Citigroup Pays $285 Million To Settle SEC Mortgage Fraud

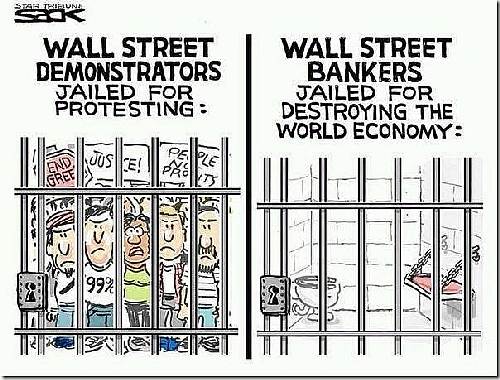

No, banks didn't commit fraud. Civil charges. No one is going to jail. Lather, rinse, repeat.

---

WASHINGTON — As the housing market began its collapse, Wall Street firms and sophisticated investors searched for ways to profit. Some of them found an easy method: Stuff a portfolio with risky mortgage-related investments, sell it to unsuspecting customers and bet against it.

Citigroup on Wednesday agreed to pay $285 million to settle a civil complaint by the Securities and Exchange Commission that it had defrauded investors who bought just such a deal. The transaction involved a $1 billion portfolio of mortgage-related investments, many of which were handpicked for the portfolio by Citigroup without telling investors of its role or that it had made bets that the investments would fall in value.

In the four years since the housing market began its steady descent, securities regulators have settled only two cases related to the financial crisis for a larger sum of money. This is also the third case brought by the S.E.C. accusing a major Wall Street institution of misleading customers about who was putting together a security and about their motive. Goldman Sachs and JPMorgan Chase & Company both settled similar cases last year.

The settlement will refund investors with interest and include a $95 million fine - a relative pittance for a giant like Citigroup. On Monday, the company reported that in the third quarter alone it earned profits of $3.8 billion on revenue of $20.8 billion. The settlement may also have trouble getting approval from Jed S. Rakoff, the federal district judge in New York who must ultimately sign off on the fine and who has taken a hard line on S.E.C. settlements.

Neither the S.E.C. nor the Justice Department would say whether the case raised questions about whether Citigroup had been involved in any criminal wrongdoing. But the case highlights a growing frustration felt by foreclosed homeowners, investors and Wall Street protesters alike that few, if any, senior banking executives have faced criminal charges for losses growing out of the financial crisis.

Oct 20, 2011 at 12:29 AM

Oct 20, 2011 at 12:29 AM

Reader Comments (4)

If you can make a bundle of money through fraud, and even if you're caught you only have to pay a 9.5% penalty, and even then it's your sucker shareholders and not you personally who pays, what's going to stop you from doing it again -- especially if you're psychopath?

Court to SEC, Citigroup: See you in September

http://www.reuters.com/article/2012/03/20/us-citigroup-sec-idUSBRE82E0VB20120320

[snip]

A federal appeals court will wait until late September to review U.S. District Judge Jed Rakoff's rejection of a U.S. Securities and Exchange Commission fraud settlement with Citigroup Inc (C.N) over mortgage investments...

...Citigroup's settlement was intended to resolve charges that the third-largest U.S. bank in 2007 sold $1 billion of mortgage-linked securities debt without disclosing it had bet against the debt. Investors lost more than $700 million, the SEC said.

Rakoff had ruled that because the settlement did not require the bank to admit or deny liability, he could not determine whether it was fair or in the public interest.

But the 2nd Circuit on Thursday chastised Rakoff for having appeared to overstep his authority by trying to dictate policy to the SEC, saying it had "no reason to doubt" the agency's representation that it had acted in the public interest.

The SEC and other federal agencies have long let companies settle without admitting wrongdoing. If Rakoff's decision is upheld, many settlements might become impossible to reach. At least two federal judges, in cases involving the SEC and Federal Trade Commission, cited Rakoff in questioning such settlements.

Robert Khuzami, the SEC enforcement chief, defended the practice of not demanding admissions at a Securities Industry and Financial Markets Association conference in Miami on Monday.

"It's not to say that we don't understand the demands by some members of the public and others for admissions, particularly in the wake of the financial crisis," he said.

http://www.zerohedge.com/contributed/2012-07-15/citigroup-earnings-nim-and-fdic-tag-program

[snip]

Your humble scribe is scheduled to be on CNBC this Monday ~ 8:00 ET to talk bank earnings for Citigroup (C) and then Goldman Sachs (GS) the following day. With all of the attention being paid to JPMorgan and its hapless CEO Jamie Dimon, I’ve been less attentive to the zombie dance queen than usual. Let us repair this deficiency.