Ben Stein: 'It's Truly Hopeless, Deficit Will Grow Until It Destroys The U.S.'

Stein splits with Krugman, admits truth about deficits.

I shudder at posting Ben Stein, but he's dead right. Watch the first 2 minutes.

BEN STEIN: I mean the situation is just hopeless. I mean poor Mr. Lew, who was just nominated to be secretary of the Treasury. It's a very prestigious post. I've been in that room in the Treasury Department many times. It's a magnificent office. It has its own fireplace. But he might as well burn himself up in it. I mean there's nothing to be done about this budgetary situation. The budgetary deficit is just going to grow and grow and grow until it eats us all alive. There's nothing to be done but accept things that are very, very uncomfortable. And as I say, you have to laugh to keep from crying.

CHRISTINE ROMANS, CNN: But Congress won't do anything uncomfortable. This Congress for 20 years has only passed laws and made policies with an eye to getting re-elected again. You know, if you looked at Congress as a stock, an 18 percent approval rating. The least productive Congress in history last year. And they're just running up a bill for taxpayers. I mean it's ridiculous.

STEIN: Well, Thomas Jefferson predicted that the democracy would not last in this country because politicians would just endlessly vote to spend money on things that the country couldn't afford in order to get themselves re-elected. And that's exactly what has happened. But it's happening now at a geometrically higher rate than has happened in the past.

ROMANS: Yes.

STEIN: As the population ages. It's just a hopeless situation. We're going to have to have -- we're going to finally have to have dramatically higher taxes on everyone, the middle class up to the rich, and there's going to have to be a dramatic cut in entitlements for the upper middle class and the upper classes. Just, it has to happen. That's arithmetic. We hate the arithmetic, but it's real.

ROMANS: I love arithmetic, actually, but there's not any honest arithmetic really in Washington. But let me -- I want to show you this arithmetic. A new public policy polling survey. Congress is now less popular than head lice, cockroaches and Donald Trump. That's funny.

STEIN: Well, I don't get why anyone would vote for head lice or why would anyone like head lice or cockroaches unless he's a bug scientist. I don't get that at all. And I like Donald Trump. But I -- I mean, I just don't get at all what anyone expects them to be able to do until they pull their heads out of the sand and say, look, we're going to have to do brave, kamikaze type action here --

ROMANS: Yes.

STEIN: Where we risk very much not being re-elected in order to save this country. Are we brave enough to sacrifice our careers to save our country? We'll see. We'll separate who's brave and who's not.

ROMANS: You don't get re-elected by saying, you're going to have to lower your living standards to pay for your living standards up to this point. You don't get re-elected saying that when that might very well be the honest truth.

STEIN: Exactly. But you might get re-elected if you say, we're going to give you a chance to cast the vote which will preserve this country for your children and grandchildren. That's the chance Congress is going to have to take.

---

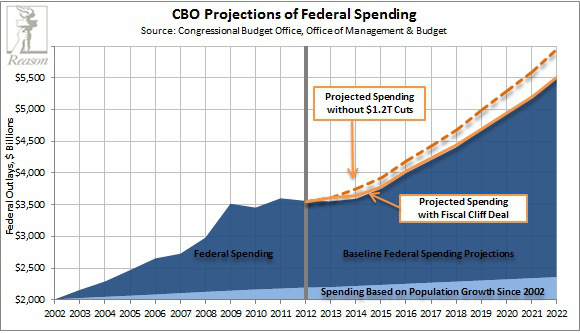

CHART - It's The Spending, Stupid!

A fiscal cliff drop in the bucket.

CBO Projection Of Federal Spending 2002 - 2022.

Just a quick chart to demonstrate that the fiscal cliff deal on taxes means essentially nothing in the grand scheme of future federal spending.

Jan 28, 2013 at 9:11 PM

Jan 28, 2013 at 9:11 PM

Reader Comments (15)

August 2007: “the [subprime MBS] sell-off seems extreme, not to say nutty. Some smart, brave people will make a fortune buying in these days, and then we’ll all wonder what the scare was about.”

http://www.nytimes.com/2007/08/12/business/yourmoney/12every.html?_r=0

March 2008: “Things aren't that bad. Short-sellers and the press are pumping fear into the national bloodstream. The unemployment rate is 5%. Only 3% of the labor force is unemployed for more than 5 weeks - 3%!”

http://money.cnn.com/2008/03/06/pf/minds_over_money.moneymag/

Stein can't even look in the rear view mirror without getting it wrong:

January 2012 (totally ignoring Ron Paul’s warnings for two decades: “No candidate has told you from either party. No candidate has told you we are going to have to default on our national debts.”

https://www.youtube.com/watch?v=kgE1yE5An1w

The national debt will hit $25 trillion in 6-7 years. At that point, assuming a normal financing cost of 5% (could be higher if we have inflation, could be lower if we are still in slow growth Japan mode), the INTEREST on the debt will be $1.25 TRILLION annually. Assuming we have federal tax receipts of approximately $3 trillion (they are about $2.4 trillion now), that means we will be spending roughly 40% of all our annual revenue just to pay the interest on the money that we already borrowed.

At 40% no government can survive.

Damn! I can hardly believe he made these comments.

DB@10:33,

The people I deal with are completely ignorant of the interest on the debt. What should I expect living under an overpass in a cardboard box. LOL

http://dailybail.com/home/ben-stein-economic-village-idiot.html

I posted the links above for the benefit of readers who might be unfamiliar with Ben's track record as a panglossian shill.

TR--

I'm always skeptical when someone who's been on the wrong side of an issue gets religion after the fact. One example of this is Alan Greenspan. Before he left the Federal Reserve, he didn't believe in fraud at all and thus refused to have any meaningful discussions whatsoever with Brooksley Born. After phase 1 of the Ponzi scheme collapse in 2008-09, suddenly Greenspan got religion and admitted that the failure to enforce age-old criminal fraud statutes was a major part of the problem.

Another example is Glenn Beck. He was all in favor of TARP before it passed. Only after it passed, over the enraged objections of ordinary Americans did Beck's wet finger in the air lead him to find anti-bailout religion.

Ben Stein is from the same class of opportunistic assholes as Alan Greenspan and Glenn Beck. Fuck all of them.

Before finishing off your boner over U.S. debt, you should take a look at public debt levels in other countries (preferably before you go blind and grow hair on your palms). On page 1, you’ll see that Japan, Greece, Italy, Portugal and Ireland are all worse off than the U.S.—and they don’t have the world’s reserve currency.

http://www.imf.org/external/pubs/ft/weo/2012/02/pdf/c3.pdf

When the U.S. goes down, we’re gonna bring plenty of company along for the ride. You won't live long enough to get rid of us, mate.

Exceptional my arse... The vast majority of yanks are not only too gutless to take back their Kuntry from the warmonger that are bleeding them dry but are basically stupid in the extreme. Face it, arseholes, that cliff you are running towards is much closer that you think! And you only have yourselves to blame for it! Yankyland > the worlds biggest sheep station!

Suck that up cheyenne!

It's an equal shitstorm in Europe - and the UK is not exempt. Last I checked Britain's central bankers were printing just like Bernanke. QE is not strictly a U.S. disease, nor is the debt.

Good to see you're still publishing at your site.

http://www.capitalismwithoutfailure.com/

---

Soopercali

I wouldn't count on rates staying low beyond the next few years. The interest on the debt will be much more substantial once rates rise.