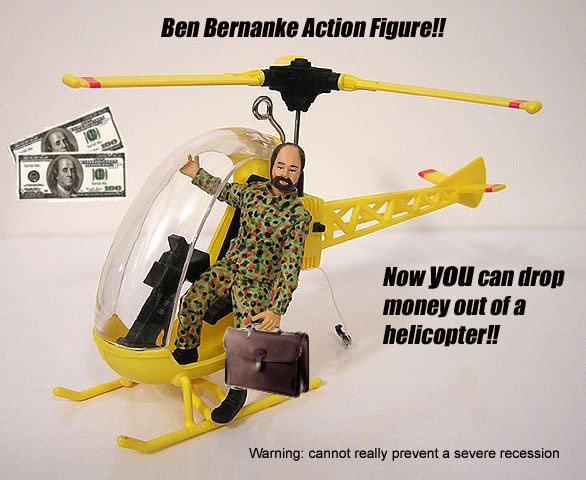

BERNANKE TO THE RESCUE IN EURO BAILOUT REDUX: European Christmas In September As World's Central Banks Announce Global Dollar Free For All

We've seen this before somewhere, ah yes, Grayson grilling Bernanke in 2009 about dollar loans to foreign banks.

Inspired by a liquidity crunch, a silent run on European banks, with no access to market capital and few dollars to spare, from the sidelines enters the Federal Reserve, with Bernanke as Peyton Manning (before the neck fusion), and The European Central Bank, the Bank of England, Bank of Japan, and the Swiss National Bank as wideouts. A trillion dollar Hail Mary that will postpone the inevitable for another 3 months.

One would think that 'the can' would be getting tired of being kicked so often, and so ineffectively down the debt highway.

---

FRANKFURT (MarketWatch) — The world’s top central banks announced Thursday that they will provide additional dollar loans to commercial banks in a move seen as a response to growing fears of a European credit crunch triggered by the euro-zone’s sovereign debt crisis.

The announcement, coming on the third anniversary of the collapse of Lehman Brothers, lifted shares in Europe and the United States, while the euro extended a gain versus the dollar to trade at $1.3904, a rise of 1.1% on the day.

The European Central Bank, the Bank of England, Bank of Japan, and the Swiss National Bank announced they will each conduct additional dollar tenders in an effort to provide liquidity through the end of the year. The central banks said the auctions are coordinated with each other and the U.S. Federal Reserve.

The move comes amid growing signs that European banks, particularly in France, are struggling to secure dollar funding in the interbank market due to worries about their exposure to Greek debt.

It shows central bankers are willing to take aim at a key concern in the markets, providing at least a short-term boost to risk appetite, said David Schnautz, interest-rate strategist at Commerzbank in London.

But the maneuver also serves to underscore nervousness over the banking system, he said.

“Obviously, the pure fact we are in a situation where central banks deem it necessary to conduct such an operation should ring alarm bells in itself,” he said.

The Euribor-OIS spread, which measures the difference between the three-month euro interbank offered rate and overnight index swaps, rose to 84.6 points on Sept. 12, its highest level since March 2009, according to Bloomberg. The index was seen at 78.1 basis points on Thursday, according to Dow Jones Newswires.

Tensions were seen mounting in funding markets in recent weeks. Moody’s Investors Service on Wednesday said it was growing increasingly worried about liquidity when it downgraded credit ratings on Societe Generale and Credit Agricole.

Shares of both banks jumped in the wake of the liqudity announcement.

The ECB will conduct three additional dollar tenders with a maturity of approximately three months in an effort to provide adequate dollar funding through the end of the year.

The Bank of England, Bank of Japan, and Swiss National Bank will also conduct additional dollar-liquidity operations.

“This provision of U.S. dollar liquidity to European banks — channeled from the Fed via ECB, BoE, and SNB — confirms our view that policy makers are not asleep and have learned lessons from the post-Lehman credit tightening that caused unwanted bank de-leveraging,” said Dan Dorrow, strategist at Faros Trading in Stamford, Conn.

“Central banks are proactively coordinating to limit real economy effects of the incipient European credit crunch,” he said, in emailed comments.

Nick Stamenkovic, fixed-income economist at RIA Capital in Edinburgh, said the move shows the ECB is clearly growing worried about funding conditions in Europe.

Ultimately, the situation still comes down to how policy makers handle Greece, but the move is “certainly a step in the right direction,” he said. “The ECB is doing its job.

---

Central banks buy Europe three more months

http://blogs.marketwatch.com/thetell/2011/09/15/central-banks-buy-europe-three-more-months/

---

Global Central Bank Intervention Half-Life: 30 Minutes?

http://www.zerohedge.com/news/global-central-bank-intervention-half-life-30-minutes

---

Much Ado About Nothing

http://www.zerohedge.com/news/here-what-just-happaned

Sep 15, 2011 at 12:17 PM

Sep 15, 2011 at 12:17 PM

Reader Comments (10)

Posted by Lisa - tireless volunteer advocate and founder of The Hamlet. She nails it again!

Big Law Pimps for Banks "World Will Come to an End Scenerio" after 4th DCA Glarum Opinion

http://www.foreclosurehamlet.org/profiles/blogs/big-law-pimps-for-banks-world-will-come-to-an-end-scenerio-after-

$nip>

We must respond to this! This is deeply insulting to anyone who wants due process and values an independent judiciary.

In a clear attempt to influence the 4th DCA to change their opinion in the Glarum case, Big Law is at it again. Remember the pressure the 4th's judges caved to when they changed the Riggs case. In that case, the decision was flipped 180 degrees.

Believe me. These attorneys would be screaming bloody murder if the 4th was willing to loosen up the hearsay rules in regards to the types of cases they heavily depend upon the compliance with those same rules. It's only when the banks do not want to follow the hearsay rules that we see this type of outright pressure applied to the appellate judges.

Apparently, any Florida appellate decision that requires banks to follow long established court rules or evidence are fair game to be overturned with a little push from the industry and their powerful attorneys.

Remember, rules of evidence exist for a reason. As result of the dishonest affidavits, assignments, allonges, & summary judgement affidavits filed by banks, LPS, and their foreclosure mills, Florida judges have been deceived into entering hundreds of foreclosure judgements based on unsworn affidavits & other hearsay evidence containing no admissible evidence and signed by a witness not competent to testify to the facts presented.

$nip>

Fuck them! (Lisa would not approve of my foul-mouthed comment...lol). TPTF is ramping up a campaign to scare us to death that if we question the banks authority we will all suffer a certain death. BULLSHIT. The opposite is true!

Join DB & I in the skybox & we'll have a great view of the global cataclysm. BYOB

How could anyone have concerns about economics when there are more important issues?

http://www.thehindu.com/sci-tech/science/article2432999.ece

WTF!!!

Did you catch this on Zero Hedge from yesterday? Hilarious!

It's Official: America Is Now As Dumb As A Bag Of Hammers

http://www.zerohedge.com/news/its-official-america-now-dumb-bag-hammers

http://www.marketwatch.com/story/negative-philly-fed-index-worse-than-forecast-2011-09-15

Fourth straight negative monthly reading

http://www.marketwatch.com/story/new-york-manufacturing-activity-dips-again-2011-09-15

http://www.marketwatch.com/story/morgan-stanleys-mack-to-step-down-as-chairman-2011-09-15

http://www.marketwatch.com/story/us-jobless-claims-jump-to-highest-since-june-2011-09-15

http://www.marketwatch.com/story/banks-ecb-deposits-loans-rise-signaling-tension-2011-09-15

Commentary: The difference between a mistake and a lesson

http://www.marketwatch.com/story/can-europe-avoid-the-sovereign-sequel-2011-09-14

Missed that pitiful chart. Great expression: LET"EM DIE DUMB