Robert Rubin Sounds The ALARM On U.S. Debt Crisis: "We're In Terribly Dangerous Territory, Bond Market Could Implode"

Hot off the presses...

Just a quick thought for Bob. Perhaps if you, Greenspan and Larry Summers hadn't done everything in your power to derail and destroy Brooksley Born in the late 90's when she warned on derivatives and attempted to regulate them at the CFTC, then we wouldn't be in this extend-and-pretend, fed-ponzi, economic-collapse, national-debt nightmare.

So, thanks for your hard work in that regard. Taxpayers appreciate it!

---

From Aaron Task at Clusterstock

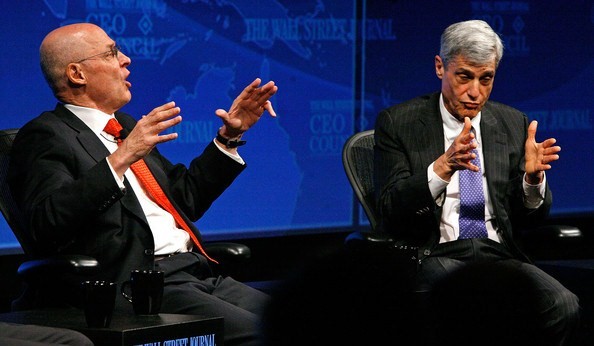

Warning of the risk of an "implosion" in the bond market, former Treasury Secretary Robert Rubin says the soaring federal budget deficit and the Fed's quantitative easing are putting the U.S. in "terribly dangerous territory."

Speaking at an event at The Pierre Hotel in New York City honoring Sen. Kent Conrad (D-N.D.), Rubin joined the growing number of current and former officials (foreign and domestic) to criticize QE2. The Fed's plan to buy $600 billion of Treasuries "has a lot of risk," he said, calling the international reaction "horrendous."

Rubin, who issued a similar warning about the bond market at The FT's "Future of Finance" conference in October, said Congress' vote on raising the deficit ceiling next spring could be the "trigger" for a rout in the Treasury market. Several Republican and Tea Party candidates vowed to not increase the government's debt ceiling unless Democrats agree to sharp cuts in spending that may not be politically tenable.

A Congressional standoff on the debt ceiling could spook international investors, Rubin said, alluding to a market event similar to the Dow's 778-point plunge on Sept. 29, 2008, when the House initially voted no on TARP.

While most pundits worry about the potential for China to dump its Treasury holdings, the former non-executive chairman of Citigroup said a financial version of the Cold War concept of Mutual Assured Destruction will likely prevent them from doing so. But he is worried about selling by the government's of Singapore, Hong Kong and Malaysia. "They could say ‘the Chinese are stuck but we're not,'" Rubin predicts.

Rubin's comments came during a panel discussion that also featured Sen. Conrad, chair of the Senate Budget Committee, former Nebraska Senator Bob Kerrey and former U.S. Comptroller General David Walker. The panel was moderated by former Commerce Secretary Pete Peterson, the senior chairman and co-founder of The Blackstone Group as well as founder of the Concord Coalition.

---

Video: Rubin speaks to students at Princeton...

What's interesting here is that this clip is from 2005. Just watch the first 2 minutes. An IMF bailout for the U.S?

---

Related stories:

-

FLIP-FLOP Fed Chairman - Greenspan The Bank Fraud Denier! - FLASHBACK To Battles With Brooksley Born

Nov 17, 2010 at 4:05 PM

Nov 17, 2010 at 4:05 PM

Reader Comments (4)

source for this story...

HOT: Former Treasury Secretary Rubin: Bond Market Could Implode; Vote to Increase Deficit Could be the Trigger