerted their counterparties, regulators and shareholders to the impending calamity.

We would like to see how A.I.G. was able to pay huge bonuses to its officers based on the short-term income they received from counterparties for selling guarantees that, lacking adequate loss reserves, the companies would never be able to honor. We would also like to know what regulators knew, and what they did with the information they had obtained.

Congress wants answers, too. This month, during hearings on Ben Bernanke’s nomination to a second term as chairman of the Federal Reserve, several senators fumed about being denied access to his A.I.G.-related documents.

No doubt, some of the e-mail messages contain privileged conversations among lawyers. Others probably include private information that is irrelevant to A.I.G.’s role in the crisis. But the vast majority of these documents could be made public without legal concern. So why haven’t the Treasury and the Federal Reserve already made sure the public could see this information? Do they want to protect A.I.G., or do they worry about shining too much sunlight on their own performance leading up to and during the crisis?

A.I.G.’s board of directors, a distinguished group of senior business executives, holds the power to decide whether to publish the e-mail messages and other documents. But those directors serve at the behest of A.I.G.’s shareholders. And while small shareholders of public corporations generally do not have the right to force publication of internal documents, in this case one shareholder — the taxpayer — holds an 80 percent stake. Anyone with such substantial ownership has effective control over corporate decisions, even if the corporation is a large public one.

Our stake is held by something called the A.I.G. Credit Facility Trust, whose three trustees are Jill M. Considine, a former chairman of the Depository Trust Company and a former director of the Federal Reserve Bank of New York; Chester B. Feldberg, a former New York Fed official who was chairman of Barclays Americas from 2000 to 2008; and Douglas L. Foshee, chief executive of the El Paso Corporation and chairman of the Houston branch of the Federal Reserve Bank of Dallas.

Ultimately, these three trustees wield all the power at A.I.G., and have the right to vote out the 11 directors if the directors are unwilling to publish the e-mail messages. In other words, if these three people ask A.I.G.’s board to post the messages and other documents, the board will have no choice but to comply. Ms. Considine, Mr. Feldberg and Mr. Foshee have the opportunity to be among the most effective and influential investor advocates in history. Before A.I.G. escapes, they should demand the evidence.

The longer it remains hidden, the less likely we will be to answer many questions about the A.I.G. collapse and the larger economic crisis — including the most important one: how do we prevent a repeat? Time is the enemy of effective investigation; records disappear, memories fade. The documents should be released — without excuses, or delay.

Dec 22, 2009 at 4:29 PM

Dec 22, 2009 at 4:29 PM

Reader Comments (6)

Surging Shadow Inventory Means Actual Housing Inventory Has Barely Budged At All

http://www.washingtonpost.com/wp-dyn/content/article/2009/12/21/AR2009122103269.html?hpid=topnews

http://english.cctv.com/20091222/102853.shtml

http://brucekrasting.blogspot.com/2009/12/us-treasury-deep-thinking.html

Inches Away From Finish Line, Abortion Divide May Still Torpedo Healthcare Bill

I just hope that a few political contributions do not make it go away, and then you see them as cabinet members in the next administration...

Stranger things have happened.