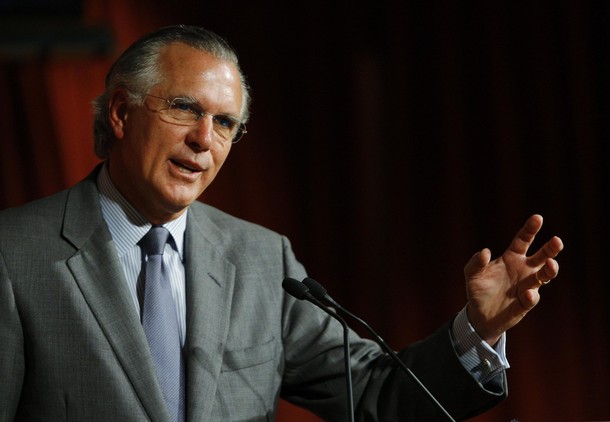

Fed President Richard Fisher Slams The Obama-Summers Approach On TBTF Banks Calling It 'Financial Dementia'

Richard W. Fisher, President of the Federal Reserve Bank of Dallas:

Financial Reform or Financial Dementia?

Remarks at the SW Graduate School of Banking 53rd Annual Keynote Banquet.

Dallas, Texas

June 3, 2010

---

Financial Reform or Financial Dementia?

I understand from Scott MacDonald that tonight is the 53rd annual keynote address and banquet of the SW Graduate School of Banking—an impressive anniversary, which reminds me of a story.

A couple is deciding where to dine on their 10th wedding anniversary. They settle on the Ocean View Restaurant because that is where the beautiful, hard-bodied people go. On their 20th anniversary, they discuss where to celebrate, and they agree again on the Ocean View because the wines and the food are superb. For their 30th, they return to the Ocean View once more, having agreed that, as they sit there in silence, the view from the terrace is second to none. On their 40th anniversary, they agree that the Ocean View is just right because it has wheelchair access and an elevator to get them to the porch overlooking the ocean. On their 50th, they want to do something truly special to celebrate. So they decide to go to the Ocean View … because they have never been there before.

Most of you are bankers—many, graduates or future graduates of this fine school. My message to you tonight is to remember where we have been. We have collectively been to hell and back. Let’s not go there again. Let’s remember that bankers should never succumb to what is trendy or fashionable or convenient but should instead focus on what is sustainable and in the interest of providing for the long-term good of their customers.

You gather tonight on the eve of a conference of key members of the House of Representatives and the Senate of the United States seeking to agree upon legislation to foster financial reform.[1] This evening, I am going to discuss this reform initiative. I do so, as always, speaking my own mind, making clear that I speak for nobody else at the Fed (something that is usually patently clear). I do so as one of only a few members of the Federal Open Market Committee who have been practicing commercial bankers. And I do so in the belief that it is always best to speak the truth to political convention.

In their unicameral sessions, the House and Senate have cleared away a lot of the underbrush of who does what to whom. As it now stands—due in significant part to the efforts of Sen. Hutchison of Texas and her colleague Sen. Klobuchar of Minnesota—my colleagues and I at the Federal Reserve will have responsibility for regulating, in some fashion, banking organizations across the spectrum, from community and regional banks to money center banks to thrift holding companies. I believe we are best suited for such responsibility. We have been battle hardened by the crises of both the 1980s here in Texas and this most recent episode, which threatened to bring the system of market capitalism to the brink. Yet, at the same time, I have some concerns about our ability to deal with the most vexing of the issues presented by the recent crisis: the issue of institutions that are considered “too big to fail” (or, if you prefer the acronym that has become commonplace, TBTF).

The Not-So-Shadow System

It has become popular to blame recent financial problems on the so-called shadow banking system. This, however, is an obfuscation. The heavily advertised distinction between commercial banks and the shadow banking system is, in many ways, false.

Take, for example, one of the most well-known and problematic phenomena of the shadow banking world: structured investment vehicles, or SIVs. Despite repeated claims to the contrary, SIVs were not distinct from commercial banks. Many SIVs actually originated from the very core of the commercial banking system—dominated in size by the largest banks—where bank regulation was presumably the strongest. Make no mistake: Big banks created SIVs. They supported SIVs with credit and liquidity enhancements. They marketed and invested in SIVs. And once the crisis hit, big banks were forced to bring SIVs onto their balance sheets. In this way, the presumed distinction between the commercial banking system and the so-called shadow banking system is false.

It is also a widely held misperception that SIVs escaped regulatory treatment. Regulators knew about them and even applied capital requirements to them. Unfortunately, those regulatory requirements were woefully inadequate. The favorable regulatory treatment granted to many of these vehicles was, in many cases, what accounted for their existence. The vehicles were created not so much for an economic purpose, but rather to minimize regulatory capital requirements.

SIVs and other programs sponsored by big banks were also exposed to runs. In contrast to other members of the shadow banking system—like hedge funds—SIVs had inadequate mechanisms in place to protect their liquidity.

I do not wish to single out SIVs. They are just one example of the excess to which large institutions succumbed. We are well aware of the alphabet soup of acronyms, including CDOs and CLOs, that contributed to the crisis, along with an excessive degree of faith in the ability of complex statistical models to mathematize risk taking.

---

Related stories:

China Warns Fisher Repeatedly About U.S. Debt Monetization...

---

Dealing with TBTF

Of course, recent financial problems have not been limited to large institutions and their opaque operations. As you in this room know all too well, regional and community institutions have faced their own difficulties, especially in the context of construction lending. Smaller banks that have realized debilitating losses have failed. When they got into deep trouble, regulators took them over and resolved them.

We might have expected a similar treatment of big banks. But we would have been wrong. Regulators have, for the most part, tiptoed around these larger institutions. Despite the damage they did, failing big banks were allowed to lumber on, with government support. It should come as no surprise that the industry is unfortunately evolving toward larger and larger bank size with financial resources concentrated in fewer and fewer hands.

Based on these considerations, coupled with studies suggesting severe limits to economies of scale in banking, it seems that mostly as a result of public policy—and not the competitive marketplace—ever larger banks have come to dominate the financial landscape. And, absent fundamental reform, they will continue to do so. As a result of public policy, big banks have become indestructible. And as a result of public policy, the industrial organization of banking is slanted toward bigness.

Big banks that took on high risks and generated unsustainable losses received a public benefit: TBTF support. As a result, more conservative banks were denied the market share that would have been theirs if mismanaged big banks had been allowed to go out of business. In essence, conservative banks faced publicly backed competition.

Let me make my sentiments clear: It is my view that, by propping up deeply troubled big banks, authorities have eroded market discipline in the financial system.

The system has become slanted not only toward bigness but also high risk. Consider regulators’ efforts to impose capital requirements on big banks. Clearly, if the central bank and regulators view any losses to big bank creditors as systemically disruptive, big bank debt will effectively reign on high in the capital structure. Big banks would love leverage even more, making regulatory attempts to mandate lower leverage in boom times all the more difficult. In this manner, high risk taking by big banks has been rewarded, and conservatism at smaller institutions has been penalized. Indeed, large banks have been so bold as to claim that the complex constructs used to avoid capital requirements are just an example of the free market’s invisible hand at work. Left unmentioned is the fact that the banking market is not at all free when big banks are not free to fail.

It is not difficult to see where this dynamic leads—to more pronounced financial cycles and repeated crises.

This is the threat that legislators are now attempting to address in the financial reform bill. A widely noted feature of this legislative effort is the fairly broad scope for regulatory discretion.

For instance, under propsed legislation, systemically important companies are required to submit a “living will.” According to the legislation, these firms are “to report periodically to the [Fed’s] Board of Governors, the [Financial Stability Oversight] Council, and the [FDIC] the plan of such company for rapid and orderly resolution in the event of material financial distress or failure.”[2]

If the Board and FDIC find the plan deficient, the bill calls for the company to resubmit an alternative approach within a set time frame. Failure to resubmit the resolution plan could result in the imposition of more stringent capital, leverage or liquidity requirements or restrictions on growth and activities. Furthermore, the Board and FDIC, in consultation with the council, may direct the firm “to divest certain assets or operations identified by the Board of Governors and the [FDIC], to facilitate an orderly resolution.”[3]

The legislation also requires that a Credit Exposure Report be submitted “periodically” on “the nature and extent to which the company has credit exposure to other significant nonbank financial companies and significant bank holding companies; and … the nature and extent to which other significant nonbank financial companies and significant bank holding companies have credit exposure to that company.”[4]

The new Financial Stability Oversight Council is directed to “make recommendations to the [Fed’s] Board of Governors concerning the establishment of heightened prudential standards for risk-based capital, leverage, liquidity, contingent capital, resolution plans and credit exposure reports, concentration limits, enhanced public disclosures, and overall risk management” for systemically important institutions.[5]

The name of the game, here, is regulatory discretion.

There are—as there always are—criticisms. Some feel, for instance, that while regulators are being given more authority, they are also being given ambiguous, if not conflicting, directives that would leave the specter of TBTF lurking in the background. For instance, the bill states that it seeks “to provide the necessary authority to liquidate failing financial companies that pose a significant risk to the financial stability of the United States in a manner that mitigates such risk and minimizes moral hazard.”[6] It also directs the FDIC to “ensure that the shareholders of a covered financial company do not receive payment until after all other claims … are fully paid.”[7] However, the bill goes on to state that in the disposition of assets, the FDIC shall “to the greatest extent practicable, conduct its operations in a manner that … mitigates the potential for serious adverse effects to the financial system.”[8]

Language that includes a desire to minimize moral hazard—and directs the FDIC as receiver to consider “the potential for serious adverse effects”—provides wiggle room to perpetuate TBTF.

Criticisms aside, this is the path our legislative powers have laid out for dealing with the issue of TBTF. Regulators must now decide exactly how they will travel down that path.

There appear to be three major ways to navigate proposed policy making toward big banks: (1) the regulate ’em camp, (2) the resolve ’em camp and (3) the shrink ’em camp.

Let’s examine these one by one.

Regulate ’Em

First, we have the “regulate ’em” camp. While it is certainly true that ineffective regulation of systemically important institutions—like big commercial banking companies—contributed to the crisis, I find it highly unlikely that such institutions can be effectively regulated, even after reform.

To be blunt: Simple regulatory changes in most cases represent a too-late attempt to catch up with the tricks of the regulated—the trickiest of whom tend to be large. In the U.S. financial system, what passed as “innovation” was in large part circumvention, as financial engineers invented ways to get around the rules of the road. There is little evidence that new regulations, involving capital and liquidity rules, could ever contain the circumvention instinct.

The history of regulatory capital requirements is not a distinguished one:[9]

- In 1864, the National Bank Act set minimum capital requirements, but these attempts at quantifying capital adequacy were unsuccessful. Over the years, such efforts continued at both the state and federal level, but without much success.

- By the 1950s, it was concluded that static capital requirements could only interfere with the more comprehensive analyses required to obtain a complete picture of a bank’s ability to absorb losses.

- In 1981, the federal banking agencies responded to diminishing bank capital positions by introducing numerical capital requirements, as the judgment-based approach to capital regulation had proven insufficient. But before long, authorities felt the need to revise these new numerical requirements, as they failed to differentiate between banks according to risk and invited capital arbitrage.

- In 1988, the central banks of the G-10 adopted risk-based capital requirements, as embodied in the Basel Accord. It did not take long before the need for change was felt once again as the original accord proved a blunt instrument that did not differentiate properly among various risk types and allowed significant avenues for capital arbitrage, particularly through loan securitization.

- In response, authorities began crafting Basel II. However, before it could be fully implemented, the risks taken through loan securitization blew up, producing the most severe financial crisis since the Great Depression.

- And as we know all too well, even if Basel II had gone into full effect, it would not have contained risk effectively nor created a sufficient buffer against losses.

- Thus, policymakers have been busily constructing what may be thought of as Basel III.

Regulatory reform discussions portray the need to control systemic risk as a new game in town—as if it were a new responsibility that need only be assigned. This is not the case: Bank regulators have long viewed the containment of systemic risk as a primary rationale for capital requirements. The problem is that capital regulation has rarely been truly successful.

Requiring additional capital against risk sounds like a good idea but is difficult to implement. What should count as capital? How does one measure risk before an accident occurs? And how does one counteract the strong impulse of the regulated to minimize required capital in highly complex ways? History has shown these issues to be quite difficult. While we do not have many examples of effective regulation of large, complex banks operating in competitive markets, we have numerous examples of regulatory failure with large, complex banks.

So, you might say I am a skeptic of regulation alone.

Resolve ’Em

In my opinionated view, a traditional regulatory response—while well-intentioned—cannot, by itself, fully address the threat of TBTF. So we turn to the “resolve ’em” camp.

The argument goes something like this: If deeply troubled large banks are allowed to fail, the banking industry could evolve toward a market-driven structure. During the recent crisis, regulators lamented the lack of a formal resolution process for large and complex financial organizations, claiming it reduced their options and tied their hands. So it follows that a resolution regime whereby regulators can economically resolve failed big banks might be the ticket. In this case, there will be no more TBTF.

Unfortunately, imposing creditor losses at a failing big bank, while simultaneously avoiding market disruptions, involves more than a bit of sophistry. Realistically, it would be difficult to accomplish both at the same time. Based on experience, one of these goals will take precedence over the other. And history shows which goal typically wins.

The sad truth is that when the chips are down, regulators become reluctant to put their money where their mouths are—or more precisely, they become too eager to put their money where they said they would not. Few, if any, policymakers have been willing to let large banking organizations fail, thereby missing an opportunity to impose significant losses on failed institutions’ creditors. We know from intuition and experience that any financial institution deemed TBTF will not be allowed to fail in the traditional sense. When such an institution becomes troubled, its creditors are protected in the name of market stability. The TBTF problem is exacerbated if the central bank and regulators view wiping out big bank shareholders as too disruptive, extending this measure of protection to ordinary equity holders.

In the recent crisis, authorities protected both—uninsured creditors and shareholders of big banks. While uninsured creditors received the greatest protection, regulators even partnered with existing shareholders through the injection of public funds. This program eventually spread to banks of all sizes, but its initial focus was the very largest banks. True, many large-bank shareholders sustained severe losses—but they were not zeroed out. They and their institutions have lived to see another day.

Why should we think the future could, realistically, be any different—especially with even bigger banks that dominate the financial landscape today?

A credible big-bank resolution process that imposes creditor losses will be difficult to enforce, especially when regulators are explicitly directed to mitigate disruptions to the financial system, as they are in the proposed reform bill. And there remain the technical problems of resolution, such as the difficulty of quickly estimating a rate of recovery on a large and complex banking organization and paying it out to creditors. Countless issues like this remain unaddressed. For instance, how would a resolution regime market assets of a failed big bank? Major business lines presumably would be kept intact to preserve value and maximize recovery. But if one large organization were simply sold to another, the industry could become more concentrated than before. That is exactly what happened during the crisis as large failing firms were sold to other large firms.

All of this ignores a still-greater problem: Even if an effective resolution regime can be written down, chances are it might not be used. There are myriad ways for regulators to forbear. Accounting forbearance, for example, could artificially boost regulatory capital levels at troubled big banks. Special liquidity facilities could provide funding relief. In this and similar manners, crisis-related events that might trigger the need for resolution could be avoided, making resolution a moot issue. TBTF would continue, in any case.

Consider the idea of limiting any and all financial support strictly to the system as a whole, thus preventing any one firm from receiving individual assistance. Many have argued such a restriction would minimize the possibility of bank bailouts. Even under this restriction, however, support for large institutions at the expense of smaller peers could live on. If authorities wanted to support a big bank in trouble, they would need only institute a systemwide program. Big banks could then avail themselves of the program, even if nobody else needed it. Systemwide programs are unfortunately a perfect back door through which to channel big bank bailouts.

Or consider the so-called living wills introduced in the financial reform bill. These presumably might serve as a type of instruction manual or roadmap for resolving a large failed bank. But, quite unfortunately, large banking companies have organized themselves in ways that entail significant spillovers to other financial firms and the economy, thereby making a bailout, in many cases, the only credible choice for policymakers. Legislators have attempted to work around this pitfall, requiring changes to large banking companies whose wills are found wanting—prior to a crisis. This could, if used properly, reduce to tolerable levels the spillovers that would result from the imposition of creditor losses. Regardless, even after requested changes have been made, if these wills are still lacking, the associated firms will be TBTF.

Again, in my view, enhanced resolution regimes, by themselves, are not enough to end TBTF. Even a combination of enhanced regulation and resolution would likely be inadequate. The temptation to use regulatory discretion to avoid disruptions is just too great.

Shrink ’Em

This leaves us with only one way to get serious about TBTF—the “shrink ’em” camp. Banks that are TBTF are simply TB—“too big.” We must cap their size or break them up—in one way or another shrink them relative to the size of the industry.

In its latest version, the financial regulatory reform bill has left regulators (specifically, the Board of Governors and the Federal Deposit Insurance Corp.) with the authority to impose greater restrictions on firms whose living wills are not credible. That authority, as I mentioned previously, could include “[divesting] certain assets or operations … to facilitate an orderly resolution.”[10] I would argue that regulators should freely use this broad authority to commit credibly to resolution with creditor losses by reducing big banks’ size and interconnectedness.

(You can see why my stance on TBTF hardly endears me to audiences on Wall Street. I am given to quoting Winston Churchill in response. He said that “in finance, everything that is agreeable is unsound and everything that is sound is disagreeable.” It is most disagreeable to the big bank, big money lobby to countenance restrictions on size, and hence it is the perceived wisdom that this approach is disagreeable. And yet it is perhaps the most sound approach of all those proffered.)

Some counter that even if all banks were made small or mid-size (or at least not TBTF), systemic threats—and thus the incentive for regulators to step in and save financial institutions—would not disappear. For instance, if a lot of small banks got into trouble simultaneously—or, as I like to say, forgot they had already been to the Ocean View Restaurant before and made the same bad bets at the same time—one might expect the central bank and regulators to protect bank creditors, extending TBTF protections once again. As the argument goes, breaking up big banks may be necessary but is possibly not sufficient—policymakers still must grapple with the possibility of many smaller banks getting into trouble at the same time, causing a “systemic” problem.

I consider this argument hollow for a few reasons.

First, even if this possibility turned out to be true, the threat of a loss from more isolated difficulties would mean creditors could reasonably expect losses in certain circumstances—a situation unlike TBTF.

Second, going by what we see today, there is considerable diversity in strategy and performance among banks that are not TBTF. Looking at commercial banks with assets under $10 billion, over 200 failed in the past few years, and as we have seen, failures in the hundreds make the news. Less appreciated, though, is the fact that while 200 banks failed, some 7,000 community banks did not. Banks that are not TBTF appear to have succumbed less to the herd-like mentality that brought their larger peers to their knees.

We saw similar diversity during the Texas banking crisis of the late 1980s. Small banks had diverse risk exposures. The most aggressive ones failed, while the more conservative did not.[11]

Some have also pointed to the Great Depression as a period when many small banks got into trouble at the same time. That situation seems less relevant to the policy questions we face today. Those failures were the result of a liquidity crisis that brought down both nonviable and viable banks. Such a liquidity crisis among small banks would be unlikely today, as we now have federal deposit insurance, which protects deposits for funding. And, I might add, the Federal Reserve has demonstrated quite effectively over the past two years that we not only have the capacity to deal with liquidity disruptions but also the ability to unwind emergency liquidity facilities when they are no longer needed.

The point is this: The arguments against shrinking the largest financial institutions are found wanting. And sufficient or not, ending the existence of TBTF institutions is certainly a necessary part of any regulatory reform effort that could succeed in creating a stable financial system. It is the most sound response of all. The dangers posed by institutions deemed TBTF far exceed any purported benefits. Their existence creates incentives that will eventually undermine financial stability. If we are to neutralize the problem, we must force these institutions to reduce their size.

I do not want to be naïve here. I am not suggesting that our banking system devolve into institutions like the Bailey Building and Loan Association in It’s a Wonderful Life. Large institutions have their virtues. They can offer an array of financial products and services that George Bailey could not. A globalized, interconnected marketplace needs large financial institutions. What it does not need, in my view, are a few gargantuan institutions capable of bringing down the very system they claim to serve.

Europe and TBTF

Of course, we are not the only ones dealing with the monstrous challenges of TBTF. Our friends across the Pond are also focused on the risks posed by institutions that have grown dangerously large (called “systemically important financial institutions,” or SIFIs). Despite Europe’s longstanding accommodation of, and preference for, large banking organizations in the universal banking model, the European Central Bank has become fairly forthright about the problem.

Unfortunately, in attempting to address TBTF, the European Union is falling into the regulate ’em and resolve ’em camps, leaning toward capital regulation and enhanced resolution regimes as a way to limit systemic risk. Given Europe’s prevailing universal banking model, policymakers have so far stayed well outside the shrink ’em camp.

But even while policymakers in Europe debate ways to tackle TBTF, the risks posed by big, interconnected banks are materializing once again, as the adverse effect of rising sovereign credit risk on euro-area banks has led to renewed concerns about systemic risk.

Moreover, Europe’s extensive public support of the banking sector under TBTF policy has left authorities with challenging questions about how to disengage this support fully without disrupting the nascent financial recovery. All these policy questions serve to illustrate the harsh tradeoffs and intractable complexities arising from the public–private intermingling entailed by TBTF.

Conclusion

For our capitalist system to work properly, it is important that successful risk taking be rewarded and equally important that unsuccessful risk taking be penalized. Legislators have done their level best over the past few months to, in effect, solidify this principle in our system.

That said, the race is far from over. Regulators now must pick up the baton and head for the finish line, using the authorities granted them in a manner that will ensure the safety and soundness of our system in the future. I would like to see us not waste this opportunity for true reform.

Just this morning, the Washington Post summarized the impasse that inevitably blocks treatment of the TBTF pathology. In an article on preparation for this weekend’s Group of 20 talks on bank reform, it was noted that “some” participants “remain hesitant to lean too hard on banks they consider vital to their national economies.”[12] This hesitancy only perpetuates the problem: The longer authorities delay the process, the more engrained behemoth financial institutions become; the more engrained they become, the less extricable they are. And so the debilitating disease of TBTF spreads. What appears “vital” becomes “viral” and grows ever more threatening to financial stability and economic stability.

I know the night is long, and I apologize for imposing the ponderous thoughts of a central banker upon you at this late hour. But go back to our aging couple and their fondness for the Ocean View Restaurant. In September, we will celebrate the 26th anniversary of the first announcement of the government’s TBTF policy. In September 1984, the Comptroller of the Currency testified before Congress that the government would not allow any of the nation’s 11 largest banks to fail. The Comptroller did, however, stress the need to find a way to deal with the potential failure of large institutions, and here we are today having failed to do so.[13] We can now keep kicking the can of TBTF down the road until dementia sets in and the banking system is made rotten by a refusal to acknowledge the pathology at the heart of the problem. Or we can use the occasion of the recent financial crisis to deal with it forthrightly while we are still vigorous and vital. I prefer the latter approach.

---

Richard W. Fisher is president and CEO of the Federal Reserve Bank of Dallas.

The views expressed by the author do not necessarily reflect official positions of the Federal Reserve System.

---

Reaction to this speech from Simon Johnson (and others):

Richard Fisher: Larry Summers, The G20, And Financial Dementia...

Too Big To Fail Lives On, Only Way Out Is To Shrink Megabanks...

Jun 8, 2010 at 6:57 PM

Jun 8, 2010 at 6:57 PM

Reader Comments (14)

http://baselinescenario.com/2010/06/06/richard-fisher-federal-reserve-bank-of-dallas-larry-summers-the-g20-and-financial-dementia/

http://www.huffingtonpost.com/2010/06/04/too-big-to-fail-lives-on-richard-fisher_n_600133.html

http://dailybail.com/home/dallas-fed-president-richard-fisher-on-the-economy-pbs-video.html

http://dailybail.com/home/fed-president-richard-fisher-even-we-cant-print-enough-money.html

http://dailybail.com/home/china-warns-us-about-debt-monetization.html

The president of the Dallas Fed on inflation risk and central bank independence.

http://online.wsj.com/article/SB124303024230548323.html?ref=patrick.net

http://www.telegraph.co.uk/finance/financetopics/financialcrisis/5379285/China-warns-Federal-Reserve-over-printing-money.html

http://preview.bloomberg.com/apps/news?pid=newsarchive&sid=a5dzZKuooyFU

Financial Reform: A Framework for Financial Stability

http://www.group30.org/pubs/pub_1460.htm

He is just selling G of 30.

So, it was boring to me.