CHART OF THE DAY: Fed's Balance Sheet Hits NEW RECORD $3 Trillion

Up, up and away in my beautiful balloon.

---

UPDATE - Bubble, Balance Sheet Losses Played Down By Bernanke

---

Details from the WSJ:

Fed’s Balance Sheet Tops $3 Trillion For First Time Ever

The U.S. Federal Reserve‘s balance sheet topped $3 trillion for the first time as the central bank continued with its easy-money policy.

The Fed’s asset holdings in the week ended Jan. 23 increased to $3.013 trillion from $2.965 trillion a week earlier, the central bank said in a weekly report released Thursday. The Fed’s holdings of U.S. Treasury securities rose to $1.697 trillion Wednesday from $1.689 trillion a week earlier. The central bank’s holdings of mortgage-backed securities rose to $983.17 billion, from $947.61 billion a week ago.

---

A detailed interactive chart of the Fed's balance sheet, courtesy of the Cleveland Fed.

---

Here's more on Bernanke's insanity from Zero Hedge.

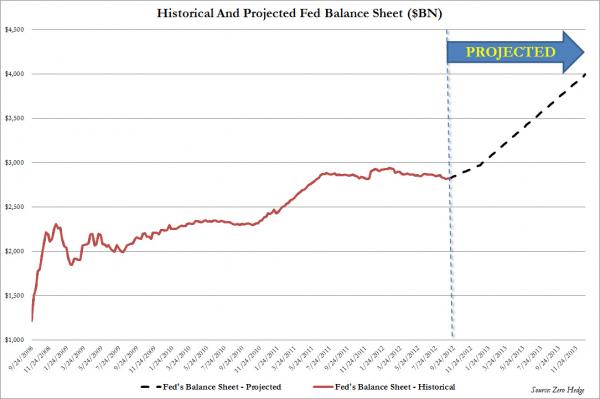

Wake us up when the Fed's balance sheet is $4 trillion, in precisely 11 months. The Fed will monetize roughly half of the US budget deficit in 2013. This is what the Fed's balance sheet will look like in 1 year:

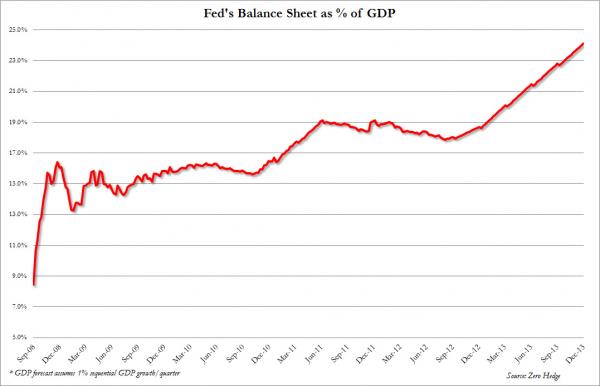

Another way of visualizing this is how many assets as a percentage of US GDP the Fed will hold on its books. Currently, this number is 18%. By the end of 2013, the Fed's historical flow operations will be accountable for 24% of US GDP.

Why is this important? Simple: when the time comes for the Fed to unwind its balance sheet, if ever, the reverse Flow process will be responsible for deducting at least 24% of US GDP at the time when said tightening happens.

***

And finally from Global Macro Monitor.

How Much QE Is Leaking Into The Economy?

We have posted several pieces (see here and here) on how the expansion of the Fed’s balance sheet is financed by reserve creation, which are held by depository institutions in the form of excess reserves and not circulating in the economy. In the chart below we try and get a sense of how much of the quantitative easing has leaked out of the banking system into the economy.

The monthly data in the chart below is the year on year change ($ billions) of total Federal Reserve assets less excess reserves of depository institutions. Because the last observation of excess reserve data is from December the chart doesn’t capture the latest effects of quantitative easing.

---

Bernake's bubble theme song (Nancy Sinatra):

Would you like to ride in my beautiful balloon.

Apr 1, 2013 at 12:12 PM

Apr 1, 2013 at 12:12 PM

Reader Comments (8)

http://www.marketwatch.com/story/treasury-cuts-quarterly-borrowing-estimate-2013-02-04-1591028

WASHINGTON (MarketWatch) -- The U.S. government expects to borrow $331 billion in the January-March quarter, $11 billion less than previously forecast, the Treasury Department said Monday.

http://www.businessweek.com/articles/2013-02-04/the-consumer-watchdog-comes-under-new-fire-from-congress

Will the Fed eventually remove the wobbly bamboo financial scaffolding currently supporting not only the US, but by extension the lion's share of the world's economy? Of course. As soon as another of Newton's laws applies itself: gravity. This will end, but it will end poorly.

http://www.americanthinker.com/2013/02/the_feds_want_your_retirement_accounts.html

Many are talking about just giving in to the Bankstas, some are "thinking" of fighting back but the

only way to do that is, get your money and take a loss, then hide it.

There are even people who brag of paper gold & silver. How good can that be?

Very, very few are preparing for a self sufficient life, as Gompers and Skinflint have been describing.

This discussion has been around since the Clinton's, and yet, no one has taken up the pitchforks!

Will it take the attack on 401's to awaken the Beast?

Will it be slow, or will the crash come fast and furious?

The bigger question is, why aren't more people concerned?