Bloomberg Accuses The Fed Of Fear-Mongering & Hyperbolic Speculation In Fighting Transparency (Update On FOIA Appeal)

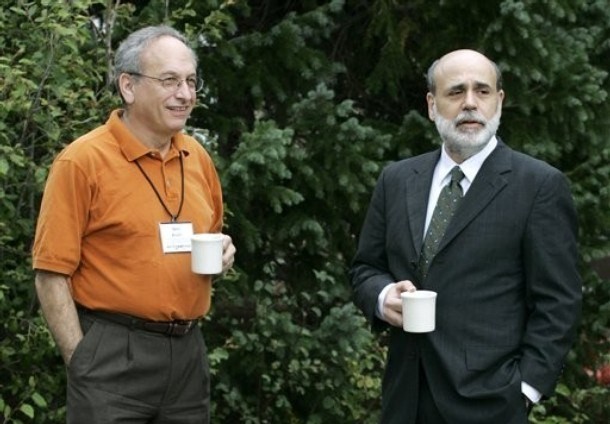

Bernanke, Donald Kohn, general counsel Scott Alvarez and ancillary legal minions at the Federal Reserve continue their fight to prevent you from finding out exactly what they're doing with that $2 trillion balance sheet and trillions more in shady and secret commitments. It's safe to assume that the only thing they fear more than Ron Paul and Alan Grayson is collateral shock and an immediate destruction of the dollar. They have a timetable for slow devaluation, lest the people actually notice and start complaining.

Bloomberg along with Fox News, (separate suit) are the only media organizations fighting for you and your kids. Judge Preska ruled courageously a few weeks ago in favor of sunshine and the Fed promptly appealed, with the same arguments that lost the case to begin with. No matter, the legal wheel spins and Bloomberg has responded to the Fed's appeal with the following:

The Board’s interests in secrecy are, in fact, aligned with the banks’ interests and are contrary to the public interest. The Board wishes to continue to lend trillions of dollars of public money without oversight or accountability, and the banks wish to continue to reap the benefits of their access to public money without their depositors or shareholders – or the public at large – knowing anything about it.

The Board contends that it is serving the public’s interest by keeping all of this information secret from it, claiming that disclosure might harm the borrowers and, therefore, the entire U.S. economy. But the Board has offered no evidence – relying instead on hyperbolic speculation – from which this Court could conclude that such harm was likely to result from disclosure.

By contrast, the public has a manifest interest in understanding and evaluating the government’s response to the recent economic crisis, in safeguarding its money, and in knowing whether its government is doling out its money to private entities imprudently. To make matters worse, the public is being denied this basic information even as the Board continues to act on its behalf in providing public assistance to private financial institutions. In order to allow the public to participate in the ongoing debate on the appropriate role of the federal government in alleviating the economic crisis, it should be provided with details of last year’s loans.

******************

Click To Scroll Our List Of Recent Stories

Thank you!

If you support our cause then PLEASE re-tweet our stories when you visit. It takes about 5 seconds and is something simple you can do that really makes a difference.

Oct 7, 2009 at 12:34 AM

Oct 7, 2009 at 12:34 AM

Reader Comments (15)

http://www.nytimes.com/2009/10/05/business/economy/05tarp.html

Some on-the-ground observations, Japan 1989 to 2009 Deflation Vs. Inflation...Interesting

http://patrick.net/forum/?p=16931

Wall Street’s Near-Death Experience

Absolutely outstanding detail from Sorkin...you will want to read this one...

http://www.lewrockwell.com/woods/woods124.html

Wall Street’s Near-Death Experience

I'm repeating this one...set aside 20 minutes...Phenomenal detail and reporting...

http://www.responsiblelending.org/overdraft-loans/research-analysis/overdraft-explosion-bank-fees-for-overdrafts-increase-35-in-two-years.html

http://www.cnbc.com/id/33120552

Where Jim Rogers Would Invest $1 Million

http://www.cnbc.com/id/33114835

Evil Ben Bernanke Halloween Masks Sell Out!---Halloween idea

http://www.cnbc.com/id/27455228

http://www.theglobeandmail.com/globe-investor/e-zines/trade-by-numbers/jim-rogers-answers-your-questions/article1309660/

For some reason the audio sucks, and it sounds like Rogers is working out, but interesting nonetheless.

"Whodunit? Sneak attack on U.S. dollar"

http://news.yahoo.com/s/politico/20091008/pl_politico/28091

Apparently one of the culprits behind this "sneak attack" (no, it's not Ben Bernanke), is likely to be a gold trader. Because everyone knows that the gold bugs control the forex markets, right? Any takers on whether the gold traders meme will find legs? Is Larry Summers getting antsy? Pretty strange that crack financial reporter Eamon Javers even knows the gold market exists. Even harder to imagine that he would think to talk about it in an article about the dollar. Hmmm....

"To recover from the Great Recession, we’ve had to go even deeper into debt. One need only look at today’s record-setting price of gold, in a period of deflation, to know that a lot of people are worried that our next dollar of debt — unbalanced by spending cuts or new tax revenues — will trigger a nonlinear move out of the dollar and torpedo the U.S. currency."

(Nb: I think "nonlinear" is just tossed in there to let you know that Tom is one of the Sophisticated People -- no pedestrian "linear" moves for him.)

If the dollar keeps falling and gold keeps rising then yes you will hear much more about this...

http://letthemfail.us/archives/2271

(warning: proceding to this link without the recommended consumption of Rolaids tablets may be hazardous to your overall sense of well-being).

"And I hope at some point that we can fully expose this deadly form of gaming, contrived to loot the working class of the world, and shift their remaining wealth–as well as their productive capacity to create true wealth–to the predatory casino owners, bent on taking complete control of the world before our very eyes."

I agree completely, why are your comments closed? hope you had a great vacation.