Tuesday

Apr162013

Bob Pisani: What Happens To Gold ETFs During Selloff

Pisani on today's gold selloff and redemptions at ETFs.

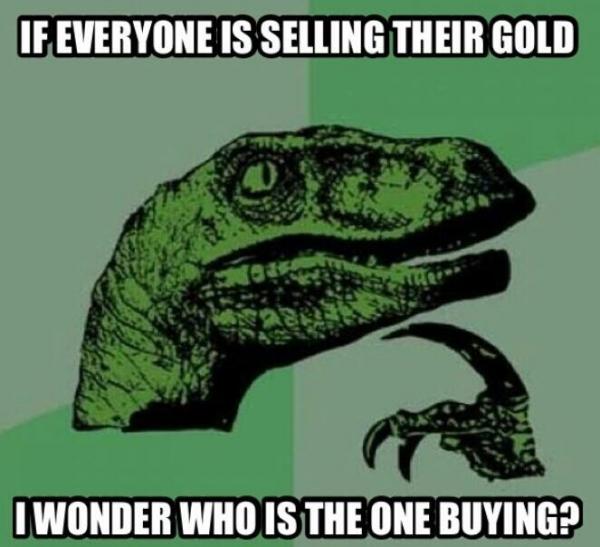

Who will be the marginal buyer in gold? Here's a hint.

If the Fed needs to buy several hundred tons of gold to eventually send back to Germany, they would certainly benefit from today's lower prices, wouldn't they.

Central Banks Buy The Most Gold Since 1964

MUST SEE: Is The Fed Lying About Its Gold?

Apr 16, 2013 at 3:00 AM

Apr 16, 2013 at 3:00 AM

Reader Comments (3)

http://dailybail.com/home/central-banks-buy-the-most-gold-since-1964.html

http://dailybail.com/home/chart-stocks-vs-bonds-vs-gold.html

The banks are buying up gold thanks to the FED best efforts, as evidenced by FMOC minutes, to have their member "primary banks" flood the market with "naked" shorts.

The end game is not a "gold standard". The end game is "gold currency". And the plan, when it is fully executed, will have all the gold owned by" too big to be accused of moral turpitude" primary banks.

THE BANKS WILL OWN THE CURRENCY. That has been the plan all along

THe commons will have mini storage lockers filled with worthless fiat and forced to buy gold at 10K and ounce to enter into any transactions. And of couse, the commons will not own the minuscule amount of gold their worthless fiats will be able to afford, the will only be able to license it to complete a transaction. The commons will still be paid in "not worth the ink" "coupons" that they'll have to convert to a license to use the gold, the banks own, to complete a transaction.

[1] http://www.sweetliberty.org/issues/israel/freedman.htm