National Average: 492 Days From Default to Foreclosure

492 days in October 2010 versus an average of 382 days in October of last year.

"In other words, people who default on their mortgages can reasonably expect, on average, to stay in their homes rent-free more than 16 months. In some states such as New York and Florida, the number is closer to 20 months."

---

Reprinted with permission.

492: The number of days since the average borrower in foreclosure last made a mortgage payment.

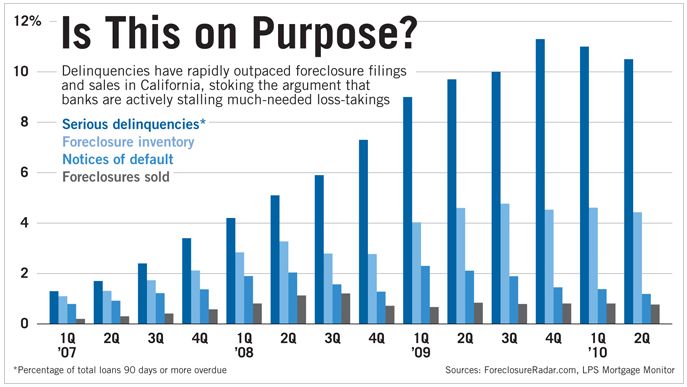

Banks can’t foreclose fast enough to keep up with all the people defaulting on their mortgage loans. That’s a problem, because it could make stiffing the bank even more attractive to struggling borrowers.

In recent months, the number of borrowers entering severe delinquency — meaning they missed their third monthly mortgage payment — has been on the decline, falling to about 700,000 in October, according to mortgage-data provider LPS Applied Analytics. But it’s still more than double the number of foreclosure processes started.

As a result, banks are taking progressively longer to foreclose. The average borrower in the foreclosure process hadn’t made a payment in 492 days as of the end of October, according to LPS. That compares to 382 days a year ago and a low of 244 days in August 2007.

In other words, people who default on their mortgages can reasonably expect, on average, to stay in their homes rent-free more than 16 months. In some states such as New York and Florida, the number is closer to 20 months.

That’s a meaningful incentive, and it’s likely to grow unless banks manage to boost their throughput. Speeding up the process won’t be easy, as demonstrated by the banks’ continuing legal troubles related to robo-signers, bank employees who signed foreclosure affidavits without properly checking the required loan documentation.

Millions of Americans still are paying their mortgages even though they owe more than their homes are worth. The more banks’ backlog grows, the more likely they are to join it, adding to the already giant pile of foreclosures weighing on the housing market.

---

Watch this short clip...

---

How many different signatures can one robo-signer have..?...

Start the slideshow...

You will see several examples of ACTUAL fraudulent documents that were submitted by large, well known banks in court proceedings.

We're talking over the top, ridiculous fraud here - Fake people, fake signers, fake documents, false notaries, and EVEN fake banks...

---

Spoiler ALERT -- Do not miss #7:

---

The best for last...

---

Jan 27, 2011 at 6:22 PM

Jan 27, 2011 at 6:22 PM

Reader Comments (5)

article source...

http://www.alternet.org/newsandviews/article/368312/ex-german_chancellor_says_bush_is_a_liar

Read this one...

CNN: Is It Time To Start Profiling?

http://revolutionarypolitics.tv/video/viewVideo.php?video_id=13265

it's absurd, if unsurprising, that this isn't being discussed seriously anywhere in the main stream media.

“FASB Eases Fair-Value Rules Amid Lawmaker Pressure

The Financial Accounting Standards Board, pressured by U.S. lawmakers and financial companies, voted to relax fair-value accounting rules that Citigroup Inc. and Wells Fargo & Co. say don’t work when markets are inactive.

Changes to fair-value, or mark-to-market accounting, approved by FASB today allow companies to use “significant” judgment in gauging prices of some investments on their books, including mortgage-backed securities. Analysts say the measure may reduce banks’ writedowns and boost net income. Firms could apply the changes to first-quarter results.

http://www.acting-man.com/?p=6189