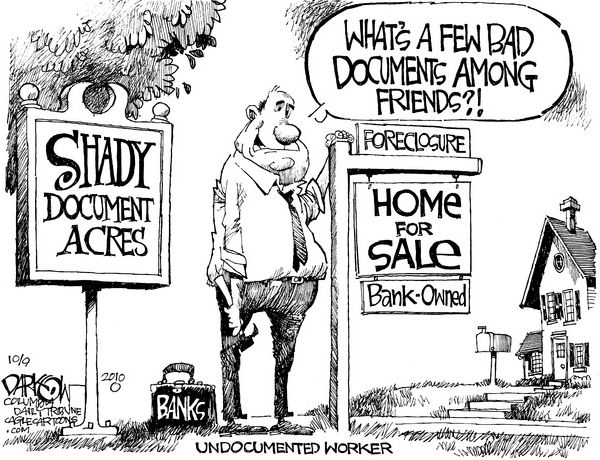

Federal Reserve works to strip a key mortgage protection for homeowners against predatory lending

WASHINGTON — As Americans continue to lose their homes in record numbers, the Federal Reserve is considering making it much harder for homeowners to stop foreclosures and escape predatory home loans with onerous terms.

The Fed's proposal to amend a 42-year-old provision of the federal Truth in Lending Act has angered labor, civil rights and consumer advocacy groups along with a slew of foreclosure defense attorneys. They're not only asking the Fed to withdraw the proposal, they also want any future changes to the law to be handled by the new Consumer Financial Protection Bureau, which begins its work next year.

In a letter to the Fed's Board of Governors, dozens of groups that oppose the measure, including the National Consumer Law Center, the NAACP and the Service Employees International Union, say the proposal is bad medicine at the wrong time.

"At the depths of the worst foreclosure crisis since the Great Depression, we are surprised that the Fed has proposed rules that would eviscerate the primary protection homeowners currently have to escape abusive loans and avoid foreclosure: the extended right of rescission."

http://www.mcclatchydc.com/2010/12/01/104568/fed-wants-to-strip-a-key-protection.html#ixzz1ABdTsFMP

---

Fed moves to gut predatory lending protection

The Federal Reserve is pushing a new mortgage regulation that would effectively eliminate the most powerful federal remedy for predatory lending.

The regulation would severely limit a practice called "rescission," used to strike down demonstrably-illegal or fraudulent loan contracts and void a bank's ill-gotten gains from such predatory lending practices. When a mortgage borrower wins a rescission case in court, the bank loses the right to foreclose, and has to give up all profits from interest and fees on the loan. The borrower still has to repay the principal -- the original amount of money extended by the bank -- but can't be kicked out of the house.

Under the Fed's new proposal, however, borrowers would be required to pay off the balance of the loan before the bank loses its right to foreclose -- that means borrowers could still lose their homes, even in cases where banks have broken the law.

Unsurprisingly, banks support the move, but consumer advocates say this would essentially make rescission worthless to borrowers.

"The ... proposal would eviscerate the single most effective tool that homeowners have to stop foreclosures and avoid predatory loans," reads a letter penned by Margot Saunders of the National Consumer Law Center and signed by 16 national public interest groups, along with 33 state housing and legal aid groups and 144 individual attorneys. "Passage of the proposed rule will considerably exacerbate foreclosure statistics in this nation."

Six Democratic senators, led by Sherrod Brown of Ohio, also urged the Fed to reconsider its rule in a Monday letter. "In this time of record foreclosures and reports of systemic problems with the operations of the largest mortgage servicers, the proposed revisions are unfortunate and unnecessary," the letter reads. "The mortgage market needs greater oversight and accountability to restore borrower confidence lost in the mortgage crisis. The proposed rules would undermine this goal." The signatories included outgoing Senate Banking Chairman Chris Dodd (Conn.), incoming Chairman Tim Johnson (S.D.), and Sens. Jack Reed (R.I.), Daniel Akaka (Hawaii) and Jeff Merkley (Ore.).

---

From the Fed's website...

The Federal Reserve Board has proposed enhanced consumer protections and disclosures for home mortgage transactions. The proposal includes significant changes to Regulation Z (Truth in Lending) and represents the second phase of the Board's comprehensive review and update of the mortgage lending rules in the regulation. The proposed changes reflect the results of consumer testing by the Board, which will begin accepting public comment.

Read comment letters for the Fed left by others

---

---

Dr. Pitchfork has covered it in the past...

The Fed Will Revoke the "Recission" Penalty for Predatory Lending

There is only one serious federal remedy for predatory lending, and the Fed is now knowingly trying to gut that remedy in order to help banks avoid losses from their own fraud. The remedy is called rescission, and it works like this:

If a bank failed to make key consumer protection disclosures about a mortgage, the borrower can demand that all of the interest and closing costs on the loan be refunded. Equally important, the bank must also stop all foreclosure proceedings and give up its right to foreclose. Once the bank gives up its right to foreclose, the full amount of the mortgage, minus interest and closing costs, becomes due. This isn't a free lunch for the borrower, especially when the value of her home has declined dramatically, but it's better than nothing, and it does impose real costs on banks.

As usual, the Bernanke Fed is doing everything it can to spare the banks from the consequences of their own actions:

Under the Fed's proposal, if you're the victim of illegal predatory lending, the bank will still get to foreclose on you unless you pony up hundreds of thousands of dollars all at once. And you'll have to pony up what the banksays you owe, which may be very different from what you actually owe. That eliminates the usefulness of rescission, making the new rule a bailout for predators.

But here's where the Fed's gutting of the recission penalty intersects with the deeper, underlying problems with Foreclosure-Gate:

The largest banks don't have enough capital to weather a bad housing market. And any process that sheds light on the documentation procedures at mortgage servicers will expose the big banks to investor lawsuits. But investors can't sue without those documents. Rescission judgments create a paper trail for illegal loans. In addition to creating immediate losses for banks, rescission documents that banks sold illegal loans, giving investors who bought mortgage-backed securities ammunition for well-founded lawsuits. Those lawsuits, in turn, could sink some of the biggest names on Wall Street, something the Fed has been trying to prevent at all costs since 2008.

---

Related reading - Matt Taibbi's most recent work...

---

Aug 16, 2011 at 6:58 PM

Aug 16, 2011 at 6:58 PM

Reader Comments (18)

Consumer groups believe the Fed is intentionally pushing through new mortgage rules before the consumer agency is formed, and want the Fed to drop the proposal. The Fed and mortgage lenders, they say, want to make sure rules favoring mortgage lenders are already in place when Warren’s agency comes into power.

http://www.totalmortgage.com/blog/mortgage-regulations/mortgage-rule-proposal-on-recscissions-causes-controversy/8937

http://www.housingwire.com/2010/11/18/consumer-advocates-urge-federal-reserve-board-to-withdraw-rescission-proposal

(Media-Newswire.com) – ( COLUMBUS, Ohio ) — In a letter sent today to the Federal Reserve’s Board of Governors, Ohio Attorney General Richard Cordray urged the Fed to maintain existing protection for homeowners who currently have the right to undo loan agreements where material disclosures were not made, in violation of the law. The existing provisions that protect a consumer’s right to rescind such loan agreements – including mortgage loan agreements – could be greatly weakened through a proposed rule now under consideration by the central bank.

http://foreclosureblues.wordpress.com/2010/12/27/lisa-madigan-richard-cordray-urge-federal-reserve-not-to-erode-consumer-rights/

http://www.huffingtonpost.com/zach-carter/the-feds-new-foreclosure_b_784280.html

WASHINGTON — As Americans continue to lose their homes in record numbers, the Federal Reserve is considering making it much harder for homeowners to stop foreclosures and escape predatory home loans with onerous terms.

The Fed's proposal to amend a 42-year-old provision of the federal Truth in Lending Act has angered labor, civil rights and consumer advocacy groups along with a slew of foreclosure defense attorneys.

They're not only asking the Fed to withdraw the proposal, they also want any future changes to the law to be handled by the new Consumer Financial Protection Bureau, which begins its work next year.

In a letter to the Fed's Board of Governors, dozens of groups that oppose the measure, including the National Consumer Law Center, the NAACP and the Service Employees International Union, say the proposal is bad medicine at the wrong time.

"At the depths of the worst foreclosure crisis since the Great Depression, we are surprised that the Fed has proposed rules that would eviscerate the primary protection homeowners currently have to escape abusive loans and avoid foreclosure: the extended right of rescission."

http://www.mcclatchydc.com/2010/12/01/104568/fed-wants-to-strip-a-key-protection.html#ixzz1ABdTsFMP

Why people still do business with these banks is a mystery to me. I realize it's the FED behind this but it's driven by the majors.

The bank DOESN'T EXTEND ANY MONEY! The entire banking industry just creates "loans" out of thin air. These fools are paying priincipal and interest on a figure that the bank literally pulled out of its ass!

Jesus Christ, people haven't figured this out YET?

http://www.thestatecolumn.com/blog/2011/01/rep-barney-frank-expect-a-major-fight/

http://mensnewsdaily.com/2011/01/04/waxman-frank-to-hell-with-the-constitution/

[snip]

This isn’t the first time I’ve heard politicians claim that they have no practical allegiance to the Constitution. Members of both parties have been ridiculing citizens for raising Constitutional concerns for decades. Not my yob, mon!, as if aiming at the obvious ignorance of the common masses.

Perhaps, one might think, too many lawyers have been elected to public office. Their professional relationship to the Constitution is one far different from that which is implied when taking the oath of public office. Protecting and defending the Constitution is a far distant second to protecting and defending a client, even for ethical attorneys. That easily translates into representing special interests, in ways that are unethical, or even illegal for legislators.

I know one (1) guy who got a HAMP mod worth a fuck, a major fuck. When I reveal how to get a HAMP mod to the masses, it is all over. HAMP mods are a cinch if you know the key words.

What amuses me is the misplaced trust in the FED. It's like Caesar pleading with Brutus to call off the daggers. The FED will soon own this country's debt, in entirety. And by extension, those foreign banking interests will literally OWN the United States of America.

We'd fight to the death to keep our sovereignty in a bloody war, but to preserve the illusion of our great and decadent society, we'll hand it over to the FED, agent of the global banking dictatorship, with nary a whimper.

As long as that remains the ugly truth, I see no point in writing much beyond that.

"When a mortgage borrower wins a rescission case in court, the bank loses the right to foreclose, and has to give up all profits from interest and fees on the loan. The borrower still has to repay the principal -- the original amount of money extended by the bank -- but can't be kicked out of the house."

"Under the Fed's new proposal, however, borrowers would be required to pay off the balance of the loan before the bank loses its right to foreclose -- that means borrowers could still lose their homes, even in cases where banks have broken the law."

Huh? First things first. When a bank files a foreclosure case without a promissory note, the bank lacks standing and should have its case dismissed on a Rule 12(b)(1) or 12(b)(6) motion, Fed.R.Civ.P. (or state law equivalent). That means the court never even reaches the merits of the foreclosure; it instead confirms that the bank hasn't submitted a note and it's game over. When this happens, the homeowner doesn't owe anything to the bank, neither interest nor principal.

Second, for the bank to even reach the merits, it must've coughed up a promissory note. The whole point of a promissory note is to document the fact that the loan is secured by collateral called a home. So what if the HO can't pay the principal? That's right, he gets kicked out of his house. Perhaps there are statutes and rules I'm not aware of--please weigh in if you can show I'm wrong--but this is fairly black letter stuff.

Third, where in the fuck does the Fed (created in 1913) get off proposing changes to common law pre-dating the U.S. itself by a few centuries. Does the Fed now simply draft legislation and feed it to congressional minions for passage? Have we reached the point where members of the house simply execute orders from Ben Bernanke? Really?

Fascinating subject, DB, but this piece raises far more questions than it answers.