James Grant: Life Behind Bars For Bernanke

Grant goes for the jugular.

Flashback to Bernanke's reconfirmation...

By James Grant

Ben S. Bernanke doesn't know how lucky he is. Tongue-lashings from Bernie Sanders, the populist senator from Vermont, are one thing. The hangman's noose is another. Section 19 of this country's founding monetary legislation, the Coinage Act of 1792, prescribed the death penalty for any official who fraudulently debased the people's money. Was the massive printing of dollar bills to lift Wall Street (and the rest of us, too) off the rocks last year a kind of fraud? If the U.S. Senate so determines, it may send Mr. Bernanke back home to Princeton. But not even Ron Paul, the Texas Republican sponsor of a bill to subject the Fed to periodic congressional audits, is calling for the Federal Reserve chairman's head.

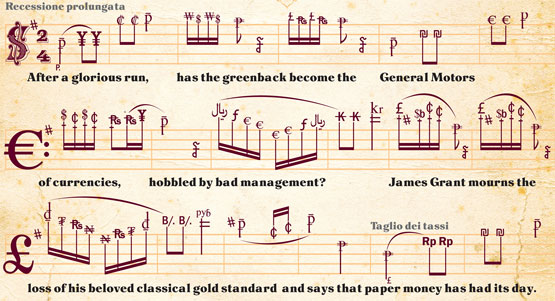

I wonder, though, just how far we have really come in the past 200-odd years. To give modernity its due, the dollar has cut a swath in the world. There's no greater success story in the long history of money than the common greenback. Of no intrinsic value, collateralized by nothing, it passes from hand to trusting hand the world over. More than half of the $923 billion's worth of currency in circulation is in the possession of foreigners.

In ancient times, the solidus circulated far and wide. But it was a tangible thing, a gold coin struck by the Byzantine Empire. Between Waterloo and the Great Depression, the pound sterling ruled the roost. But it was convertible into gold—slip your bank notes through a teller's window and the Bank of England would return the appropriate number of gold sovereigns. The dollar is faith-based. There's nothing behind it but Congress.

But now the world is losing faith, as well it might. It's not that the dollar is overvalued—economists at Deutsche Bank estimate it's 20% too cheap against the euro. The problem lies with its management. The greenback is a glorious old brand that's looking more and more like General Motors.

You get the strong impression that Mr. Bernanke fails to appreciate the tenuousness of the situation—fails to understand that the pure paper dollar is a contrivance only 38 years old, brand new, really, and that the experiment may yet come to naught. Indeed, history and mathematics agree that it will certainly come to naught. Paper currencies are wasting assets. In time, they lose all their value. Persistent inflation at even seemingly trifling amounts adds up over the course of half a century. Before you know it, that bill in your wallet won't buy a pack of gum.

For most of this country's history, the dollar was exchangeable into gold or silver. "Sound" money was the kind that rang when you dropped it on a counter. For a long time, the rate of exchange was an ounce of gold for $20.67. Following the Roosevelt devaluation of 1933, the rate of exchange became an ounce of gold for $35. After 1933, only foreign governments and central banks were privileged to swap unwanted paper for gold, and most of these official institutions refrained from asking (after 1946, it seemed inadvisable to antagonize the very superpower that was standing between them and the Soviet Union). By the late 1960s, however, some of these overseas dollar holders, notably France, began to clamor for gold. They were well-advised to do so, dollars being in demonstrable surplus. President Richard Nixon solved that problem in August 1971 by suspending convertibility altogether. From that day to this, in the words of John Exter, Citibanker and monetary critic, a Federal Reserve "note" has been an "IOU nothing."

To understand the scrape we are in, it may help, a little, to understand the system we left behind. A proper gold standard was a well-oiled machine. The metal actually moved and, so moving, checked what are politely known today as "imbalances." Say a certain baseball-loving North American country were running a persistent trade deficit. Under the monetary system we don't have and which only a few are yet even talking about instituting, the deficit country would remit to its creditors not pieces of easily duplicable paper but scarce gold bars. Gold was money—is, in fact, still money—and the loss would set in train a series of painful but necessary adjustments in the country that had been watching baseball instead of making things to sell. Interest rates would rise in that deficit country. Its prices would fall, its credit would be curtailed, its exports would increase and its imports decrease. At length, the deficit country would be restored to something like competitive trim. The gold would come sailing back to where it started. As it is today, dollars are piled higher and higher in the vaults of America's Asian creditors. There's no adjustment mechanism, only recriminations and the first suggestion that, from the creditors' point of view, enough is enough.

So in 1971, the last remnants of the gold standard were erased. And a good thing, too, some economists maintain. The high starched collar of a gold standard prolonged the Great Depression, they charge; it would likely have deepened our Great Recession, too. Virtue's the thing for prosperity, they say; in times of trouble, give us the Ben S. Bernanke school of money conjuring. There are many troubles with this notion. For one thing, there is no single gold standard. The version in place in the 1920s, known as the gold-exchange standard, was almost as deeply flawed as the post-1971 paper-dollar system. As for the Great Recession, the Bernanke method itself was a leading cause of our troubles. Constrained by the discipline of a convertible currency, the U.S. would have had to undergo the salutary, unpleasant process described above to cure its trade deficit. But that process of correction would—I am going to speculate—have saved us from the near-death financial experience of 2008. Under a properly functioning gold standard, the U.S. would not have been able to borrow itself to the threshold of the poorhouse.

Anyway, starting in the early 1970s, American monetary policy came to resemble a game of tennis without the net. Relieved of the irksome inhibition of gold convertibility, the Fed could stop worrying about the French. To be sure, it still had Congress to answer to, and the financial markets, as well. But no more could foreigners come calling for the collateral behind the dollar, because there was none. The nets came down on Wall Street, too. As the idea took hold that the Fed could meet any serious crisis by carpeting the nation with dollar bills, bankers and brokers took more risks. New forms of business organization encouraged more borrowing. New inflationary vistas opened.

So our Martian would be mystified and our honored dead distressed. And we, the living? We are none too pleased ourselves. At least, however, being alive, we can begin to set things right. The thing to do, I say, is to restore the nets to the tennis courts of money and finance. Collateralize the dollar—make it exchangeable into something of genuine value. Get the Fed out of the price-fixing business. Replace Ben Bernanke with a latter-day Thomson Hankey. Find—cultivate—battalions of latter-day Hellmans and set them to running free-market banks. There's one more thing: Return to the statute books Section 19 of the 1792 Coinage Act, but substitute life behind bars for the death penalty. It's the 21st century, you know.

Continue reading (there's MUCH more) at the WSJ...

Aug 31, 2011 at 1:47 PM

Aug 31, 2011 at 1:47 PM

Reader Comments (28)

Obama: My family is 'fine' with one term

http://www.politico.com/news/stories/0611/56917.html

So you can peg the dollar to gold or you can pay that stuff back, but you can't do both.

A twitterpated, obsessive, compulsive, closet socialist, birther, neo-con with a limited grasp of reality.

So therefore I am politely asking you to move along. Thank You.

http://www.youtube.com/watch?v=H9m3GyDh6M8

For God's sake, man, take up an indoor game and spare the rest of us. Is this clown good at anything not involving a teleprompter?

i've banned your IP and will immediately delete all of your future comments if you attempt to use another IP...

The Wall Street Gang and The Big Banks Gang (American and International, IMF, World Bank et. al) have lied to us and stolen from us. It is as simple as that. The Regulator elements, such as The Fed (private) and the Federal regulators (public) and many elected officials have been The Facilitators in this Co-Dependency of Corruption……The Mainstream Media and The Neoconservative Media Lies to us about employment and other economic indicators, telling us how everything is improving……Not so.

Some years ago (not too many) individuals and then gradually (maybe not so gradually), as the “collective ethic” changed, Wall Street and The Big Bankers realized that there was MUCH MORE MONEY and money which could be made MUCH FASTER AND EASIER if they just by-passed employment and production of REAL GOODS AND SERVICES and just made money out of money (Because of powerful, unreasonable unions and government regulation, as well as some other factors, much of America‘s former economic might of goods and services has been exported offshore anyway)………Hence, the various “Instruments” were created: “Ponzi A” rated, “Ponzi B” rated and so on, going far down the line to “Ponzi Z,” rated bonds, thus creating 26 times the original wealth, let’s say (since there are 26 letters in the English Alphabet-36 letters in the Russian alphabet, take note).

Nothing will change SIGNIFICANTLY until these guilty people are investigated, prosecuted, convicted and put in jail. And they should not be put in Country Club Jails, like Bernard Madoff, but they should be put in REAL jails like the one where DSK recently resided, Riker’s Island. These people are “Ponziophiles” who have reeked havoc on The Entire World and have caused suffering and even death, to millions of individuals……………………

I am a capitalist. Capitalism is good but some men are not motivated by good, employing their capital and their ideas in helping others by creating employment and other positive contributions to society. These Ponziophiles have been consumed with Pleonexia, unbridled greed and covetousness, making/taking money out of other peoples’ money. This is not capitalism. This is “Ponziophilia,” and it is immoral, indecent and shameful.

There are some Good Men and Women who are trying to make this happen but until IT ACTUALLY DOES there will be little confidence in the “confidence men” of Wall Street, OR The Banks, OR The Fed, OR The Treasury OR “The Fantasy Island of Economic Indicators/Statistics.”

These people are “Ponziophiles” and should be sent to Riker‘s for Rehab! (You read “Ponziophiles” here first. I “coined“ the term today, as well as “Pleonexiaphiles.”) PUT GOLD AND HONESTY BACK INTO WALL STREET, THE BIG BANKS, OUR ELECTED OFFICALS, AND OUR CURRENCY.

………………………………Leo M. McCormick……………………………….

……………………………www.SilvertonGold.org……………………….

“I tremble for my Country when I reflect that God is just.”------Thomas Jefferson.

This essay is not endorsed by Ron Paul but I endorse Ron Paul for President 2012.……….”End the Fed”……….Back the Dollar with Gold………..

"A twitterpated, obsessive, compulsive, closet socialist, birther, neo-con with a limited grasp of reality".

LEAVE MY FAMILY OUT OF THIS!!! ROFLMAO

http://edition.cnn.com/2011/OPINION/08/01/frum.debt.republicans/index.html?source=patrick.net

DB, Start 6:20

http://www.youtube.com/watch?source=patrick.net&v=aCQiVSRGlT4

CONgress debased the monetary system. No FRNs are exchangeable for a lawful money (gold/silver coin) at any bank or post office. Nixon with congress performed the final debasing of US money in 1972-73 when they shut off the payment of silver for US paper money and for FRNs.

Bernanke, Paulson, Geithner, along with all the Banksters that were and are being bailed out... could be charged with damaging the faith and credit of the United States.

I agree with Grant's sentiments, but not his legal evalustion...

FRNs are not money and are not coinage. FRNs cannot be debased, only devalued.

FRNs are contracts and evidence of IOUs. Notice, that the Secretary of the Treasury signs under the Treasury Seal -- accepting the contract for the Federal Reserve. The TREASURER of the United States signs under the Federal Reserve Seal acknowleding the seal and the debt incurred. IOUs are not money, not lawful, constitutional money

Hence you cannot charge Bernanke with a crime comitted by CONgress decades ago.

JF Kennedy had the solution.... start printing US Notes where the US borrowed from the public, until it could pay off the debt to the Federal Reserve and end its economic tyranny once and for all.

http://www.forbes.com/2011/07/29/barack-obama-welfare-state.html?partner=opinions_newsletter

Ayn Rand Was Right: Wealthy Are on Strike Against Obama

http://biggovernment.com/waroot/2011/06/21/ayn-rand-was-right-wealthy-are-on-strike-against-obama/

China says debt financing unlikely 'to save' US, EU

http://iphone.france24.com/en/20110805-china-says-debt-financing-unlikely-save-us-eu

If you really sit back and look at the American political system, there is ZERO difference between Rep. or Dem. They are all bought and paid for before before their names are on the ballots. This also includes your local govt.. Look how many locals are going to jail for stealing your money. Not much happens, does it.

Is there a way out of this mess, I doubt it. We are going to sit back and see what DC is going to do to us next. We're just going to let them just pork us to death. When we're all out in the streets fighting over your neighbors cat to eat, then you'll say, gee we should have spoken up.

Everyone who is in office today in Washington is protecting their own agenda, their own wealth. It's a vote for me and screw you system. For decades we all have given Washington the power and we all LOST our freedoms. I hope I live long enough to see when "the Home of Free" has their own troops turn on them to keep the peace. I'm going to LOL.

How many teabaggers are aware of these corporate schemes? Why are they so uneducated, and do not research they arent aware of their support for these banksters, gangsters, swindlers, ponzi schemers. Why do they hate the government and blame the government. If we the people are in charge, if you believe in the consittuion than we are the government.....its the Supreme Court those radical zionists, bilderbergers, rothschilds who all appear to be out of the Bank of England, that drove us into bankruptcy. So how can the Koch Brothers and that ilk convince these baggers to support corporate america against themselves. Our country is suffering from PTSD.

Hang the traitors! All of them!