Wednesday

Mar112009

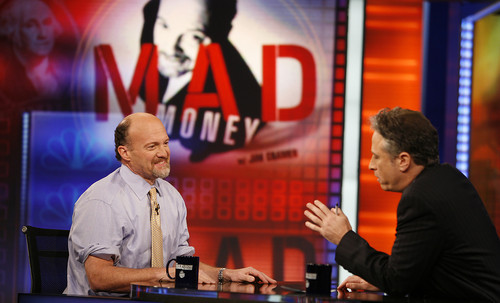

Jon Stewart Vs. Jim Cramer Video: It's Getting Slightly More Interesting. Cramer To Appear On The Daily Show Thursday

It's getting slightly more interesting as Cramer is now slated to be a Daily Show guest for Thursday night. Stewart's opening salvo, Monday night. Video runs 4 minutes. Three more clips from the 36-hour battle are inside.

Stewart's response to Cramer, Tuesday night.

Cramer on Morning Joe, Tuesday.

Cramer on the Today Show, Tuesday.

Mar 11, 2009 at 2:52 AM

Mar 11, 2009 at 2:52 AM

Reader Comments (5)

Aggregate demand remains in freefall, acquisitive and organic growth is largely nonexistent and capital expenditure continues to contract…globally. Steve Roach is correct, in the last decade America’s consumption bubble was inflated symbiotically with Asia’s export bubble and now both have burst. In the US consumption grew to an astounding 72% of GDP while in China exports surged to nearly 36% of GDP; both post-WWII peaks and both unsustainable. In the US, unemployment will surely climb another 25% to reach in excess of 10%, disposable income is withering and personal bankruptcy is on the rise.

Although I presently run money in global credit, and am therefore always focused on the downside, I really dislike being bearish; perhaps a remnant of my days as an equity manager. Nonetheless, from an earlier post, I agree with DB’s multiple-derived, directional comment and that short-selling is not ultimately to blame.

To add to the malaise consider that the Libor OIS has been creeping upward for a couple of weeks, the VIX remains persistently high and, a trillion here and a trillion there and, the flight to quality will loose its luster. I’ve already commented on the impending CRE problem and an auditor colleague of mine with knowledge suggests that many large financial institutions haven’t even fully made impairments for the Alt-A problem; I thought at very least I wasn’t going to continue to hear about stated income.

There is no quick fix and trying to solve the global imbalance with Keynesian stimulus, loose monetary policy and quantitative easing only forestalls the inevitable pain; Humpty Dumpty cannot and should not be put back together. Unfortunately the crisis may only be solved through time, the Mother of All Workouts, enhanced transparency in risk exposure and a change in US and Chinese savings and consumption; I’ll try to get to it before my 1PM conference call.

And neither Joe or Cramer seem to understand Stewart's basic point. These people were cheerleaders who ignored the housing bubble, the credit bubbled, the fact that the credit derivatives market was valued nearly 10x higher than the debt it was based upon, and on and on and on. They all talked about stock prices. Not one of them studied fundamentals.