Morgan Stanley’s Deep Secret Is Now Revealed

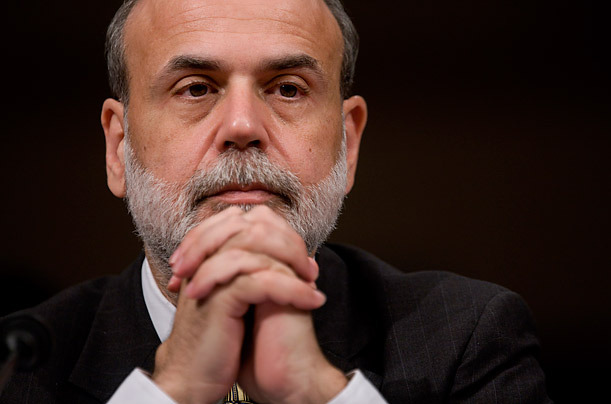

Bernanke's secret bailout flashback.

This ray of transparency was not provided by Bernanke, rather it's been sitting unnoticed on the FCIC website, having NOT been included in the final report. What's another $3.5 billion surreptitious bailout among friends courtesy of the comely Federal Reserve.

--

Bloomberg

By Jonathan Weil

Here’s a little secret the Federal Reserve Board doesn’t want you to know. On Sept. 24, 2008, while financial markets were collapsing, Morgan Stanley borrowed $3.5 billion through the Fed’s oldest lending program, the 98-year- old discount window.

The Fed has long claimed that releasing this type of data could trigger bank runs, public hysteria, death spirals at financial institutions large and small, and other horrible outcomes. Yet I’ve got a hunch Morgan Stanley somehow will survive this revelation. Mass panic will not ensue. The world will not end.

This is the kind of information the late Bloomberg News reporter Mark Pittman was seeking when he filed a Freedom of Information Act request with the Fed in May 2008, nine months after the financial crisis began. Among other things, he asked for documents showing which banks had borrowed money under the Fed’s emergency-lending programs and the details of those loans.

The Fed blew off his request. Bloomberg LP, the parent of Bloomberg News, responded by suing the central bank. The company won both at the district court level and on appeal. This week, the Supreme Court decided to let those rulings stand. And so almost three years after Pittman sent his original FOIA letter, the Fed finally will have to comply with the law.

The discount window functions as a lifesaver through which qualifying borrowers can secure emergency liquidity during times of severe stress. Historically the Fed had kept the names of borrowers confidential on the grounds that disclosure could stigmatize them in the public’s eyes, even though it was the public’s money the Fed was lending.

As it turns out, the information about Morgan Stanley (MS)’s $3.5 billion discount-window loan has been sitting on the Financial Crisis Inquiry Commission’s website since last month. The panel didn’t mention it in its final report. And nobody had written a story about it before. So there: Now it can be told.

You can see the raw data by clicking here. The link takes you to a Morgan Stanley spreadsheet showing the company’s day- to-day liquidity changes during a two-week period in September 2008 when the New York-based bank was fighting for survival. (You may need to magnify the pages 400 percent to see all the numbers.)

The loan came three days after Morgan Stanley said it had received Fed approval to become a bank holding company, giving it access to the discount window for the first time.

A Morgan Stanley spokesman, Mark Lake, confirmed that my reading of the spreadsheet is correct. The bank had stamped the document “confidential treatment requested” when it handed it over to the crisis commission. The panel released it anyway, apparently seeing no harm.

The Fed’s arguments for keeping this sort of data secret were transparently bogus. One Fed economist, Brian Madigan, said in an affidavit that disclosing discount-window borrowers’ names “can quickly place an institution in a weakened condition vis- a-vis its competitors by causing a loss of public confidence in the institution, a sudden outflow of deposits (a ‘run’), a loss of confidence by market analysts, a drop in the institution’s stock price, and a withdrawal of market sources of liquidity.”

Continue reading at Bloomberg...

Aug 14, 2012 at 5:13 PM

Aug 14, 2012 at 5:13 PM

Reader Comments (6)

http://www.bloomberg.com/news/2011-03-24/ultrasound-at-59-490-is-outrage-in-aetna-claim-against-doctors.html

Read this one...

http://www.msnbc.msn.com/id/40456055/ns/business-eye_on_the_economy/

http://www.ritholtz.com/blog/wp-content/uploads/2009/02/us-fed-assets.png

Under these programs, the Fed has purchased a veritable landfill of toxic assets from the TBTF banks. In the weeks leading up the passage of TARP, Hank Paulson was telling the whole wide world that a $700 billion bailout from the Treasury was needed to do exactly what the Fed was already doing at the time--buying the banks' toxic assets.

Once TARP passed on 10/3/08, Paulson changed his tune of course and gave his bankster buddies direct equity infusions of taxpayer money rather than buying any toxic assets. (That fact alone destroys Paulson's claim that the monetary system would collapse but for Treasury purchases of toxic assets, btw.)

So what exactly was the TARP money for? Was Paulson just lying his ass off?

http://cryptome.org/0005/doj101111.htm

[snip]

On January 18, 2006, KeySpan Corporation (``KeySpan'') and Morgan

Stanley Capital Group Inc. (``MSGC''), a subsidiary of defendant Morgan

Stanley,\1\ executed an agreement (the ``Morgan/KeySpan Swap'') that

ensured that KeySpan would withhold substantial output from the New

York City electricity generating capacity market, a market that was

created to ensure the supply of sufficient generation capacity for New

York City consumers of electricity. The likely effect of the Morgan/

KeySpan Swap was to increase capacity prices for the retail electricity

suppliers who must purchase capacity, and, in turn, to increase the

prices consumers pay for electricity. For its part, Morgan enjoyed

profits arising from revenues earned in connection with the Morgan/

KeySpan Swap.

http://www.huffingtonpost.com/2012/08/07/morgan-stanley-price-fixing_n_1753637.html

Obama connections with international banking elite

http://mapper.nndb.com/maps/633/000003624/