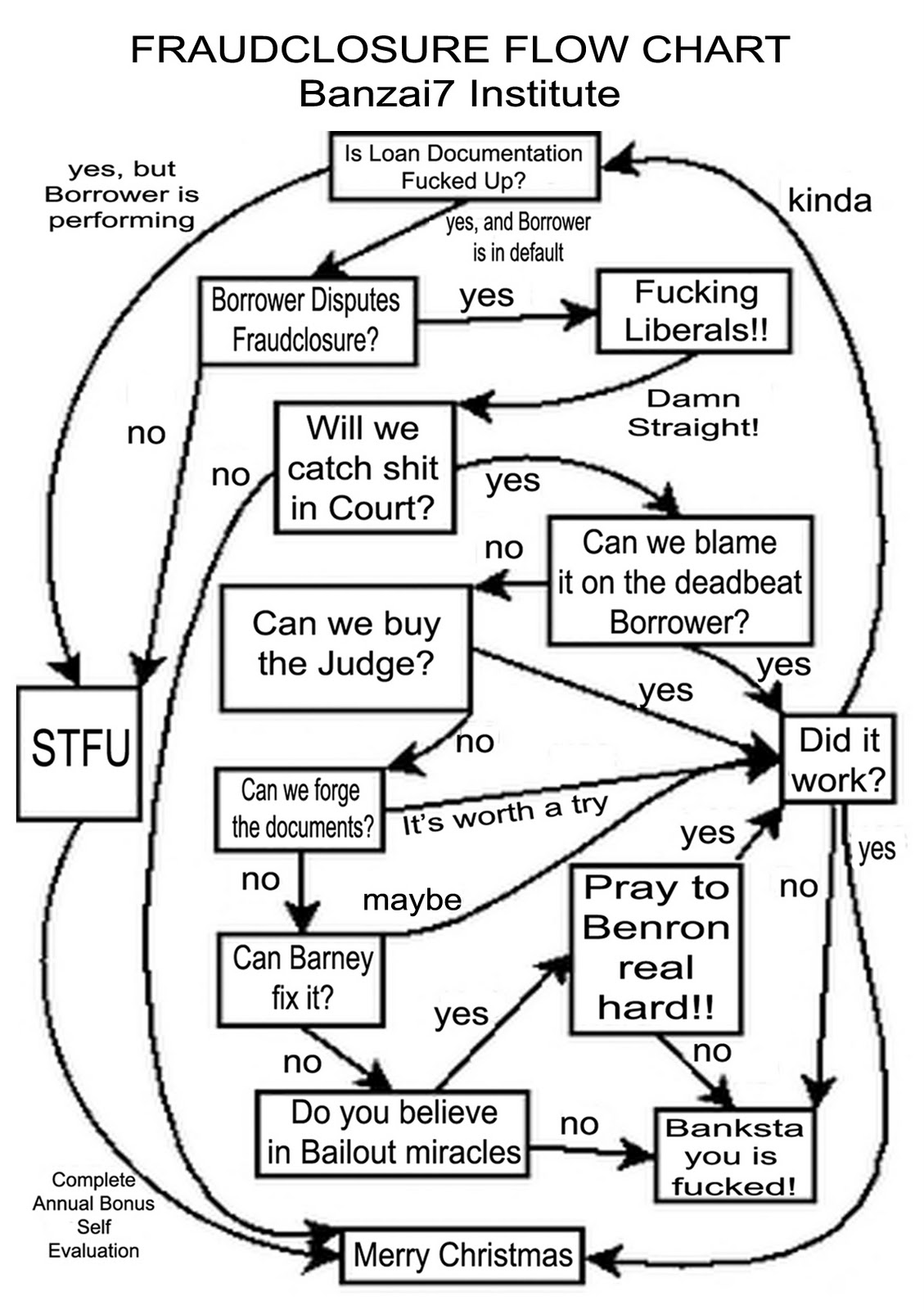

Foreclosure Fraud Talks Snag On Bank's Future Liability: "They Want To Be Released From Everything, Including Original Sin" (WSJ)

The latest detail on the foreclosure fraud talks can be found here:

---

Efforts to reach a settlement that would end the long-running probe of foreclosure practices are snagged over whether banks will get broad legal immunity from state officials for mortgage-related claims.

Federal and state officials are seeking penalties of $20 billion to $25 billion from Bank of America Corp., J.P. Morgan Chase & Co. and other financial firms under investigation since last fall. The banks are pushing hard for a deal, but they have insisted on a wide-ranging legal release from state attorneys general.

"They wanted to be released from everything, including original sin," said a U.S. official involved in the discussions. The legal protection sought by the banks included loan origination; securitization and servicing practices; fair-lending procedures; and their use of the Mortgage Electronic Registration Systems, an industry-owned loan registry that often acts as an agent for owners of mortgage loans, people familiar with the discussions said.

"The reason the banks would settle or pay anywhere near $20 billion to $25 billion is to get this behind them," said one person familiar with the banks' thinking. "There's no reason the banks would pay that amount of money and leave their flank exposed."

U.S. and state officials dismissed the push for broad immunity as a "nonstarter," according to a federal official involved in the talks, but they have countered with a narrower offer. It would cover robo-signing and other servicer-related conduct but leave banks open to potential legal action for wrongdoing in fair lending and securitization, according to people familiar with the situation. Attorneys general in California, Delaware, Massachusetts and New York have said they are investigating mortgage-securitization practices.

"Those of us at the table…have maintained this investigation is about robo-signing and loss-mitigation problems," Illinois Attorney General Lisa Madigan said in an interview. "The release should be narrowly drafted to cover those issues."

The debate over the release is one of the most contentious issues facing banks and government officials.

Aug 22, 2011 at 12:53 PM

Aug 22, 2011 at 12:53 PM

Reader Comments (5)

http://beforeitsnews.com/story/989/214/Guess_What_Will_Never_Happen_A_Sales_Tax_on_Wall_Street_Transactions.html

The president does say in a CBS News interview that the country is in danger of not recovering fast enough and acknowledges his reelection depends on the economy.

http://www.latimes.com/news/nationworld/nation/la-na-obama-economy-20110822,0,3923080.story

Trump was asked his thoughts on the development of Libya and the U.S.’s handling of the situation. Not surprisingly, the business mogul had some passionate sentiments.

“We are NATO,” Trump said. “We back NATO in terms of money and weapons, what do we get out of it? We have all of these rebels running around, beautiful name ‘rebels,’ are they from Iran, who is going to take over Libya, who’s going to take over the oil?”

That self-questioning prompted The Apprentice host to believe that America should reward itself for the events in Tripoli.

“So what do we get out of it, and why won’t we take over the oil?” he said. “Why aren’t we reimbursing? You know in the old days, when you win a war, you ‘kept to the victor, belongs the spoils.’”

http://www.rawstory.com/rawreplay/2011/08/trump-on-libya-why-wont-we-take-over-the-oil/

Scumbag.

Accountability is key to recovery.