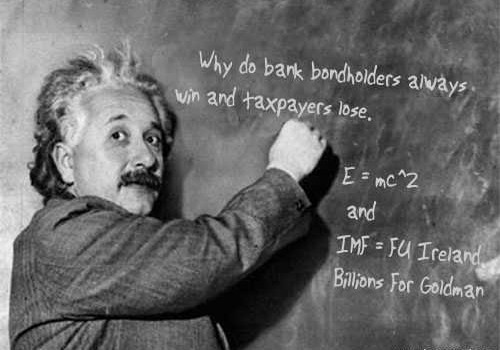

Hungary Won't Be The Last To Make Bondholders Pay

It never ends - protect the billionaire bondholders at all costs. But Hungary's president says 'screw the IMF.'

---

By Matthew Lynn

LONDON (MarketWatch) — Much like Greece, Hungary was one of those small, slightly peripheral countries that most people in the financial markets probably thought they could get through a career without ever worrying about very much.

With a population of slightly less than 10 million, and with a total gross domestic product of less than $200 billion — only half the market value of Apple Inc. — it hardly had much of a claim on the attention of investors.

But right now, Hungary is could be the epicenter of the latest next financial storm.

The country is teetering on the edge of bankruptcy. Its authoritarian populist Prime Minister Viktor Orban is refusing to play ball with the International Monetary Fund. Bond yields are soaring and credit is drying up. The country may, in the next few weeks, become the first major nation of this ongoing sovereign crisis to default — and that could trigger a wave of massive, perhaps even crippling losses across the European and indeed global banking system.

Hungary by itself doesn’t matter very much to the markets. It is neither big enough nor rich enough. But it is a foretaste of things to come. The markets keep demanding more and more austerity. Eventually political leaders are going to kick back against that. It might be the first major country to default on its debts, but it won’t be the last, and that means there is a lot more pain ahead for the markets.

The Hungarian economy is a mess. Pumped up by lots of cheap lending during the credit bubble — and in particular by lots of cheap mortgages denominated either in euros or Swiss francs — it hit a brick wall after the credit crunch. It suffered one of the deepest recessions anywhere in 2008 and has struggled to recover since. A mountain of foreign debt has started to catch up with it. The ratings agencies have steadily cuts its status down to junk, and bond yields have soared. Ten-year yields are now up around 10% and the stock market has been hammered.

It is quite clear what the markets want. After a decade-long debt-fueled bubble, they are looking to the IMF to come in and clear up the mess, and make sure foreign investors don’t suffer any losses. If that means a harsh austerity regime for the ordinary people, so it goes.

---

Related stories:

Jan 18, 2012 at 11:31 AM

Jan 18, 2012 at 11:31 AM

Reader Comments (1)