Monday

Jun292009

Monday Morning Bailout Links: R.I.P. PPIP (Sayonara Mothafu**kas)

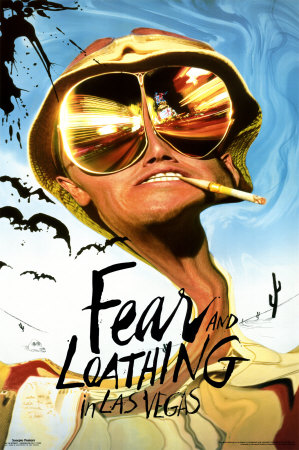

I'm posting all the links in comments. There are no text formatting issues that way. I have 172 tabs open within 5 different firefox windows and am approaching this version of Thompson. I will aim to narrow it but that's only if things don't get too weird first.

I'm posting all the links in comments. There are no text formatting issues that way. I have 172 tabs open within 5 different firefox windows and am approaching this version of Thompson. I will aim to narrow it but that's only if things don't get too weird first.

It was a cool ride into the desert. Cool, I suppose if you think floating an inch from a buffalo's ass is a sane way to see anything...(me)

Please Help Our Cause by emailing this story to a friend. Thank you.

Please Help Our Cause by emailing this story to a friend. Thank you.

Jun 29, 2009 at 3:55 AM

Jun 29, 2009 at 3:55 AM

Reader Comments (12)

http://online.wsj.com/article/SB124622976702566007.html (past the title into google, then search and you can read the whole thing free--the way to read ANY restricted WSJ article)

Wary Banks Hobble Toxic-Asset Plan

The government's plan to enable banks to dump troubled assets is facing troubles of its own.

Markets initially rallied when Treasury Secretary Timothy Geithner announced in March a two-pronged plan to offer favorable government financing to entice investors to buy bad loans and toxic securities from banks.

But that initiative -- called the Public-Private Investment Program, or PPIP -- has lost momentum. Big banks worried about having to sell at fire-sale prices while small banks feared they would be shut out. Potential buyers balked at the risk of doing business with the government, concerned that politicians might demonize them for making big profits.

The program's problems threaten to stymie efforts by struggling smaller banks, in particular, to clean up their balance sheets. That in turn could hinder efforts to revive the nation's economy.

A look at why the program has stumbled underscores how difficult it has been to solve one of the economy's biggest problems: Mountains of bad debt sitting on the books of the nation's banks. As those loans and securities lose value, they are saddling the banks with losses and constricting their ability to lend.

Recovery threatened by toxic assets still hidden in key banks

• Governments too slow to act, warn central bankers

• CBI sounds warning over 'worrying' bad debt levels

Taxpayers around the world still face potentially large losses because governments have failed to act quickly enough to remove toxic assets from the balance sheets of key banks, the world's leading central bankers warn today.

Despite months of co-ordinated action around the globe to stabilise the banking system, hidden perils still lurk in the world's financial institutions according to the Basle-based Bank of International Settlements.

"Overall, governments may not have acted quickly enough to remove problem assets from the balance sheets of key banks," the BIS says in its annual report. "At the same time, government guarantees and asset insurance have exposed taxpayers to potentially large losses."

http://www.guardian.co.uk/business/2009/jun/29/taxpayers-large-losses-toxic-assets

Central banking as partisan politics

http://blogs.ft.com/maverecon/2009/06/central-banking-as-partisan-politics/

Some of the first eerie signs of a potential health catastrophe came as bizarre deformities in water animals, often in their sexual organs.

http://www.nytimes.com/2009/06/28/opinion/28kristof.html?_r=1&ref=opinion

Delinquencies on US Auto-backed Securities Jump 22%

http://www.researchrecap.com/index.php/2009/06/26/delinquencies-on-us-auto-backed-securities-jump-22/

Dollar Falls Most in Month as China Urges New Reserve Currency

http://www.bloomberg.com/apps/news?pid=20601087&sid=aQ.zWVPnOYYg

New Research on Walking Away From Your Mortgae

http://www.calculatedriskblog.com/2009/06/new-research-on-walking-away.html

Is Goldman Sachs the Root of All Evil?

http://business.theatlantic.com/2009/06/is_goldman_sachs_the_root_of_all_evil.php

Impressive Chart--graphic

http://www.mint.com/blog/finance-core/the-descent-into-credit-card-debt/

http://search.japantimes.co.jp/cgi-bin/fd20090628pb.html

Recovery When? How About If?

Shhh. Don't let this get around, but Warren Buffet just let the cat out of the bag -- no economic recovery in sight.

http://www.americanthinker.com/2009/06/recovery_when_how_about_if_1.html

Bloated State Police Pension Plans – Something Has To Give

http://globaleconomicanalysis.blogspot.com/2009/06/bloated-state-police-pension-plans.html

“Nothing is so permanent as a temporary government program,” Milton Friedman said. That’s the danger of the financial bailout programs, as officials hesitate over whether to start taking them down. The larger risk is that not removing them will inflate a bigger credit bubble.

http://blogs.reuters.com/rolfe-winkler/2009/06/26/the-temporary-problem/

Down Market Leaves Area Sellers in Lurch

http://www.washingtonpost.com/wp-dyn/content/article/2009/06/26/AR2009062604413_pf.html

New HGTV show

"Real Estate Intervention," which premiered Thursday, offers tough love for people in denial - helping home sellers grasp what their place is really worth. Hint: It's a lot less than they think.

http://www.sfgate.com/cgi-bin/article.cgi?file=/c/a/2009/06/27/BU0O18EMOO.DTL

It is easier to dump a home loan if a friend has done so too

HOUSE prices in America have fallen so far that as many as one in five households have mortgage debt greater than the value of their homes. In a few states, borrowers are not liable for the shortfall between an unpaid loan and the resale value of the home it is secured upon. Even where borrowers are on the hook, lenders often find it too costly to pursue unpaid debts. So some homeowners may be tempted to default and escape the burden of negative equity.

http://www.economist.com/businessfinance/displaystory.cfm?story_id=13905502

Click on the Chart for expansion: AIG Bailout

http://www.gimmiethescoop.com/img/AIG-insurance-bailout2.png

http://www.dailymail.co.uk/news/worldnews/article-1194891/Pensioners-kidnap-financial-adviser-lost-2m-batter-Zimmer-frames.html

Commercial real estate: The day the mall died

http://www.examiner.com/x-1528-Baltimore-Personal-Finance-Examiner~y2009m6d22-Commercial-real-estate-The-day-the-mall-died

Not Paying the Mortgage, Yet Stuck With the Keys

Foreclosure Backlog Imperils Recovery

http://www.washingtonpost.com/wp-dyn/content/article/2009/06/23/AR2009062303500_pf.html

New Mortgage Fraud Website

http://www.mortgagefraud.org/

http://www.pe.com/business/local/stories/PE_Biz_S_hotels27.386a645.html

China's banks are an accident waiting to happen to every one of us

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/5675198/Chinas-banks-are-an-accident-waiting-to-happen-to-every-one-of-us.html

Sex feels the credit squeeze in Nevada

Takings and customers have slumped at the state's licensed brothels, the only businesses in America lobbying to pay more tax, writes Andrew Clark

http://www.guardian.co.uk/business/2009/jun/28/licensed-brothels-nevada-tax

'Oldest musical instrument' found

http://news.bbc.co.uk/2/hi/science/nature/8117915.stm

Those famous investigative hearings produced the facts and momentum for the major New Deal financial reforms. If the Reuters story is accurate, progressives have a lot of work to do in a few short days while nominees are being finalized, before the moment is lost.

http://www.huffingtonpost.com/robert-kuttner/pecora-whirling_b_222072.html

Obama is choosing to be weak

http://www.ft.com/cms/s/0/706bbcde-640d-11de-a818-00144feabdc0.html?nclick_check=1

http://www.calculatedriskblog.com/2009/06/foreclosure-auction-bidding-wars.html

http://www.nakedcapitalism.com/2009/06/reader-sanity-check-interest-rate.html

http://www.bloomberg.com/apps/news?pid=20601079&sid=aWMCkePqqQzM

Commodity Rally May End as Supply Rises, Speculators Sell Bets

http://www.bloomberg.com/apps/news?pid=20601087&sid=acXzJcXpPlNk

JPMorgan Tightens Grip on Equity Sales by Selling Own Shares

http://www.bloomberg.com/apps/news?pid=20601087&sid=aYlWNEyLQzPk

Madoff Learns Today Whether His Life Will Be Spent Behind Bars

http://www.bloomberg.com/apps/news?pid=20601087&sid=agMSlB70hK_Q

http://www.bloomberg.com/apps/news?pid=20601109&sid=aSUuHSqF34ms

Lawmakers Face Growing Pressure as U.S. Health Issues Unsettled

http://www.bloomberg.com/apps/news?pid=20601070&sid=aV50z1GLL2_A

Swiss Banks Shun Americans as U.S. Compels Disclosure

http://www.bloomberg.com/apps/news?pid=20601213&sid=a_8VwpO5m0WQ

Mega-Wealthy Survivors Have Never Had It So Good

http://www.bloomberg.com/apps/news?pid=20601039&sid=a79ZqHNmHZDM

http://rudepundit.blogspot.com/2009/06/photos-that-make-rude-pundit-want-to_29.html

Or did you post this already. Apologies if that's the case.

Good to see this dog go down!