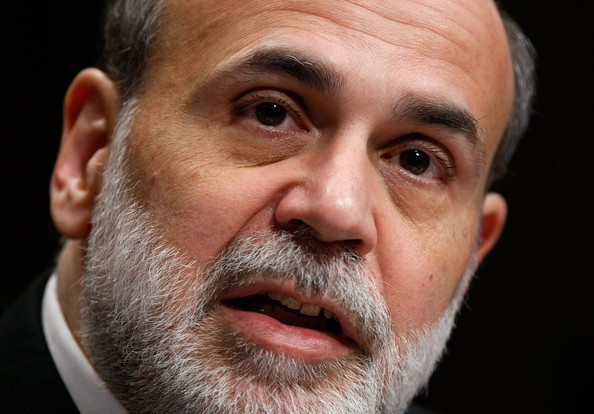

Bailout The Federal Reserve: B-52 Worries About Inflation (Bernanke Speech At Morehouse: Transcript, Video & Reaction)

Fed Chairman Ben Bernanke discusses bank mergers, mortgage crises, the stimulus package and consumer confidence at Morehouse College in Georgia.

Part II of B-52's speech at Morehouse.

Q & A from Bernanke speech.

Reacting to Fed chief Ben Bernanke's comments, with James Bianco, Bianco Research president; and CNBC's Rick Santelli, Steve Liesman & Erin Burnett.

After the jump we have the speech, the transcript, video of the Q&A, and a CNBC clip of reaction from Liesman and Santelli.

After the jump we have the speech, the transcript, video of the Q&A, and a CNBC clip of reaction from Liesman and Santelli.

From Reuters CNBC:

Federal Reserve Chairman Ben Bernanke said Tuesday the latest figures on housing and consumer spending suggest a rapid contraction in the economy could be easing.

"Recently we have seen tentative signs that the sharp decline in economic activity may be slowing, for example, in data on home sales, homebuilding and consumer spending, including sales of new motor vehicles,'' Bernanke said in a speech at Morehouse College in Atlanta.

The remarks, which were about the extensive actions the central bank is taking to stem the financial crisis, were posted on the Fed's website ahead of time.

Earlier Tuesday, President Obama proclaimed signs of economic progress but also warned Americans eager for good news that "by no means are we out of the woods."

Some recent reports have suggested a moderating of the economy's downturn but data Tuesday was less encouraging, with the Commerce Department reporting retail sales fell 1.1 percent in March where economists had foreseen a 0.3 percent rise.

Calling the current financial crisis the worst since the Great Depression, Bernanke explained the litany of emergency measures taken by the central bank and the Treasury Department with the aim of restoring battered credit markets.

The Fed, which has cut interest rates effectively to zero, has also created a broad range of lending facilities to ensure that banks can remain above water despite massive losses from mortgages and other consumer loans.

Bernanke said some of the programs might one day have to be removed in order to prevent all the stimulus from building into an outright threat of inflation.

"We have a number of effective tools that will allow us to drain excess liquidity and begin to raise rates at the appropriate time,'' he noted. "That said, unwinding or scaling down some of our special lending programs will almost certainly have to be part of our strategy for removing policy stimulus once the recovery is under way.''

That day was clearly not at hand quite yet, since Bernanke said the Fed was exploring an expansion of the types of credit made available through its program to restart securitization markets, known as the Term Asset-Backed Securities Lending Facility or TALF.

Bernanke did not specify what areas he had in mind, but analysts believe it would include bonds backed by commercial real estate, a sector that has been deteriorating quickly in recent months.

The TALF so far has seen much weaker demand than the Fed had foreseen.

While the central bank had allotted $200 billion in loans, only about $6.4 billion in deals have emerged in two auctions thus far.

Bernanke took pains to justify actions taken to save insurance giant AIG, which has been embroiled in a controversy over lavish bonuses paid after the firm was already on taxpayer-funded life support.

He argued that the firm's collapse would have compromised the entire global financial system.

Nonetheless, he argued that direct support to financial institutions and loans to investors would not compromise the taxpayer, or lead to the threat of inflation.

"I can assure you that monetary policy-makers are fully committed to acting as needed to withdraw on a timely basis the extraordinary support now being provided to the economy, and we are confident in our ability to do so,'' Bernanke said.

The U.S. economy could emerge from recession in the fourth quarter of 2009 as fiscal and monetary stimulus kick in, though the recovery is likely to be subdued, an economist with the San Francisco Federal Reserve Bank said Tuesday.

John Williams, director of research for the San Francisco Fed, said in the bank's latest "FedViews" newsletter that the U.S. economy probably shrank in the first quarter at a rate similar to, or slightly greater than, the 6.3 percent reported for the fourth quarter of 2008.

Beyond that, though, "we expect real GDP to decline at a significantly more modest, 1.25 percent annual rate in the current quarter," he said.

Among the positive signs now emerging, Williams said housing market indicators "have stopped their headlong plunges and show some tantalizing signs of improvement," helped by falling mortgage rates.

bank bailouts, bank bailout news, financial crisis

Apr 14, 2009 at 5:20 PM

Apr 14, 2009 at 5:20 PM

Reader Comments (4)

http://businessmirror.com.ph/home/bloomberg-specials/8801-keynes-vs-friedman.html

Does he really believe this, or is he just covering for Greenspan? The Fed wants to deny any and all culpability, but also makes it clear they've just been groping in the dark for the last ten years -- we don't know what effects our actions had and we don't know when or why we will be raising interest rates in the future. THIS, mind you, came at the end of a tallk that focused in part on "confidence" in financial institutions!

By the way, these were some sharp questions from these guys. Ol' Ben probably felt like he was surrounded by a bunch of Ron Paul Republicans. Nice work, Morehouse.

Instead, all we got was some vague mularkey about melting... freezing ... collapsing...or... (JUST PICK a Godamn metaphor, Ben, and stick with it.)

My translation: AIG is a big, insanely complicated firm that we knew was going to go down. We also knew it might have brought down other institutions, including (God forbid) Goldman Sachs. At that point, Hank Paulson and I promptly peed our pants. This really sucked. Therefore, in order to make sure future Fed chairmen and Treasury Secretaries do not simultaneously pee their pants, we must institute yet another gargantuan, unConstitutional regulatory agency that has powers beyond anyone's wildest dreams to shut down, regulate, and generally slap around any company under the sun.

____________________________________________

We are so SCREWED, ladies and gentlemen.

"I think one of the concerns would be not that house prices would be too high but rather that they might overshoot and go down too low below sort of what the sustainable level is."

Below what the sustainable level is? WTF? No such thing exists. Someone please direct this man to a remote village in Darfur for a little R&R.

"The Fed is not getting involved in this. I think it is going to depend a lot on how, if there is a bankruptcy or some restructuring, it depends a lot on how it takes place. I think that the goal of the administration is to create an auto industry that will be sustainable - that will not be requiring money all the time from the government - and that's what they are trying to figure out. So it will be desirable to get, if there is a sustainable structure, it will be desirable to re-engineer the company so that it's able to survive and be a productive part of the economy."

No kidding the Fed is not getting involved. The Fed (and likely Treasury) only cares about its friends in finance - and by proxy commercial and residential real estate. Keep that money making roulette table alive. Taxpayers will gladly pick up the tab either way [sarcasm].

Notice how Bernanke mentions bankruptcy and restructuring a priori in relation to the auto industry yet it is taboo in relation to AIG and the big four. What about institutions that will never be a "productive" part of the economy. Using arbitrage to exploit interest spreads produces nothing - but leeches dressed in designer suits trying to justify their existence.

Sure you can borrow seed counterfeit money from the Fed at 0% and charge me 5% on a 30 year note for the privaledge of access to the additional counterfeit money you create out of thin air. You produced something alright - an illusion David Copperfield could only dream about - and produced a debt slave in the process. Then you get to arbitrage my signature on the debt instrument for even more profit. When I default? My neighbors will cover it - in bailouts, bonuses, and guarantees made by unelected officials. After all, these institutions are too big to fail!

A leech is still a leech even if you dress it up and take it to the opera. Take the monopoly on counterfeiting away, or legalize other forms of "legal tender", and any elementary school child could make a killing through the innovation of usury. The difference is the elementary school child doesn't get to make their units of exchange out of thin air, so at least it's an honest form of usury.