JUST SAY NO To Student Loan Bailouts

Good discussion.

With 11% delinquency rates, the student loan bubble is about to pop. Kudlow is deeply suspicious taxpayers will be covering the check.

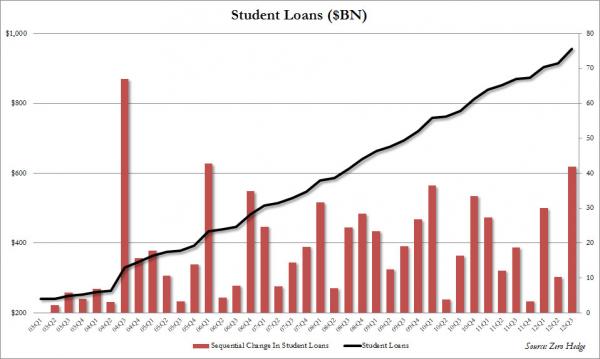

As of September 30, Federal (not total, just Federal) student loans rose to a gargantuan $956 billion, an increase of $42 billion - the biggest quarterly jump since 2006.

A personal note -- when I graduated from the University of Virginia in 1988, as an out-of-state student, the tuition bill for 4 years was approximately $25,000. In 2012, that wouldn't buy a year at UVa. So much for Jefferson's academic utopia.

Spout off. Should we bailout student loans...?

Nov 29, 2012 at 4:12 AM

Nov 29, 2012 at 4:12 AM

Reader Comments (6)

The lenders make these loans knowing full well that they'll default. Why? Two reasons. First, they collect fees when making the loan. Second, they sell the loan (which is commercial paper) onto to securitizers who bundle the loans and sell them on to investors. This is EXACTLY the fraudulent dynamic at work in the securitization of home loans. You see, once Wall Street got away with a multitude of frauds in connection with home loans, it predictably ran the same fraud again with credit cards, used car loans, and yes, student loans.

And yet none of these sophisticated financial institutions is EVER made to bear ANY responsibility, either through prosecutions for fraud or through write-downs of the debt. In the mean time, the media peddles the absurd fiction that the borrowers are 100% at fault.

Pay attention to Page 8 and 9

http://sdcera.granicus.com/MetaViewer.php?view_id=2&clip_id=478&meta_id=53490

Pay attention to Page 8 and 9

http://sdcera.granicus.com/MetaViewer.php?view_id=2&clip_id=478&meta_id=53490

Note: with all the scandals involving renewable energy Especially Larry Summers and DE Shaw, I found this and thought with all the news surrounding student loans that it was worthy of putting here. Copy before it disappears. The Name 'Alkali' is quite striking.

http://mobile.reuters.com/article/BigStory12/idUSKBN19R28Y