LINKS: Obama Gears Up For Carbon Tax Fight

A new regular feature on the Bail, John provides a weekly update on corruption, graft and waste in the green energy sector.

---

US Gears Up For Carbon Tax Fight

A major battle will erupt in 2013 over whether the US should implement a national carbon tax, observers are warning. “It’s unlikely to happen in the next few weeks, when the fiscal cliff needs to be dealt with,” Caperton said. “But they’re definitely going to work on it and people are going to be talking about it.”

Congress should direct the Department of Energy to determine the carbon price that will put the US on a path toward necessary greenhouse gas (GHG) pollution reductions, using $25 per tonne as a starting point for their analysis, he said.

The tax should be phased in on a pre-determined schedule along the lines of 25% of the target price in year one, 50% in year two, and 100% in year three, meaning a carbon price of $6.25/t in the first year, $12.50/t in the second year, and the full $25/t in the third year.

Why It's The End Of The Line For Wind Power - Forbes

Obama Administration Still Supports Wind Power Projects

The Obama administration wants the U.S. offshore wind industry to flourish. As it reposes hope in renewable sources of energy, it decided to award $28 million in grants to seven projects. Those projects are aimed at developing different kinds of power-generation technologies.

Obama's Grants

As the Obama administration believes in the beneficial use of renewable energy, the Department of Energy announced that it would grant as much as $168 million in the next several years. Grants are expected to help companies develop and build first offshore wind farms in the U.S. To date, nine wind farms are at the advance level of development and as many as 24 are at the initial levels of development.

What is interesting is that the Obama administration supports new projects and introduces policies aimed at generating approximately 80 percent of the US electricity out of renewable source of energy by 2035. The administration believes that the US has a great potential for renewable energy as it possesses "untapped clean energy sources." Therefore, several decisions were made to support the development of new clean energy technologies. In addition, the Obama administration makes moves aimed at accelerating and facilitating leasing for offshore wind projects.

Wind proponents prepare for fiscal cliff deal without extension

An energy security group told The Hill on Friday that it does not expect the one-year wind credit extension it has supported to make it into a “fiscal cliff” deal. The 2.2-cent per kilowatt-hour credit for wind power production expires Dec. 31.

UPDATE: Wind Companies Get Fiscal Cliff Bailout

Wind energy advocates have lobbied hard to prevent the production tax credit from expiring Dec. 31. The number of new wind projects has dropped sharply when the credit has been allowed to lapse in the past, which last occurred in 2004.

Kerry to face climate test at State Dept

President Barack Obama nominated Kerry on Friday for Hillary Clinton's job and the senator is expected to win swift Senate confirmation. Kerry has been a dedicated, long-time campaigner for action on climate change. In 1992 he attended the first Rio Summit on climate, which formed the framework of U.N. climate talks. In 2010, he and Senator Joe Lieberman authored a sweeping climate bill that ultimately failed.

More on this story here and here.

Clinton lays out goal of integrated power grid in the Americas

Secretary of State Hillary Rodham Clinton, in a major energy address Oct. 18 at Georgetown University in Washington, said: “Earlier this year, at the Summit of the Americas, Colombia launched a new initiative it is leading with the United States called Connecting the Americas 2022.

Modernization of Electricity Grids

To support a successful implementation of the European Grid Declaration, signed by a coalition of Europe’s 29 largest environmental NGOs and grid operators in 2011, the Renewables-Grid-Initiative (RGI) launches the European Grid Report. The report publishes over 80 selected practical experiences by different RGI members across Europe. Today at the 2nd European Grid Conference in Brussels, jointly organised by RGI and Smart Energy for Europe Platform (SEFEP), the report and the extended European Grid Declaration on Transparency and Public Participation were presented to European Commissioner for Energy Günther H. Oettinger and to European Commissioner for the Environment Janez Potočnik.

POLAND AND CZECH REPUBLIC BAN GERMANY’S GREEN ENERGY

In order to boost Germany’s ‘ecological wonder’ and its green energy transition, the Federal Republic has used power grids of neighbouring countries – without asking for permission. For this short-sighted policy, the German government is now being punished.

Germany considers itself the environmental conscience of the world: with its nuclear phase-out and its green energy transition, the federal government wanted to give the world a model to follow. However, blinded by its own halo Germany overlooked that others have to pay for this green image boost and are suffering as a result.

For example, Germany’s ‘eco-miracle’ simply used the power grids of neighboring countries not only without asking for permission but also without paying for it. Now Poland and the Czech Republic have pulled the plug and are building a huge switch-off at their borders to block the uninvited import of green energy from Germany which is destabalising their grids and is thus risking blackouts.

Iberdrola Sells Wind Farms to GE

Chairman Ignacio Sanchez Galan said in a Dec. 2 interview he was negotiating sales of French, German and Polish wind farms, and has now announced deals in Germany and France. The latest sale means Iberdrola has divested about 850 million euros of assets in 2012 as part of a plan to sell 2 billion euros worth by the end of 2014 to strengthen its balance sheet. The French unit that Iberdrola is selling directly or indirectly owns 32 wind farms, with a total of 321.4 megawatts of capacity, according to the filing.

Edward Markey to run for Kerry's Senate seat in special election

New Hawaii Senator Says Climate Change Most Urgent Challenge

Hawaii Lt. Gov. Brian Schatz (D), who was yesterday named to fill the Senate seat vacated by the death of Sen. Daniel Inouye (D), wants to tackle an issue that has largely disappeared from Washington’s political agenda in recent years: climate change. Speaking briefly after being named to the seat by Gov. Neil Abercrombie (D), Schatz voiced his concern over the threat climate change poses to the world if nothing is done:

“For me, personally, I believe global climate change is real and it is the most urgent challenge of our generation,” Lt. Gov. Brian Schatz (D), whom Hawaii Gov. Neil Abercrombie (D) tapped for the seat, said in brief comments Wednesday.

Environmental Protection Agency Administration Lisa Jackson says she's stepping down after nearly four years on the job.

Accusations fly as First Wind fights Clipper for refund

First Wind said it paid the money for a batch of Clipper's 2.5MW Liberty turbines, which were never delivered. It also said Clipper has effectively stopped manufacturing the turbines. As of mid-December 2012, the Iowa suit was still ongoing, while a similar action in California was withdrawn on 5 November by First Wind for reasons that are not clear.

First Wind, a former major customer of Clipper, has been trying to freeze $59.5 million of Clipper's assets in three different court jurisdictions. The aim is to ensure that the private equity-owned turbine manufacturer can pay an arbitration settlement under way with First Wind in Chicago currently being overseen by the American Arbitration Association.

S&P Affirms Rating on First Wind Capital

First Wind Sees Future With Sun

Enron had 6 profit centers tied to pricing CO2, 7 under cap and trade

Patrick Wood III - Enron All Over Again

Patrick Wood's Reaction to Enron Tapes Exposing Energy Manipulation

Patrick Wood III at the Milken Institute

Patrick Wood on Fraud Task Force

Patrick Wood III on board of battery maker Xtreme Power

Xtreme Power blamed the fire dept for First Wind Hawaii Fire

Patrick Wood is also on the board at First Wind and many others.

Google Search - Patrick Wood III Insider Trading

---

Other Industry News

DE Shaw, part owner of First Wind, disclosure on natural gas sector

George Soros takes stake in San Leon

Brookfield to acquire 19 hydropower dams in Maine

Brookfield (Bermuda based) to acquire Western Wind

BP Wind Hawaii Goes Into Operation

BP Wind Ozarks Comes Online in 2013

Nebraska wind farm project can't get customers

When will Warren Buffett short this one? - Mid-American Wind

Mid American completes 3 new wind projects

Vermont utility calls for renewables moratorium

Carbon Taxes Make Ireland Even Greener - NYT

---

Read Last Week's Green Energy Stories...

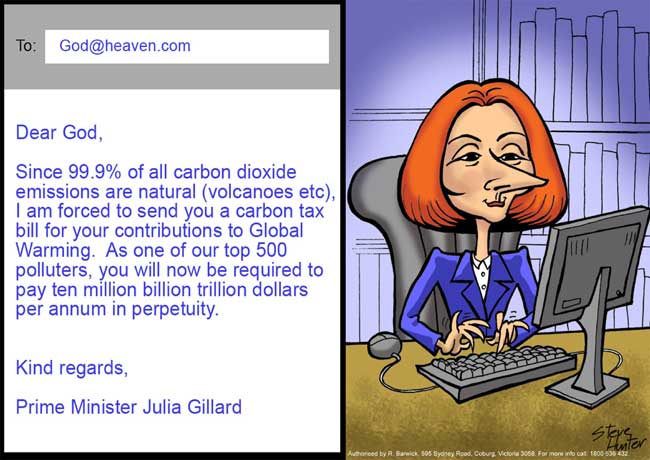

Cartoons by Steve Hunter via Andy's Rant...

Jan 3, 2013 at 10:31 PM

Jan 3, 2013 at 10:31 PM

Reader Comments (22)

Wind Power’s Negative Externalities (Part I: introducing www.windturbinepropertyloss.org)

http://www.masterresource.org/2013/01/windpower-negative-externalities-i/

Wind Power’s Negative Externalities: Here Come the Lawsuits (Part II)

http://www.masterresource.org/2013/01/wind-powers-negative-externalities-here-come-the-lawsuits-part-ii/

Note: in part 2 there is reference to Mars Hill. That is ground zero for UPC/First Wind and very serious RICO type violations.

www.examiner.com/article/canadian-galapagos-bird-sanctuary-thr...

therealrevo.com/blog/?p=13012

scitizen.com/future-energies/save-birds-by-promoting-wind-ener...

www.dailytech.com/Study+Wind+Farms++Bird+Killers/article18641.h...

http://thehill.com/blogs/e2-wire/e2-wire/275721-hawaii-sen-schatz-replaces-sen-hirono-on-energy-committee

[snip]

Green groups had expressed excitement about Hirono’s committee assignment, calling her an advocate of clean energy and conservation.

They likely will be just as pleased with Schatz who, like Hirono, has said he is committed to combating climate change.

In a December media conference that announced his appointment, Schatz said, “For me, personally, I believe global climate change is real and it is the most urgent challenge of our generation.”

Enter an entire casino built on a fake trading platform called carbon credits...

http://allafrica.com/stories/201211130115.html

http://www.tradeaidmonitor.com/2012/04/kenya-sees-spike-in-obama-administration-funded-projects.html

http://www.businessdailyafrica.com/Kenya-Power-deal-that-forced-World-Bank-out-of-wind-farm-/-/539546/1538602/-/tvegggz/-/index.html

http://www.greenbiz.com/blog/2013/01/04/carbon-fraud-us-cap-trade

[snip]

At first glance, all the news about fraud and fraud investigations in the EU carbon market might seem to give companies a good reason to oppose carbon trading. Last month’s Deutsche Bank raids and arrests -- part of European carbon-trading-fraud investigations -- came after six men already had been convicted of carbon-trading tax evasion through Deutsche Bank in 2011. In June, three others were jailed for carbon fraud in the United Kingdom. This recent spate caps a flurry of anti-carbon-fraud activity in 2009 and 2010, when European law enforcement raided hundreds of offices and arrested more than 100 suspected fraudsters. And the accusations and investigations continue.

------------------------------------------------------------------

Folks, thats reason enough right there to oppose it knowing full well what is, and will be happening HERE.

john

"Field of Teleprompters"

http://3.bp.blogspot.com/-b5JZbJNzixA/T_xP6gQOWwI/AAAAAAAAZGY/4HkZ_dWVdng/s1600/Obama%2Bat%2Bthe%2Bsolar%2Bfield.jpg

"Flickering Liberty"

http://images.nymag.com/daily/intel/19_libertyturbine_lg.jpg

Here is something I put up in my links article 3 weeks ago...

http://www.sacbee.com/2012/12/13/5051627/nc-ocean-waters-chosen-for-offshore.html

[snip]

One company that expects to file a notice of interest in bidding for leases is Arcadia Offshore, the New Jersey company whose Delaware deal collapsed for lack of subsidies. Arcadia president Peter Mandelstam said the process will be complex and time-consuming, requiring extensive environmental analyses and public hearings; even if everything goes smoothly, construction could take five years to get under way and two years to complete.

“Absolutely,” Mandelstam said of his goals off North Carolina. “We’re gonna do it.”

But he acknowledged that with historically low natural gas prices, no utility is likely to buy offshore wind power unless it’s required to do so by state regulators or lawmakers

Shares of Buffett's Chinese electric car maker tumble

http://money.cnn.com/2012/09/26/investing/buffett-electric-car/index.html

[snip]

Shares of BYD, the Chinese battery and electric car maker in which Warren Buffett is a major investor, tumbled in Hong Kong trading Wednesday after an analyst in China slashed his firm's target price for the stock to virtually nothing.

http://www.gamesacorp.com/en/gamesaen/

The feds as part of the budget shit from the other day pays wind farms 2.2 cents per kw/hr. Just fuck me.

http://www.bloomberg.com/news/2013-01-02/vestas-gamesa-advance-after-u-s-extends-wind-power-tax-break.html

At what point do we just roll over and call it a day. Nothing is sacred to these cretins. Nothing

http://phys.org/news/2012-01-maryland-mid-atlantic-offshore-capacity.html

Piece.

The study found that a maximum of 7,800 wind turbines could provide an annual average output of 14,000 megawatts, equivalent to 189 percent of Maryland’s electric load. The calculation includes the use of new technology for deep-water turbines, but even using only commercially proven, shallow-water equipment, the energy generated would total 70 percent of the state’s annual demand. This is the maximum resource possible, but actual development of offshore wind would start with power plant-sized units of 80 to 150 turbines.

Read more at: http://phys.org/news/2012-01-maryland-mid-atlantic-offshore-capacity.html#jCp

Lets pay to put them up and then lets pay them to produce the electricity. I think this is called free market. They don’t have to pay for any of it.

Understanding the Limits of Wind Power: Key Industry Terms

http://www.masterresource.org/2010/03/the-limitations-of-electricity-from-wind-energy-understanding-key-terms/

Tim Carney: How corporate tax credits got in the 'cliff' deal

http://washingtonexaminer.com/tim-carney-how-corporate-tax-credits-got-in-the-cliff-deal/article/2517397#.UOnBSaWfYQJ

[snip]

The "fiscal cliff" legislation passed this week included $76 billion in special-interest tax credits for the likes of General Electric, Hollywood and even Captain Morgan. But these subsidies weren't the fruit of eleventh-hour lobbying conducted on the cliff's edge -- they were crafted back in August in a Senate committee, and they sat dormant until the White House reportedly insisted on them this week...

Here's what happened: In late July, Finance Chairman Max Baucus announced the committee would soon convene to craft a bill extending many expiring tax credits. This attracted lobbyists like a raw steak attracts wolves.

Former Sens. John Breaux, D-La., and Trent Lott, R-Miss., a pair of rainmaker lobbyists, pleaded for extensions on behalf of a powerful lineup of clients.

General Electric and Citigroup, for instance, hired Breaux and Lott to extend a tax provision that allows multinational corporations to defer U.S. taxes by moving profits into offshore financial subsidiaries. This provision -- known as the "active financing exception" -- is the main tool GE uses to avoid nearly all U.S. corporate income tax...

...The K Street firm Capitol Tax Partners, led by Treasury Department alumni from the Clinton administration, represented an even more impressive list of tax clients, who paid CTP more than $1.68 million in the third quarter.

Besides financial clients like Citi, Goldman Sachs and Morgan Stanley, CTP represented green energy companies like GE and the American Wind Energy Association. These companies won extension and expansion of the production tax credit for wind energy.

Does NOAA’s National Climatic Data Center (NCDC) keep two separate sets of climate books for the USA?

http://wattsupwiththat.com/2013/01/06/does-noaas-national-climatic-data-center-ncdc-keep-two-separate-sets-of-climate-books-for-the-usa/

[snip]

Glaring inconsistencies found between State of the Climate (SOTC) reports sent to the press and public and the “official” climate database record for the United States.

First, I should point out that I didn’t go looking for this problem, it was a serendipitous discovery that came from me looking up the month-to-month average temperature for the Continental United States (CONUS) for another project which you’ll see a report on in a couple of days. What started as an oddity noted for a single month now seems clearly to be systemic over a two-year period. On the eve of what will likely be a pronouncement from NCDC on 2012 being the “hottest year ever”, and since what I found is systemic and very influential to the press and to the public, I thought I should make my findings widely known now. Everything I’ve found should be replicable independently using the links and examples I provide. I’m writing the article as a timeline of discovery.

At issue is the difference between temperature data claims in the NCDC State of the Climate reports issued monthly and at year-end and the official NCDC climate database made available to the public. Please read on for my full investigation...

...Based on my reading of it, with their SOTC reports that are based on preliminary data, and not corrected later, NCDC has violated these four key points:

In the guidelines, OMB defines ‘‘quality’’ as the encompassing term, of which ‘‘utility,’’ ‘‘objectivity,’’ and ‘‘integrity’’ are the constituents. ‘‘Utility’’ refers to the usefulness of the information to the intended users. ‘‘Objectivity’’ focuses on whether the disseminated information is being presented in an accurate, clear, complete, and unbiased manner, and as a matter of substance, is accurate, reliable, and unbiased. ‘‘Integrity’’ refers to security—the protection of information from unauthorized access or revision, to ensure that the information is not compromised through corruption or falsification. OMB modeled the definitions of ‘‘information,’’ ‘‘government information,’’ ‘‘information dissemination product,’’ and ‘‘dissemination’’ on the longstanding definitions of those terms in OMB Circular A–130, but tailored them to fit into the context of these guidelines.

I’ll leave it to congress and other Federal watchdogs to determine if a DQA violation has in fact occurred on a systemic basis. For now, I’d like to see NCDC explain why two publicly available avenues for “official” temperature data don’t match. I’d alos like to see them justify their claims in the next SOTC due out any day.

I’ll have much more in the next couple of days on this issue, be sure to watch for the second part.

For now, in case the SOTC reports should suddenly disappear or get changed without notice, I have all of those NCDC reports that form the basis of Table 1 archived below as PDF files.

Global warming, the tool of the West

http://english.pravda.ru/opinion/columnists/04-01-2013/123380-global_warming-0/

Related

Crony Capitalist Warren Buffett is building the world’s biggest photovoltaic solar project

http://www.bloomberg.com/news/2013-01-02/buffett-utility-buys-sunpower-projects-for-2-billion.html

Dipping paint chips in ranch dressing in Baltimore.

+1 skin

WMO Report: “The Global Climate 2001-2010, A Decade of Climate Extremes” See p.85: http://library.wmo.int/pmb_ged/wmo_1103_en.pdf

The problem is not CO2, it’s Methane.

More on WMO Report: Problem is Methane, not CO2 http://www.wmo.int/pages/mediacentre/press_releases/pr_976_en.html

Not feasible to create a financial derivative on Methane, though…

Also not feasible to tax methane, as CO2 can be…

This is all about finding a new ponzi financial framework to replace the previous failing one…

http://www.zerohedge.com/news/2015-09-26/did-goldman-sachs-sacrifice-australias-prime-minister-his-doubts-about-global-warmin

And while it is easy to blame his admission of failure on external factors, namely the Chinese slowdown, a very surprising finding has emerged over the past few days, one which reveals Abbott's "ouster" in a totally different light.

According to Freedom of Information documents obtained by Australia's ABC, now-former prime minister Tony Abbott's own department discussed setting up an investigation into the Bureau of Meteorology amid media claims it was exaggerating estimates of global warming.

Yes, it appears that the prime minister himself had dared to question to prevailing status quo on "global warming."

ABC reports that in August and September 2014, The Australian newspaper published reports questioning the Bureau of Meteorology's (BoM) methodology for analyzing temperatures, reporting claims BoM was "wilfully ignoring evidence that contradicts its own propaganda."

Naturally, the BoM strongly rejected assertions it was altering climate records to exaggerate estimates of global warming. Nevertheless, as the following document obtained by the ABC shows, just weeks after the articles were published, Mr Abbott's own department canvassed using a taskforce to carry out "due diligence" on the BoM's climate records.

As it turns out, late in 2014 the Australia government set up a taskforce to provide advice on post 2020 emissions reduction targets ahead of the United Nations Paris climate change conference in December 2015. The Department of Prime Minister and Cabinet originally wanted the taskforce to also conduct "due diligence to ensure Australia's climate and emissions data are the best possible, including the Bureau of Meteorology's Australian temperature dataset".

An accompanying brief seen by Mr Abbott noted that "in recent articles in The Australian, the BoM was accused of altering its temperature data records to exaggerate estimates of global warming". To wit from the ABC:

"The way the Bureau manages its climate records is recognised internationally as among the best in the world," the brief said.

"Nevertheless, the public need confidence information on Australia and the world's climate is reliable and based on the best available science."

Inexplicably, instead of letting it go as most "status quo" governments always do, the cabinet kept pushing with demands for audits: audits which, if taken too far, may reveals some truly very "inconvenient truths" if not so much about global warming, as about the propaganda behind it and the firms that stood to profit from such propaganda.

The pressure intensified when Mr Abbott's business advisory council chair Maurice Newman wrote an opinion piece in the paper, demanding a Government-funded audit and review of the Bureau.

The concerns centred on the Bureau's temperature homogenisation process — the method in which it adjusts temperatures for weather sites based on factors like trees casting shade or influencing wind or if the station is moved.

It was then that the pushback started in earnest: enter Greg Hunt, Australia's Environment Minister who would do everything in his power to halt Abbott's crusade to "audit" the BoM. In a letter to Abbott in November 2014, Hunt called for the removal of the due diligence clause, pointing out that he and his parliamentary secretary, Simon Birmingham, had already “established a strengthened governance oversight of the bureau’s ongoing work in this area." In other words, "trust us" - we are the government... we work for you.

Both the Department of Environment and Environment Minister Greg Hunt argued against having the taskforce investigate the Bureau. One Department of Prime Minister and Cabinet bureaucrat described a Department of Environment official as being "on a campaign" to get the references to BoM removed from the taskforce's responsibilities…

...Goldman Sachs.

While we hardly have to remind readers that it is Goldman that conceived of the carbon-credit market, and was behind cap and trade, here is an (in)convenient summary of who the true puppetmaster is behind the worldwide infatuation with stopping "global warming", and who stands to benefit the most as the world is manipulated into doing everything to kill global warming dead in its tracks, courtesy of Matt Taibbi:

…Fast-forward to today. it’s early June in Washington, D.C. Barack Obama, a popular young politician whose leading private campaign donor was an investment bank called Goldman Sachs – its employees paid some $981,000 to his campaign – sits in the White House. Having seamlessly navigated the political minefield of the bailout era, Goldman is once again back to its old business, scouting out loopholes in a new government-created market with the aid of a new set of alumni occupying key government jobs.Gone are HankPaulson and Neel Kashkari; in their place are Treasury chief of staff Mark Patterson and CFTC chief Gary Gensler, both former Goldmanites. (Gensler was the firm’s co-head of finance.) And instead of credit derivatives or oil futures or mortgage-backed CDOs, the new game in town, the next bubble, is in carbon credits – a booming trillion dollar market that barely even exists yet, but will if the Democratic Party that it gave $4,452,585 to in the last election manages to push into existence a groundbreaking new commodities bubble, disguised as an “environmental plan,” called cap-and-trade.

The new carbon-credit market is a virtual repeat of the commodities-market casino that’s been kind to Goldman, except it has one delicious new wrinkle: If the plan goes forward as expected, the rise in prices will be government-mandated. Goldman won’t even have to rig the game. It will be rigged in advance.

Here’s how it works: If the bill passes, there will be limits for coal plants, utilities, natural-gas distributors and numerous other industries on the amount of carbon emissions (a.k.a. greenhouse gases) they can produce per year. If the companies go over their allotment, they will be able to buy “allocations” or credits from other companies that have managed to produce fewer emissions: President Obama conservatively estimates that about $646 billion worth of carbon credits will be auctioned in the first seven years; one of his top economic aides speculates that the real number might be twice or even three times that amount.

The feature of this plan that has special appeal to speculators is that the “cap” on carbon will be continually lowered by the government, which means that carbon credits will become more and more scarce with each passing year. Which means that this is a brand-new commodities market where the main commodity to be traded is guaranteed to rise in price over time. The volume of this new market will be upwards of a trillion dollars annually; for comparison’s sake, the annual combined revenues of all’ electricity suppliers in the U.S. total $320 billion.

Goldman wants this bill. The plan is (1) to get in on the ground floor of paradigm-shifting legislation, (2) make sure that they’re the profit-making slice of that paradigm and (3) make sure the slice is a big slice. Goldman started pushing hard for cap-and-trade long ago, but things really ramped up last year when the firm spent $3.5 million to lobby climate issues. (One of their lobbyists at the time was none other than Patterson, now Treasury chief ofstaff.) Back in 2005, when Hank Paulson was chief of Goldman, he personally helped author the bank’s environmental policy, a document that contains some surprising elements for a firm that in all other areas has been consistently opposed to any sort of government regulation. Paulson’s report argued that “voluntary action alone cannot solve the climate-change problem.” A few years later, the bank’s carbon chief, Ken Newcombe, insisted that cap-and-trade alone won’t be enough to fix the climate problem and called for further public investments in research and development. Which is convenient, considering that Goldman made early investments in wind power (it bought a subsidiary called Horizon Wind Energy), renewable diesel (it is an investor in a firm called Changing World Technologies) and solar power (it partnered with BP Solar), exactly the kind of deals that will prosper if the government forces energy producers to use cleaner energy. As Paulson said at the time, “We’re not making those investments to lose money.”

The bank owns a 10 percent stake in the Chicago Climate Exchange, where the carbon credits will be traded. Moreover, Goldman owns a minority stake in Blue Source LLC, a Utah-based firm that sells carbon credits of the type that will be in great demand if the bill passes. Nobel Prize winner Al Gore, who is intimately involved with the planning of cap-and-trade, started up a company called Generation Investment Management with three former bigwigs from Goldman Sachs Asset Management, David Blood, Mark Ferguson and Peter Hanis. Their business? Investing in carbon offsets, There’s also a $500 million Green Growth Fund set up by a Goldmanite to invest in green-tech … the list goes on and on. Goldman is ahead of the headlines again, just waiting for someone to make it rain in the right spot. Will this market be bigger than the energy-futures market?

“Oh, it’ll dwarf it,” says a former staffer on the House energy committee.

In short: trillions are at stake for Goldman as long as the "fight" against global warming continues. And as noted above, cap-and-trade is going to happen or "something like it will" - Goldman's future revenues depend on it.

In fact, the only thing that can crush this finely orchestrated plan to generate billions in private profits from the mass euphoria to "save the planet" funded, naturally, entirely by the taxpayer, is a critical piece of evidence that the data and statistics behind "global warming" has been fabricated, something which very well may have occurred had Abbott's plan for an audit gone too far.

And so Abbott suddenly became a major liability, if not so much for Australia, then certainly for Goldman Sachs.

In retrospect, while Abbott completely unexpected exit on September 14 was a shock, his Prime Ministerial replacement should come as no surprise at all: Malcolm Turnbull, as we noted, just happened to be Chairman of Goldman Sachs Australia from 1997-2001. The same Turnbull who was deposed as opposition leader in 2009 over his support for a carbon tax and an emissions trading scheme, a "scheme" that, when fully implemented, would lead to huge monetary windfalls for none other than Turnbull's former employer: Goldman Sachs.

So was Goldman the responsible party behind Abbott's ouster? One can only speculate, however one thing is certain: any concerns and fears of "probes" or "audits" into Australia's global warming "data and statistics" are now history.

* * *

ABC's full FOIA revealing Abbott's probe of BoM "data" below: