Bill Isaac Vs. Hank Paulson's Bailout Machine -- How The Former FDIC Chairman ALMOST Stopped TARP

The little-known story behind the House's initial rejection of TARP from Bill Isaac's new book Senseless Panic.

--

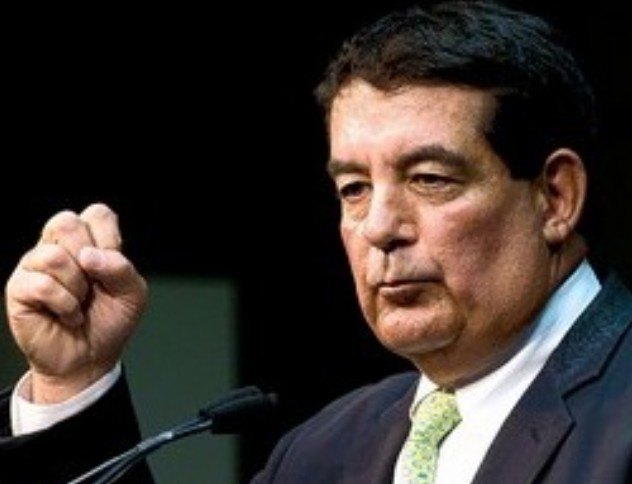

Bill Isaac was Chairman of the FDIC from 1981-1985 during one of the most tumultuous decades in American banking. He oversaw the banking system during the Latin American debt crisis and the severe recessions of the early 1980's, and tried -- against enormous political pressure -- to head off the looming S&L crisis before it got worse. As many know, the S&L clean-up cost taxpayers hundreds of billions of dollars, but had Congress taken Isaac's prescient advice earlier in the decade, the ultimate costs would have only been an estimated $2B.

Fast forward to 2008. On September 18, Paulson and Bernanke had convinced the Congressional leadership that a bank bailout plan had to be passed immediately or else the entire global economy would collapse. In his new book, Senseless Panic: How Washington Failed America, Isaac writes:

- "Having served as chairman of the Federal Deposit Insurance Corporation (FDIC) during the banking and S&L crises of the 1980's, I was disturbed, even angry, about the events that led up to the bailout plan itself. I was so upset that I wrote an opinion piece opposing the bailout plan that ran in the Washington Post of Saturday, September 27."

In his op-ed, Isaac pointed out that several of the ostensible reasons for why we had to pass the TARP bill just didn't make sense. For instance, the claim that TARP had to be passed because there was a run on money market funds was completely specious as the U.S. Treasury had announced their blanket guarantee on September 19. Similarly, if the proponents of TARP wanted to claim that ordinary depositors were scared of bank failures, then why not be more clear about "the fact that the FDIC fund is backed by the full faith and credit of the government"? (This is more or less what the FDIC did anyway, when it raised the deposit insurance limit to $250,000.) Besides, Isaac wrote, "[t]his is how the FDIC handled Washington Mutual. It would be easy to announce this as a temporary program if needed to calm depositors." As with so many of the government's excuses for TARP, actions that had already been taken disproved the claims for why TARP was necessary.

And TARP, as sold to Congress, was a blatantly stupid idea anyway. As we've pointed out so many times here at The Daily Bail, "[h]aving financial institutions sell the loans to the government at inflated prices so the government can turn around and sell the loans to well-heeled investors at lower prices strikes me as a very good deal for everyone but U.S. taxpayers. Surely we can do better."

Based on his long experience, Isaac recommended the following in his September 27 op-ed:

- "[R]eimpose on short sellers the Depression-era regulations on speculative abuses the SEC had removed in 2007."

- The FDIC should "declare a financial emergency and proclaim that all depositors and other creditors of banks would be protected in bank failures during the period of emergency."

- Suspend mark-to-market accounting, thereby restoring around $500B of capital in the system.

- Use the FDIC's existing "emergency power to restore capital in the banks along the lines of a program we used successfully in the 1980's" (i.e. the Net Worth Certificate program).

As he later wrote in Senseless Panic,

- "I believed then and continue to believe strongly that these actions would have been much more effective in dampening the financial crisis than Paulson's ill-conceived plan to purchase toxic assets, would have cost taxpayers little, if any, money, and would not have politicized the crisis and scared the public the way the Paulson plan did."

But it was on that Saturday, the 27th of September back in 2008, that Isaac started getting phone call after phone call from members of Congress who had read his op-ed in the Washington Post. He received calls that afternoon from Democrats -- Marcy Kaptur of Ohio, Brad Sherman of California, and John Hall of New York, as well as from Republicans -- Darrell Issa of California and Isaac's own congressman, Vern Buchanan of Florida. They were all skeptical of Paulson's plan, Isaac remembers, and they were equally pissed off that the leadership had decided to ram the TARP bill through without hearings, without debate, and with zero accountability.

Each of the representatives urged Isaac to come to Washington and join the fight against TARP, but he put them off.

- "Congress is going to approve the bailout bill on Monday," I explained, "and my presence in Washington is not going to change anything. We are taking the kids to see the Buccaneers play the Packers tomorrow and that's a much better way for me to spend my weekend."

Still, they persisted. Brad Sherman offered to pay all of Isaac's expenses. Darrell Issa offered the use of his office. Finally, Isaac relented and said he would talk to his wife. Isaac wasn't convinced and felt like he would just be wasting his time, but his wife told him: "You have to go. You feel so strongly about these things, you will always regret it if you don't."

"I could not have guessed how much my life would change," Isaac says. "I have devoted at least half of my time since September 28, 2008, to trying to help us out of this crisis and make sure we do not ever experience another one." Early that Sunday, September 28, Isaac flew to Washington.

Darrell Issa's office in D.C. became the "staging area" for the fight against TARP. His staff put out the word that Isaac would be available to meet with any member of Congress, Democrat or Republican, to discuss the crisis and the proposed bailout. Throughout the day, Isaac met with various groups of congressmen, not calling it quits until around 1:00AM Monday morning. For part of the day, he met with the Democratic Caucus alongside economists Jamie "Fed Killer" Galbraith and Dean Baker. In the end, he met with over 200 members of Congress, from both parties, of all political persuasions from left to right. He says he will never forget one meeting he had during which Jesse Jackson of Illinois and Maxine Waters of California sat together with several conservative Republicans, all united in their efforts to stop the bailout.

The next day, Monday, September 29, was the day set for the vote on TARP. The leadership had already decided that TARP would pass and "viewed the skeptics as an annoyance," but many of the rank and file, thanks in large part to Isaac's efforts, were not falling into line. As Ryan Grim reported at the time, when members of the leadership wrote to lower-ranking members to urge them to vote for TARP, those emails were often returned, not by the members themselves, but by Bill Isaac.

At lunch-time that Monday, there had still been no vote on TARP. Clearly there was trouble with the rank and file and the leadership couldn't be sure they had the votes. Otherwise, the vote would have already happened that morning. Finally, early in the afternoon, word went around that the vote would take place -- apparently enough arms had been twisted (Isaac says that Pelosi and others threatened to revoke members' committee assignments and withold support for their campaigns). One way or another, the leadership had gotten the votes.

- "I camped out in Darrell Issa's office to watch the vote on C-SPAN. It was every bit as exciting as a football game. The vote seesawed back and forth, the yeas and nays never more than a few votes apart. As the end drew near, the nays took a decisive lead and the billl was defeated -- 228 opposed and 205 in favor."

In the wake of the defeat, "[c]heers erupted throughout Darrell's office. We turned up the volume on the news channels to see how the news was being received. The world was as flabbergasted as we were!" That night, Isaac, along with Rep. Buchanan and his wife, headed to Dulles to catch a flight back home to Florida. "We were thrilled with the vote but knew the leadership was not going to let the vote stand."

We all know the rest of the story. The bankers, it seems, always get what they want, but Bill Isaac nearly stopped them. As Grim reported two years ago, "supporters and opponents of [TARP] agree on one thing: an obscure Carter administration policymaker named Bill Isaac helped kill the bill on Monday." Grim cites "a frustrated House GOP leadership aide" who said at the time: “That guy [Isaac] is more responsible for bringing this thing down than anybody else. He whipped them up into a frenzy.”

--

Unless specified otherwise, all quotes taken from Senseless Panic: How Washington Failed America.

Disclosure: Mr. Isaac has published this story in full on his website...

Feb 13, 2011 at 11:04 PM

Feb 13, 2011 at 11:04 PM

Reader Comments (13)

---

that's amazing. i was just worried about my family's investments at the time. i had no idea how evil the bailouts were. evil, yes. but i didn't know the extent of it. and i wasn't radicalized or politicized about the bailouts at that point. you should consider writing a few pieces about how you came to start the Bail.

when you think about it, there are a lot of writers and bloggers who have spent the last two years writing about the bailouts. and most of them are not getting any remuneration for their efforts. why do they do it? i think readers would enjoy reading how people like yourself, yves smith, wil martindale, mike morgan, larry doyle, et al. came to a point where they decided they had to blog about, and stand against, the bailouts.

these are all themes you've heard me hammer before...i never take the time to write like i used to...becasue it's not time effective for the site...the deep articles always get TROUNCED in page views by the comedy or videos...

one day when i have someone else to do the aggregation, i can return to writing longer pieces...

A couple of months later, I received a hand-wringing form email from my congressman explaining what a difficult decision he had to make as he heroically voted against his district and for the bailout.

My then-congressman? Rahm Emanuel.

http://www.youtube.com/watch?v=pRF_XnyMnMg

http://www.businessinsider.com/bill-isaac-on-tarp-2010-10

---

Yves Smith did it as a guest post...

http://www.nakedcapitalism.com/2010/10/guest-post-bill-isaac-vs-hank-paulsons-bailout-machine-how-the-former-fdic-chairman-almost-stopped-tarp-%C2%BB.html

---

And we have a few retweets from Ratigan today...

http://twitter.com/dylanratigan

---

We're starting to get a decent network going here...

http://www.nakedcapitalism.com/2010/04/rahm-emanuel-and-magnetar-capital-the-definition-of-compromised.html

isaac is no pitchfork-wielding populist, but that's why his criticism is so valuable. he recognizes better than most how badly paulson, bernanke and geithner fucked things up. i mean, he doesn't hint at that, he's said it! they screwed up and all this TARP was wonderful nonsense is just CYA on their part.

in a sense, though, isaac does favor extend and pretend. his view is that the regulators let banks get out of control and it makes no sense to "get religion" all at once in a way that is destabilizing to the entire system. when he was chair of fdic, though, he resolved some big banks even though he feared a panic might spread because of it. in other words, he's shown some balls in real situations, situations in which geithner et al. have shown a proclivity for wetting their pants.

he's one of the good guys. he's more dovish on banks than you or i might be, but he favors strict, counter-cyclical regulation. and he has no stomach for putting taxpayer dollars at risk. his view is that TBTF is always going to be a problem and the best response is good regulation. he's troubled by the concentration of power and assets in the banking system, just as much as anyone. don't write him off because his politics is different from yours or mine.

William Isaac published this story on his website...