David Stockman: Bernanke's Crony Capitalism Strikes Again

How the Federal Reserve is juicing speculators...again.

By David Stockman

Someone has to stop the Fed before it crushes what remains of America’s main street economy. Last Friday morning alone it launched two more financial sector pumping operations which will harm the real economy, even as these actions juice Wall Street’s speculative humors.

First, joining the central banking cartels’ market rigging operation in support of the yen, the Fed helped bail out carry traders from a savage short-covering squeeze. Then, green lighting the big banks for another go-round of the dividend and share-buyback scam, it handsomely rewarded options traders who had been front-running this announcement for weeks.

Indeed, this sort of action is so blatant that the Fed might as well just look for a financial vein in the vicinity of 200 West St. [Goldman Sachs (GS) headquarters], and proceed straight-away to mainline the trading desks located there. In fact, such an action would amount to a POMO [Permanent Open Market Operations] – so it is already doing just that!

In any event, the yen intervention certainly had nothing to do with the evident distress of the Japanese people. What happened is that one of the potent engines of the global carry-trade – the massive use of the yen as a zero cost funding currency – backfired violently in response to the unexpected disasters in Japan.

Accordingly, this should have been a moment of condign punishment – wiping out years of speculative gains in heavily leveraged commodity and Emerging Markets currency and equity wagers, and putting two-way risk back into the markets for so-called risk assets. Instead, once again, speculators were assured that in the global financial casino operated by the world’s central bankers, the house always has their back – this time with an exchange rate cap on what would otherwise have been a catastrophic surge in their yen funding costs.

Is it any wonder, then, that the global economy is being pummeled by one speculative tsunami after the next? Ever since the latest surge was trigged last summer by the Jackson Hole smoke signals about QE2, the violence of the price action in the risk asset flavor of the week – cotton, met coal, sugar, oil, coffee, copper, rice, corn, heating oil and the rest – has been stunning, with moves of 10% a week or more.

In the face of these ripping commodity index gains, the Fed’s argument that surging food costs are due to emerging market demand growth is just plain lame. Was there a worldwide fasting ritual going on during the months just before the August QE2 signals when food prices were much lower? And haven’t the EM economies been growing at their present pace for about the last 15 years now, not just the last seven months?

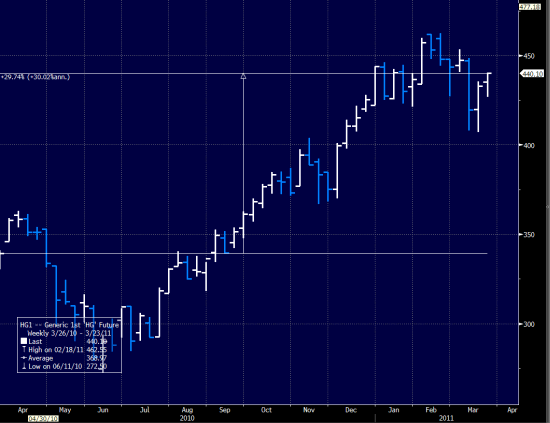

Similarly, the supply side has had its floods and droughts – like always. But these don’t explain the price action, either. Take Dr. Copper’s own price chart during the past 12 months: last March the price was $3.60 per pound – after which it plummeted to $2.80 by July, rose to $4.60 by February and revisited $4.10 per pound a few days ago.

That violent round trip does not chart Mr. Market’s considered assessment of long-term trends in mining capacity or end-use industrial consumption. Instead, it reflects central bank triggered speculative tides which begin on the futures exchanges and ripple out through inventory stocking and de-stocking actions all around the world – even reaching the speculative copper hoards maintained by Chinese pig farmers and the vandals who strip-mine copper from the abandoned tract homes in Phoenix.

Mar 24, 2011 at 12:54 PM

Mar 24, 2011 at 12:54 PM

Reader Comments (6)

http://www.bloomberg.com/news/2011-03-24/detroit-outgrows-silicon-valley-in-tech-as-ford-binges-on-hires.html

http://www.bloomberg.com/news/2011-03-23/mets-may-default-on-debt-after-settling-madoff-case-trustee-picard-says.html

http://www.bloomberg.com/news/2011-03-24/u-s-durable-goods-orders-unexpectedly-declined-in-february.html

http://www.bloomberg.com/news/2011-03-23/stuck-pipe-prevented-shear-rams-from-sealing-bp-well-u-s-says.html

http://www.bloomberg.com/news/2011-03-23/china-s-biggest-banks-may-post-record-profit-for-fourth-year.html

Is Goldman Sachs in front of the line to turn Libya into the NWO's New Babylon Shopping Mall? BP is setting up to drill ASAP. The ugliest bitches in Hollywood can't wait to line up and smell that new cement. The newest rage in TV dinner culture Poodle parlors and plastic shit no one needs and gets them no closer to respectable. Shopping centers and housing developments for the nouveau stink.

That new irrigation works belongs to Libya who built it. Not Golddigger-Rats The fans of Goldman Sachs have the same taste as house flies. Go to any battle field after the noise dies down. TV -dinner provincial.