More Evidence That TARP And The Bank Bailouts FAILED

Authored by Dr. Pitchfork

---

Just as the bank bailout apologists gear up for a victory lap, more evidence emerges that TARP and the other bailout measures were an economic failure. Brett Arends' much-discussed recent article debunks the myths lies about "strong corporate balance sheets" and "cash on the sidelines." As Arends points out, companies are "flush with cash" only because they have borrowed record amounts of money in the bond market, leaving companies more indebted than ever:

A look at the facts shows that companies only have "record amounts of cash" in the way that Subprime Suzy was flush with cash after that big refi back in 2005. So long as you don't look at the liabilities, the picture looks great. Hey, why not buy a Jacuzzi?

According to the Federal Reserve, nonfinancial firms borrowed another $289 billion in the first quarter, taking their total domestic debts to $7.2 trillion, the highest level ever. That's up by $1.1 trillion since the first quarter of 2007; it's twice the level seen in the late 1990s. (Brett Arends, "The Biggest Lie About U.S. Companies")

This gives us occasion to take yet another swipe at the infamous Blinder-Zandi paper, which (according to the NY Times) "empirically proved" that TARP prevented a Second Great Depression. Here's where corporate balance sheets meet Treserve propaganda: the Blinder-Zandi paper models TARP's effectiveness by its effect on interest rate spreads like the TED spread, and by its effect on corporate borrowing costs. This makes reasonable sense -- in normal situations. In a normal situation, corporate borrowing in the bond market would fund business expansion, capital expenditures, and new hiring. But we aren't in anything like a "normal" situation. As Arends and others have shown, corporations aren't using the borrowed funds to launch new ventures or hire more workers. Instead, they are parking those funds in other debt instruments, like Treasury securities. And as John Hussman points out, "cash on the sidelines" isn't on the sidelines at all -- those funds are currently being used to prop up the government's debt and spending binge, which itself is meant to prop up the massive decline in real private GDP.

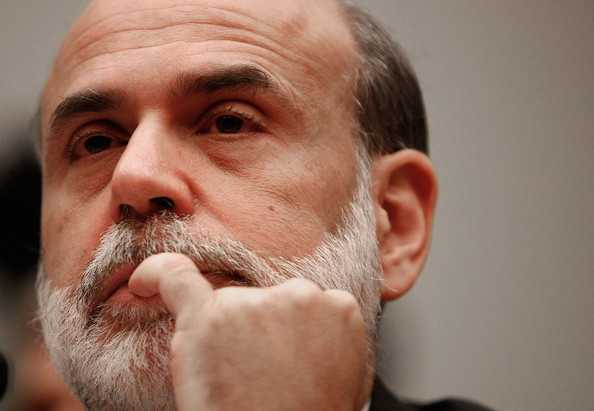

So sure, the Treserve's interventions may have reduced corporate borrowing costs (and subsidized bank profits), but contra Blinder and Zandi, these actions have done very little to spur real economic activity and may, even at record-low interest rates, be crowding out private economic activity. At the beginning of 2009, companies from Textron to Teck Cominco were struggling to roll over debt. Over the last year or so, they have been able to borrow at 6 or 7%...and earn a whopping 2 or 3% by parking that cash in Treasuries. Is this how Bernanke and Geithner plan to spark an economic recovery? These bridge loans to nowhere are mathematically guaranteed to end in grief. And even though they won't reveal the assumptions in their model, we can be certain that Blinder and Zandi (and other bailout apologists) are not accounting for these current economic realities. The reasonable conclusion to draw is one we have been making here at The Daily Bail since the crisis first started: TARP and the other bailout measures were always about saving the banks, and had almost nothing to do with saving the real economy.

So, Remember in November: vote ALL the bastards out (except Ron Paul), but especially if they voted for TARP.

Aug 16, 2010 at 1:52 PM

Aug 16, 2010 at 1:52 PM

Reader Comments (6)

Instead, since TARP had NOTHING to do with spurring lending and helping the recovery, and was really about saving the politically-connected banks from failure, we have gotten basically NO new lending...as you know, bank balance sheets are in deleveraging/recovery mode, and so the banks are just sitting on the cash earning a few points on treasuries....

http://local.cincinnati.com/share/news/story.aspx?sid=156420&cid=100224

http://www.daytondailynews.com/news/dayton-news/wild-hogs-could-be-past-point-of-elimination-in-ohio-484799.html

Nothing a little lead poisoning, or spear hunting can't fix, with a grill of course. But the good party animals would rather see them given bus tickets to somewhere else.

Al-Qaeda No. 2 Calls Arab Leaders ’Zionists’ and Mocks Obama

http://www.israelnationalnews.com/News/news.aspx/138683

Arab leaders are Zionists in disguise, according to Al-Qaeda’s number two terrorist, Ayman al-Zawahiri, in a new online message, his first since last December, which also mocks U.S. President Barack Obama.

http://www.in.gov/dnr/images/co-dnr-lion1.jpg

and this...

http://image3.examiner.com/images/blog/replicate/EXID22873/images/co-dnr-lion2.jpg

http://www.zerohedge.com/article/john-taylor-explains-why-credit-growth-equals-gdp-growth