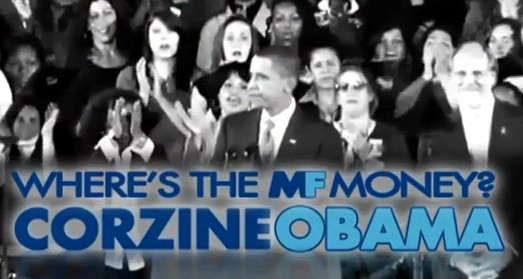

Letter From Satan: Dear Brother Corzine

Dear Brother Corzine:

Here's an early Christmas present even though I find that holiday so loathsome, as you know. It's a federal court of appeals decision that came out last week.

I trust you'll find it as comforting as I do.

http://scholar.google.com/scholar_case?case=9044222163921408620&hl=en&as_sdt=2,34

Excerpt:

"Instead of maintaining customer assets in segregated accounts as required by law, Sentinel had pledged hundreds of millions of dollars in customer assets to secure an overnight loan at the Bank of New York, now Bank of New York Mellon. This left the bank in a secured position on Sentinel's $312 million loan but its customers out millions. After filing for bankruptcy, Sentinel's liquidation trustee brought a variety of claims against the bank to dislodge its secured position. After extensive proceedings, including more than two weeks of trial over the course of more than a month, the district court rejected the claims. This appeal raises concerns about Sentinel's business practices and the degree to which the bank knew about them, but based on the district court's factual findings, we affirm."

Yours in Untrammeled Malevolence,

Satan

---

UPDATE - Satan Clarifies His Letter

To be clear about my minions' fine work in punishing innocent account holders by rewarding evildoers with the contents of those accounts: the court freely acknowledges, in the 1st sentence of the opinion, that Sentinel's transfer of those accounts--to the Honorable Jon Corzine's colleagues at Bank of New York Mellon ("Bank")--was illegal.

Clinging to the notion that the rule of law has any place in my Kingdom of Evil, the account holders tried to prove they were entitled to their own money, even after it was stolen, under a theory of "equitable subordination," under which Bank's claim to the purloined funds would have been subordinated to those naive account holders. Too succeed under the dead letter of law, the account holders had to prove that the Bank acted inequitably, that is, with conduct that was egregious.

As a humorous demonstration of my raw dark power, I dispatched to court several officials of the Bank--all pathological liars--whose own email correspondence demonstrates to a certainty that they knew that the $300 million transferred could not possibly have belonged to Sentinel, but must instead have belonged to the fools banking there.

Predictably, the Bank officials perjured themselves repeatedly at trial.

It is on the following basis that I will appoint all three appellate court panel members to an Executive Suite in Hell. What follows is a perversion of justice so remarkably devious that I'm inclined to strike the judicial triumvirate dead this instant so that we may enjoy cocktails together before dining on slaughtered puppies this evening:

"Instead of finding that their testimony justified a finding of egregious bank behavior, the district court essentially found that the bank officials were such artless liars that they couldn't have been concealing deliberate wrongdoing. Instead, the bank officials were simply trying to cover up their own incompetence."

Keep on Rocking in the Free World,

The Devil Himself

P.S. - This court ruling is not good news for those who want to see you in prison...

---

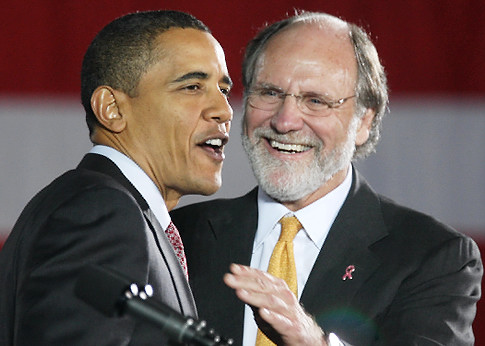

Corzine congressional testimony:

Dec. 08 2011 - In testimony to congress, former MF Global CEO Jon Corzine apologized but said he did not know what happened to the missing customer funds.

--

Editor's Note - It's $1.6 trillion, not $1.2 trillion.

And Corzine is lying. Read the following links.

- Email Ties Corzine to Missing Funds - WSJ

- $1.6 billion in missing MF Global funds traced

- MF Global Clients Get $130M From CME But $1.6B Is Still Missing - Forbes

Aug 17, 2012 at 2:04 AM

Aug 17, 2012 at 2:04 AM

Reader Comments (27)

I did not write this. I didn't want to spoil the story and the simplistic elegance of Satan's letter by describing its origin in the post. It was posted last night by Moloch, who is in fact Cheyenne. Sorry man. Had to out you. This was too brilliant to go unclaimed.

http://dailybail.com/home/reason-1-that-jon-corzine-is-not-in-prison-corzine-and-obama.html#comment18843974

http://dailybail.com/home/independent-trader-talks-about-losing-everything-in-mf-globa.html

Pretty good.

I wonder if people will even realize what this means? Ann Barnhard sums it up

RED ALERT: IT'S OPEN SEASON ON ALL CUSTOMER FUNDS

snippet...

What this means is that even if Jon Corzine is somehow dragged into court by private citizens, because you know damn good and well that the Justice Department will never, ever touch him, Corzine now has a legal precedent, likely from a bribed or otherwise coerced Federal Appeals Court, explicitly stating that an FCM can use customer deposits to pay its debts, and that the customers themselves are subjugated and have basically no legal right to their own monies, no matter what the law says, or what legal assurances, claims or guarantees are made to that customer about their funds held with an FCM or any other brokerage or depository institution. The "secured" party at the front of the line will always be the mega-bank who made the fraudulent loan using the stolen customer funds as collateral.

In other words, all customer funds in the United States are now the legal property of JP Morgan, Goldman Sachs, BNYM, or whichever megabank is the counterparty on the loans the FCM or depository institution takes out in order to fund its mega-levered proprietary in-house trading desks.

For the love of God, I don't know what more there could possibly be to say to snap you people out of your normalcy bias trance. You have GOT to get ALL MONIES out of the financial system NOW. This ruling sets precedence for every depository institution, not just futures brokerages. It is now legal in the United States for any financial institution to steal customer funds, borrow money against those funds for the uber-levered proprietary trading use of the financial institution, and the customers have ZERO CLAIM TO THEIR OWN FUNDS once they are in the custody of the financial institution.

The court has ruled that once your money passes out of your PHYSICAL POSSESSION, and I mean PHYSICAL possession, it is no longer yours, and you have no legal claim or legal recourse to it when it is stolen. This includes BANK ACCOUNTS. Money in a bank is in the possession of the BANK, not you. Do you comprehend this? The entire system is utterly devoid of any integrity or genuine security and is breaking down catastophically before our very eyes. You HAVE to comprehend that your money sitting in an account is no longer legally yours. You have to force your brain to process and comprehend this, no matter how incomprehensible it may seem. IT IS OVER. This is Marxist hell. We have arrived.

This ruling and precedent will be used by every brokerage, every bank, every insurance company and every pension fund to deny you your money when the financial system finally collapses, be it on Monday, or be it two years from now.

DO YOU UNDERSTAND?

You have GOT to GET OUT.

And all of this goes straight back to the criminal mafia that is the National Futures Association, and the fact that they have not actually been auditing those firms who were in the "cosa nostra", and allowing Ponzi schemes to operate with full bureaucratic protection for decades. Sentinel. PFG Best. The legal precedent enabling this protection racket and blatant fraud and thievery is fully in force, and what Corzine did at MF Global is now legally PROTECTED.

in full

http://barnhardt.biz/

btw she also has the full ruling on site

Did We Just Find Someone to Take On the Banks?

http://www.bloomberg.com/news/2012-08-09/did-we-just-find-someone-to-take-on-the-banks-.html

Now the let down

Flash: So It Was Simple Extortion?

http://market-ticker.org/akcs-www?post=210151

Sorry to be so cynical that's what being older and living in the real world does to anyone who has been watching the corruption for years.

p.s. More transparency please :) (hope you know I'm JK)

OBAMA ADMINISTRATION SUED FOR RECORDS ABOUT BANKRUPT MF GLOBAL HOLDINGS LTD.

http://www.breitbart.com/Big-Government/2012/08/13/Obama-Administration-Sued-for-Records-about-Bankrupt-MF-Global-Holdings-Ltd

Clinging to the notion that the rule of law has any place in my Kingdom of Evil, the account holders tried to prove they were entitled to their own money, even after it was stolen, under a theory of "equitable subordination," under which Bank's claim to the purloined funds would have been subordinated to those naive account holders. Too succeed under the dead letter of law, the account holders had to prove that the Bank acted inequitably, that is, with conduct that was egregious.

As a humorous demonstration of my raw dark power, I dispatched to court several officials of the Bank--all pathological liars--whose own emai correspondence demonstrates to a certainty that they knew that the $300 miillion transferred could not possibly have belonged to Sentinel, but must instead have belonged to the fools banking there.

Predictably, the Bank officials perjured themselves repeatedly at trial. It is on the following basis that I will appoint all three appellate court panel members to an Executive Suite in Hell. What follows is a perversion of justice so remarkably deviious that I'm inclined to strike the judicial triumvirate dead this instant so that we may enjoy cocktails before dining on slaughtered puppies this evening:

"Instead of finding that their testimony justified a finding of egregious bank behavior, the district court essentially found that the bank officials were such artless liars that they couldn't have been concealing deliberate wrongdoing. Instead, the bank officials were simply trying to cover up their own incompetence."

---

And where did you find that juicy final quote?

http://lewrockwell.com/slavo/slavo114.html

The part I found most interesting here is how she harangues her readers to stop "cowering in normalcy bias, unable to deal with reality." This applies to so much of what we've seen happen over the last 4 years. So many otherwise intelligent people still believe in sham fictions like "liberal" and "conservative", or believe that the "rule of law" still exists.

Barnhart is saying all accounts, but I'm not convinced.

Mr. Satan directs your attention to the google scholar opinion, linked above, wherein the juice may be found by searching on "artless". Alernatively, the quote may be found at pages 21-22 of the 7th Circuit's slip opinion by following this link:

http://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=0CEUQFjAA&url=http%3A%2F%2Fvolo.abi.org%2Fin-re-sentinel-management-group-inc%2Fopinion%2Fdownload&ei=MK0qUJTpEOHd0QHnxIGAAw&usg=AFQjCNGleKutk1Is7CMIZ9flO2Roc2y1iA

Mr. Pitchfork:

Your name sounds familiar. Have we met? Is Ms. Barnhardt trying to be ironic by screaming at Americans not to be cowed? Hopefully they'll be too riveted to the "election" to hear her speak truth like that.

Sentinel ruling may hurt MF Global clients

http://www.reuters.com/article/2012/08/10/us-sentinel-appeals-decision-idUSBRE87900T20120810

This will help people understand what a Brokerage encompasses

Are Banks and Brokers All the Same?

https://www.iramarket.com/post/show/are-banks-the-same?_ts=1344978242957

This is just for the hell of it...

Investigations galore

It’s not just LIBOR. Banks and brokers are under scrutiny from all quarters

http://www.economist.com/node/21558583

Barnhardt is correct assuming the financial institution holding the funds goes into a Chapter 11 bankruptcy.

The court's entire analysis of who had held the priority claim (account holders or the transferee, Bank of NY) turned on the bankruptcy statute alone. Now, whether a party meets or fails the requirements of that statute may differ by the type of instittution at issue, but the applicable legal standards all flow from bankruptcy statutes and case law.

That's really bad news for account holders going forward. Here Sentinel was caught in a flat violation of the law involving segregated accounts, and the transferee had every reason to know the transfer was not above board. AND YET THE ACCOUNT HOLDERS GOT FUCKED.

Frankly, it's difficult to imagine a violation more blatantly fraudulent--short of a time-stamped videotape of, say, Jon Corzine calling Jamie Dimon directly and telling him, "Yo, JD, I've got 1.5 billion of customer funds I just looted right here in my office--should I wire it over?"

Separately, it may be that financial insitutions of a different type than Sentinel, when bankrupt, would be treated under a different chapter of the bankruptcy code, and with correspondingly different standards.

But aside from those two qualifiers, which look pretty thin, I can't see any reason why it's not open season right now.

Coupled with recent disclosures of living wills for the TBTF banks, together with supposedly secret plans by the 5 largest banks for what to do if a sudden financial calamity hits, the writing is on the wall for anyone who cares to read it: GET THE FUCK OUT. NOW.

http://bottlefuelrag.blogspot.com/2011/10/first-occupy-wall-street-protester.html

Yours in loving grace,

J.H.C.

I would think there would be calls for Congress to get involved in the wake of the Sentinel ruling. The idea that your money is not really your money if you keep it with Charles Schwab or Ameritrade would freak out everyone. Call me skeptical, but I see this as an issue that Congress will settle and likely soon. They all have brokerage accounts that they will want to protect.

Money Market Funds Can Lose Money, Just Not Your Money

http://dealbreaker.com/2012/08/money-market-funds-can-lose-money-just-not-your-money/

Breaking a Buck, Maybe, but Not Taxpayers’ Backs

http://www.nytimes.com/2012/08/12/business/sec-vote-is-near-on-money-market-fund-plan-fair-game.html?_r=1

In other words, I don't see how this wouldn't apply to Schwab or Ameritrade accounts. However, do retail brokers typically lever up 10-1 and trade for their own accounts? I didn't think so, but I hope I'm right.

---

That's why I'm not too worried about this. It would take something strange to bring down one of these retail shops. But if you remember, Etrade almost failed back in 2007 when their sub-prime exposure was exposed. They owned a mortgage financing subsidiary or something. I don't remember all the details, but their stock traded below $3 for at least 18 months after that. There was fear that they might fail. But I remember reading at the time the accounts would be protected.

Famous last words.

Lehman's broker-dealer business wasn't part of the bankruptcy estate. It was sold to Barclays instead, which is not to say that the transcontinental transfer went off without a hitch:

http://www.4-traders.com/LEHMAN-BROTHERS-HOLDINGS-4021573/news/Lehman-Brothers-Holdings-Inc-Lehman-Trustee-Barclays-Continue-Fight-Over-Margin-Money-14019958/

The cast of characters in the link is interesting, to say the least.

Hopefully that clarifies.

Who was the biggest buyer of U.S. commercial real estate in the past 12 months?

It wasn't a big private equity firm or luxury developer. Rather, it was the estate of Lehman Brothers, which is still making deals nearly four years after its demise. In the past year, it paid $3 billion to take over Archstone from its creditors, and it is now preparing to take the firm public.

more

http://www.ibtimes.com/articles/373627/20120814/lehman-estate-real-creditors.htm

http://www.reuters.com/article/2012/12/04/us-banks-bny-sentinel-idUSBRE8B303Z20121204

The timing is curious given what happened just 2 weeks later:

"Confiscating the customer deposits in Cyprus banks, it seems, was not a one-off, desperate idea of a few Eurozone 'troika' officials scrambling to salvage their balance sheets. A joint paper by the US Federal Deposit Insurance Corporation and the Bank of England dated December 10, 2012, shows that these plans have been long in the making; that they originated with the G20 Financial Stability Board in Basel, Switzerland (discussed earlier here); and that the result will be to deliver clear title to the banks of depositor funds."

http://webofdebt.wordpress.com/2013/03/28/it-can-happen-here-the-confiscation-scheme-planned-for-us-and-uk-depositors

You'll find now that the link above to the Sentinel opinion on google scholar is dead. Interesting.