Peter Schiff: The Fed Has A Drug Problem, Bernanke Is Addicted To Printing

By Peter Schiff

Aug. 15, 2010

The FED is addicted to Quantitative Easing

This week, national attention was fixated on JetBlue flight attendant Steven Slater, whose bold, creative, and controversial exit strategy could revitalize his future prospects. Not nearly as noticed was the Federal Reserve's decision on Tuesday to avoid finding an exit strategy for its own never-ending career trap. Unfortunately, the Fed's choices affect our lives much more than Slater's.

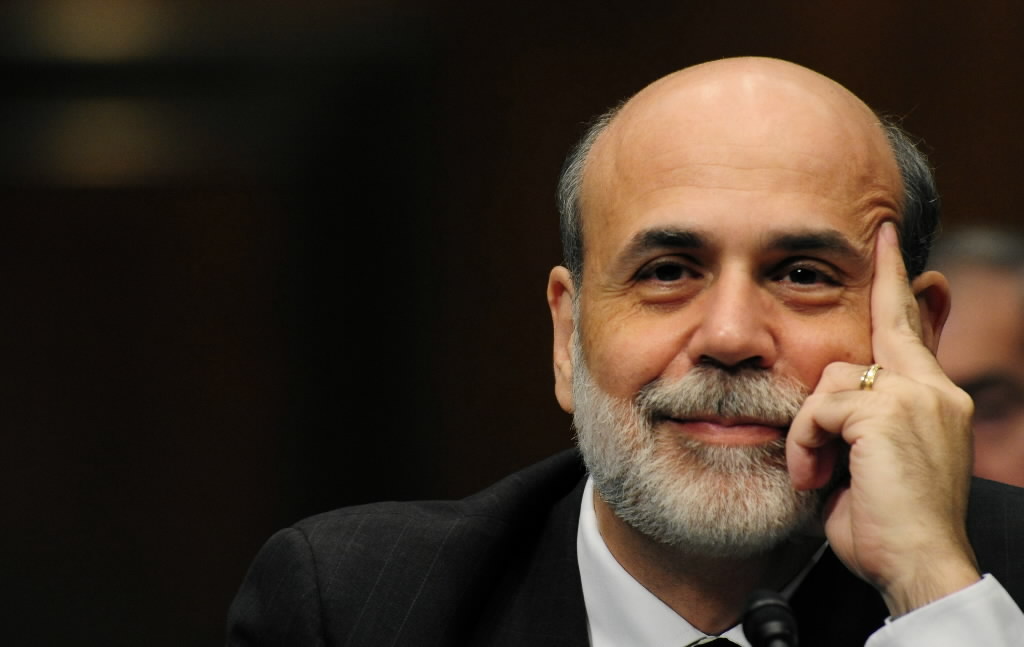

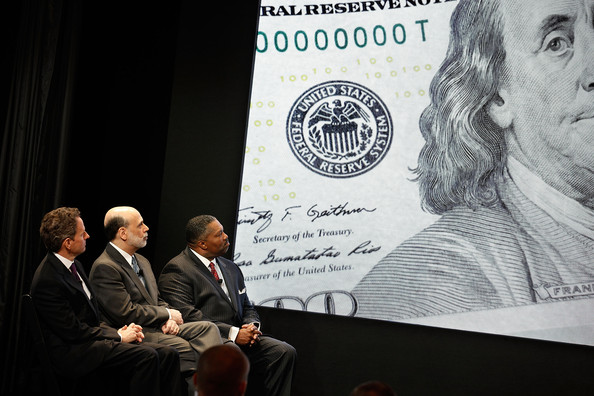

Just a few weeks ago, pundits were asking how Ben Bernanke would shrink the Fed's bloated post-crisis balance sheet. But in its August 10th decision, the Fed signaled that it would "recycle" its debt holdings; in other words, there would be no exit strategy for the foreseeable future. Given the fact that monetary stimulus will not only fail to spark a genuine recovery, but create a never-ending need for successively larger doses, Bernanke should grab a few beers and head for the nearest available emergency slide.

About a year ago, economic forecasters claiming insight into Fed deliberations spread the word that the central bank had devised a methodical exit strategy to unwind its balance sheet. The only question they thought worth discussing was when the plan would begin. Some even speculated that it already secretly had. In a July 2009 commentary entitled "No Exit for Ben," I argued that Bernanke and his cohorts never had any serious intention of implementing such a policy. I suggested that the Fed would continue to play the role of money-pusher - making sure the addicts were never denied a fix, even if an overdose threatened.

Like their patrons in the White House and on Capitol Hill, the Fed is totally dedicated to postponing the short-term consequences that would result from breaking America's addiction to cheap money and easy credit. Compared to this imperative, the long-term economic health of the country barely gets a second thought.

Any moves by the Fed to shrink its balance sheet, thereby withdrawing liquidity from the real estate market, would add significant downward pressure to home prices. Lower house prices would bring on an additional wave of foreclosures, which would then force many previously bailed-out financial institutions back into bankruptcy. (With foreclosure data growing more ominous despite the current stability in house prices, it looks like these institutions are headed back toward bankruptcy even with Fed support.)

To prevent this economic chain-reaction, the Fed will step in with "quantitative easing" as soon as it becomes obvious that the Administration's stimulus-fueled "recovery" of the past three quarters is fading. The problem is that each round of stimulus, as with each hit of an addictive drug, requires ever larger doses to produce the same result. The more leveraged an economy becomes, the bigger the lever required to move it. So the more the Fed stimulates now, the more it will be forced to stimulate later. The only exit strategy this course allows is an overdose - hyperinflation.

To counter these concerns, Bernanke and his supporters have said that their stimulus will be withdrawn as soon as the recovery takes hold in earnest. This misses the point that any "growth" created by stimulus is totally dependent on stimulus to continue. The "recovery" will end as soon as the stimulus prop is removed.

Those who fear a double dip recession are justified in their concerns, but they are also missing the big picture. The 2008 recession never ended. It was merely interrupted by trillions of dollars of stimulus that purchased GDP "growth" with borrowed money. But as the bills come due, GDP should now contract so we can settle up - but instead we'll take on more debt.

I expect the coming doses of quantitative easing will finally spark adverse reactions, first in the dollar and later in the bond market. When a falling dollar forces consumer prices and long-term interest rates to rise, the Fed's actions will be rendered impotent. The Open Markets Committee will have to make a horrific choice: fight inflation by tightening policy into a weakening economy, or fight recession by allowing inflation to burn out of control. I think it's obvious that they will choose inflation, all the while pretending that it doesn't exist.

Unfortunately, no one at the Fed has the honesty and courage to suffer the short-term shock that would accompany any meaningful exit strategy. Withdrawing liquidity and shrinking the Fed's bloated balance sheet would no doubt bring on a severe contraction in GDP, but the moves would also enable the US economy to form a solid foundation of savings, capital investment, and industrial production upon which a real recovery could be built. By contrast, more stimulus simply magnifies the imbalances, including excessive government spending, too much consumption, inadequate production, and artificially elevated asset prices. After decades of abuse, it's time for the Fed to take make a dramatic exit, because the US economy can't take it anymore.

Classic:

Aug 20, 2010 at 5:09 PM

Aug 20, 2010 at 5:09 PM

Reader Comments (19)

All human understanding is accomplished by simplifying, holding some variables constant and allowing other variables to trace their patterns so that we can draw lessons.

But we often find ourselves contemplating the contours of our theories and not the actual situation. Mathematics is indispensable but no one would be satisfied with calling a house a parallelogram, for example.

Peter Schiff, partly as a result of finding it necessary to raise his voice and repeat himself so much, seems to me to be a victim of mistaking his finger for what he is pointing at.

The target, human societies, are so complicated and difficult to understand that it is tempting for all of us to sit in front of our computers and imagine that our thoughts are the reality they only represent.

Clearly, I'm not going to substitute another theory for his variation of Austrian School Economics but I think it is dangerous or at least misleading to think we can gain clarity by repeating any one of so many economic mantras that necessarily simplify the world by leaving so much out.

Economic theorizing is essential to avoid complete chaos in our intellectual lives but we need to exercise vigilance in not mistaking the finger pointing to the moon reflected in the pond, for the moon. One way is to balance the ethics, goals and methodology of many such theories against each other as a way of highlighting their inevitable errors.

Schiff rarely does that, as far as I can tell.

One of the biggest economic variables is emotion and those emotions have variables. It is the human that is crunching those economic statistics. Peter Schiff is no different than the rest of us. His theories like yours and mine are based on a stirred pot of facts, untruths, emotions, interpretations, misinterpretations and so on.

Since you declined to present a different theory, we must take the theories of the people that impress us and process them in our own noggin to come up with some conclusions. The object to me is to remove the noise like in photography and beautiful music and to simplify the complex and make it meaningful and understandable.

What is happiness to you?

This was so poetically asked in Vanilla Sky, what is happiness to you, David?

http://www.youtube.com/watch?v=cXH-ltR2ZjU

David replies…”I want to live a real life. I don’t want to dream any longer.”

I will leave you with this JamesS…

To err is human; to forgive is canine.

and this animal quote on economics…

A horse! A horse! My kingdom for a horse! Shakespeare

It also seems that most of the people who should be interpreting the data that is available and figuring out what to do about the economic mess we are in are,

corrupted and involved in creating and maintaining the mess or,

totally incompetent with their heads so far up their asses they can't see reality.

Theories are like assholes everybody has one. Peter Schiff and a few others saw this mess coming and said so. The know it all's said they didn't know what hell they were talking about.

Those folks who said Peter and the other doom-sayers were wrong, I am going to group with the incompetents with their heads placed in the same location.

I think Peter may be a little more in touch with what happened and is happening then the people who criticized and are still criticizing his theories. He was right and they weren't even close. As far as I'm concerned that puts him way out front.

Peter Schiff is a messenger for a targeted audience. It's about electing him to Congress and forming a following, and not about examining the content of his Austrian School message.

And the problem is even deeper because it is a problem with all economics messages, or economics itself, of which the Austrian School is simply a branch.

Think about the grave error of Marxism which was to base its economics on the simplistic and unrealistic axiom "from each according to his ability and to each according to his need."

Then think of the axiom that stands at the bottom of most American economics, homo economicus: rational, perfectly informed and self-interested actor who desires wealth, avoids unnecessary labor, and has the ability to make judgments towards those ends. http://en.wikipedia.org/wiki/Economic_man

But human motives are obviously more complicated than either axiom. Human social behavior has political/military (justice) religious/theological (ethics) psychological (advertising) and sociological (crowd behavior and mass conformity) aspects as well as a mathematical-model aspect which economists teach in universities.

What we call a “market crash” or depression is no more (or less) predictable than a revolution or war.

Markets don't crash the way bridges crash and they aren't fixed or “pulled back from the brink” the way engineers shore up an overflowing river or rebuild a fallen bridge. They re fixed with all the usual political, theological, military and psychological incantations and mumbo jumbo used by governments all over the world.

Schiff and a lot of other ambitious people are actually paraphrasing Richard III and yelling: "My horse for a Kingdom."

Their horse is an old nag (simplistic ideas) and their kingdom is a Congressional seat, a Nobel Prize, a post at the Federal Reserve, a university chair ....

But, to mix metaphors: "Where's the beef?"

I think we are starting to beat a dead horse. I don’t think that there is an argument that emotions, motivations and group behaviors are at play with regards to the economy and the market. Yes, so is the greed and lack of empathy of the individual. Max Keiser calls it the Casino Gulag Model, a criminal operation, and it is.

http://www.youtube.com/watch?v=MSxb4Ywr5sg

I have been pushing DB to focus on the faces of the criminal operation because it is more difficult to fight convoluted ideas and massive organizations.

Right now, the people in power dictating what will happen next are the Democrats and specifically Barack Obama. There is more and more information floating to the surface on Barack like a bloated body in the river or lake popping up signifying a gift from the mob. In this case, the bloated body is the mystery surrounding who is the creator of Barack Obama. There is speculation that it is the CIA or maybe it is even worse, a foreign intelligence network made “the Chosen One”. The corporate media has been told not to dig up Obama back yard. That has not stopped many from digging and reporting on the mysteries surrounding his mother who worked for Tim Geithner’s father at the Ford Foundation.

The Big Money Behind Geithner

By Cliff Kincaid | January 15, 2009

http://www.aim.org/aim-column/the-big-money-behind-geithner/

“It also turns out that Geithner’s father, Peter F. Geithner, serves on the board with Kissinger of the National Committee on U.S.-China Relations. This is the group that rang the opening bell at the New York Stock Exchange, celebrating Chinese investments in the U.S. economy. In another interesting connection, it turns out that Peter F. Geithner was with the Ford Foundation and oversaw the work of Obama’s mother, Ann Dunham, developing what are called microfinance programs in Indonesia.”

There is a lot of information leading to a conclusion that Barack Obama was groomed for his current role. He was chosen but not by the American public but by the elites to run their empire. The empire is not American and does not recognize any borders. The empire is not nationalistic.

As Cliff Kincaid wrote (link above)… “ If you examine the nature of the “Group of Thirty,” an affiliation which appears at the bottom of his biography, right after his Council on Foreign Relations membership, you will quickly learn that the President of the New York Federal Reserve Bank is an associate of the governor of the Chinese central bank through this mysterious organization of bankers and other top current and former officials from various countries. You will notice that other Obama nominees and associates are members, including Paul Volcker and Lawrence Summers.”

As soon as the American people create a steady drumbeat of questions regarding where Barack Obama came from and whether he is for real or an imposter, the closer we will get to the real power base that is causing all of the current destruction in the economy. The Goldman Sachs of the world were successful in decriminalized their massive ponzi schemes and illegal gambling operations. They have recreated Feudalism in the modern age. This type of society is the best structure for the elite to accumulate the world’s wealth while providing little to no daylight for the modern serfs.

http://www.youtube.com/watch?v=uWOIh4rI_Eo&feature=related

I disagree with this James, After twenty five years of study, I believe they are all engineered. The priveledged few make money on the ups and downs and continue to consolidate power.

Just a few tidbits;

http://www.marketoracle.co.uk/Article12970.html

http://www.rollingstone.com/politics/news/12697/64796

http://www.afajof.org/pdfs/2004program/UPDF/P306_Asset_Pricing.pdf

http://www.afajof.org/pdfs/2004program/UPDF/P306_Asset_Pricing.pdf

http://hubpages.com/hub/Proof-the-Stock-Market-is-Manipulated-by-Investor-Class

http://hubpages.com/hub/How_Smart_Money_Manipulate_Stock_Market

http://www.marketoracle.co.uk/Article20969.html

On an interesting side note;

http://edition.cnn.com/2010/WORLD/asiapcf/08/22/australia.elections/?hpt=T2#fbid=CwwGn7gkn4U&wom=false

I can’t wait for your less than witty comeback.

Whenever I see sheep, I just can't help thinking of haggis...

Something to keep you from being so lonely.

http://www.muttonbone.com/faq/

But there will be no revolution or even significant change until economic and social conditions deteriorate much further than they have. I don't mean to be an economic and social agnostic, but I don't think it is possible to predict economic and social bad weather ahead with any certainty, using any theory from Marxism and Austrian School economics to Jon Stewart armchair humoromics.

Yes, you can predict that some things will probably occur and I do, according to the state of my humors and state of mind.

And obviously none of us can be certain.

But we can have fun kicking the asses of all the establishment ostriches with their butt feathers sticking in the air and their frightened heads sticking in the sand.

I've heard apparently sane and intelligent academics say that "no one predicted" the severity of the housing collapse. That's insanity in itself. These Think Skank Career Ladders didn't WANT to see the coming housing collapse and now they are retrospectively telling us that people who saw it coming were "no one" which is to say, crazy and not worth listening to.

As for Peter Schiff, no economic theory can change anything. No magic formula will clean our American house of cards. The cards will fall where they will and the next generation is going to have to pick up the pieces and build a new house using the same old material. I realize that Peter and the Austrians preach a variant of this "let it collapse" view but they are much too optimistic about the results, I think.

Also, I would never say that the corporate media is told what to print and investigate. I wish I could say that but it's much worse than that.

The corporate media is complicit. The corporate media are a gentleman's club, (and I use the word gentleman loosely.)

They attend the same prep schools and play golf at the same country clubs that the corporate businessmen and corporate politicians do.

The corporate media does what is good for corporate America because it's good for them.

They don't have to be told anything, just be reminded occasionally.

Human nature has not changed at all in 5000 years. Only science and technology have changed. There has been no social progress only technological progress which has allowed slaves to be replaced, partially, by machines.

I'm gong to have a drink. Maybe it will cheer me up.

As for Barry, I would like to know what his grades were at Harvard and I would like to read some of the articles he wrote while he was there. Or at least I would like to know why I can't.

Yes, I think you are spot on. There are rumors that Obama didn’t hold down too many chairs at Columbia or Harvard. Very few people remember him which is strange as he is very memorable with his unique Harvard looks, his swagger and his distinctive name and background. I have not heard from any of his professors. They must remember such a remarkable man. As the Editor of Harvard’s Law Review, Obama left no fingerprints similar to the rest of his life before the DNC convention. There was talk of a lost law review article by Obama, yes just one, that never surfaced to my knowledge. Conveniently, the HLR does not give the student author’s name on its articles.

I always find it so interesting that the people who know him best have not come forward to talk about him. I posted this article here a while back…

How many serious white girlfriends has Obama had?

http://isteve.blogspot.com/2010/04/how-many-serious-white-girlfriends-has.html

Maybe DB will post it this time. When Obama turned 30, he was all of the sudden back on the grid. You got to have a lot of help to stay off the grid until then being so, ha, remarkable.

Obama's family and CIA

http://isteve.blogspot.com/2010/08/obamas-family-and-cia.html

"The notion of Obama as CIA's Manchurian Candidate is excessive. But if you conceive of CIA less as the Master Puppeteer and more as a well-funded part of the Global Favor Bank, then otherwise odd bits of the President's biography like his feeling like a "spy behind enemy lines" at Business International, a firm that had admittedly provided cover as business journalists for four CIA agents, make more sense."

It is a great read!!!!

The massive population explosion and economic prosperity of the twentieth century was driven by science and technology. But no one could predict that the inventions of the early twentieth century would be so spectacular and change society so completely, from cars and airplanes to radio, movies and refrigeration. Obviously no one could plan such discoveries and inventions either.

Virtually no one predicted World War I and too few predicted World War II.

Many people predicted a nuclear World War III that never happened.

Almost no one predicted the imminent fall of the Soviet Union in say 1985.

We can't be sure that scientific and technological discoveries will continue on the same trajectory they've been on for the last hundred years.

We can't predict for certain that there wont be massive environmental catastrophes or epidemics such as an airborne or insect born form of HIV.

What we can predict for certain is that there will be "black swan" events and they will overwhelm our expectations.

That was easy...

Human nature hasn't changed, possibly for about 25,000 years. It remains venal.

The forms of this venality are what change. I can imagine a time when all markets would be abolished and then even your easy prediction would fail.

But as Emerson said, "you can drive nature out of the front door with a pitch fork but it will come back in through the window" and then we would have American commissars living in the former mansions of the rich and riding on the backs of the underprivileged.

My unpleasant solution for this problem is benevolent dictatorship. But then you have the problem of succession ....

"I an just going to predict that markets will continue to be manipulated, and for every "reform" there will be a team of lawyers and lobbyists spending many hours and dollars wooing politicians and searching for loopholes to get around those "reforms"."

I think you just made a very accurate economic prediction, move over Peter Schiff!

If I were a dictator the Wily brothers would either work for me or be in prison. I think they would make the right choice but who can predict?

I will predict not in our lifetimes if ever, to much money involved...

"Way to go Gompers,"

Thanks Sagebrush, I can guess weights too. Maybe after the system collapses I can get a job as a carnie, LOL.