Tory Leader David Cameron: "This Big Government Has Reached The End Of The Road"

A quick look across the pond at UK Tory Leader David Cameron. Two short clips that run 3 minutes combined. A harbinger of 2012 elections here undoubtedly. Terrific speech.

Ron Paul On Bailouts, Wall Street Fraud And Washington Capture

Have you hugged your HR 1207 lately? Show your support and don't miss this outstanding clip. One of the best from Dr. Paul in a while. Story has been updated with a partial transcript.

Foreclosed And Getting Scammed? Don't Do What This Couple Did

Facing foreclosure and getting scammed by loan mods? Grab some friends and commit torture.

Alex Jones: Fall Of The Republic - Economic Takeover (DVD Trailer)

There are several trailers for Alex Jones' new DVD Fall Of The Republic available on youtube, most of which I don't agree with or endorse. Throw your spears Jones fans, but remember that you can not hurt what does not bleed. I do appreciate his drive and passion for freedom, in a general sense. This clip is focused on the Federal Reserve and Treasury. Bernanke, Paulson, Geithner, Summers, Bush And Obama are targets. It runs 2 minutes.

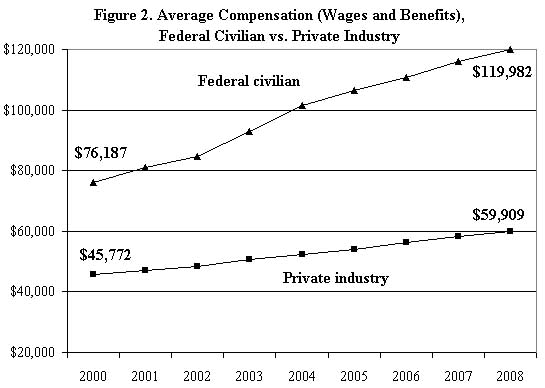

Rethinking Salary Constructs, Federal Pay Continues To Skyrocket (CHART)

In 2008 the average federal worker earned twice that of his private-industry counterpart in wages and benefits: $120,000 per year versus $60,000.

Check out the difference in slope of the two lines. Yowza. Federal pay and benefits are up 58% since 2000 compared to just 28% in the private sector.

Of course, when you consider the massive productivity advantage government workers enjoy over their private counterparts, it all makes sense. WTF?

Well, it's all the Democrats fault undoubtedly. Wait, looks like it was Bush.

Soros: Dollar Is Done, World Needs A New Reserve Currency

Video: George Soros With The Financial Times Broadcast October 23

- "China must be part of the New World Order."

- "The dollar's decline should be orderly."

Take a few minutes to read the transcript inside. This is an excellent interview.

Because It's Important To Know What Your Enemies Are Thinking

There is a particular cacophonous distaste when Christina Romer's voice waddles through my speakers. The Chair of the White House CEA "cringes at the thought" of ending the stimulus early, and swears that the White House is "not cool with trillion-dollar deficits," though she offers no alternative, besides the vague illusion of savings from healthcare reform.

Why? Because they have NO deficit-reduction plan, people. None. Geithner, Summers, Romer & Obama are praying, salivating for massive debt-induced growth. They have no other hope.

Meanwhile, tic-tock, just don't look at the debt clock.

Dr. Warren Is Still Waiting For Geithner To Answer THE Question

- ROMANO: I was reading a transcript of a hearing that you conducted with Secretary Geithner. And you had a very good question, which was why is it that the banking institutions and the automobile companies were treated differently, that the criteria for receiving the funds was very different. The banking industry didn't really have to meet much, and the automobile industry did. If I recall right, you asked the question three times. And I'm not sure he ever answered it (go to the 2:55 mark of this link).

- WARREN (all quotes below are hers): If he answered it, I didn't catch it.

- Obviously, it bothered me. That's why I kept asking it. There is such a difference. I mean, just take a deep breath for a second on this. We said with the auto companies you have to have an entirely new business plan. You have to go through bankruptcy. You have to wipe out your shareholders. Your debt holders have to take a hit. Your labor has to take a reduction. Your management team is at risk for being fired; some of them got fired.

Bird And Fortune On The Financial Crisis: "You Have To Understand What Bankers Actually Do" (Comedy)

If you've never heard of British comedy team, Bird and Fortune, you can start here. It's Friday afternoon, so enjoy some laughs.

The Next Big Bailout? Look No Further Than The New FHA

One year after rescuing Fannie and Freddie (to the tune of $200 billion, and still growing), what has the government learned about irresponsible mortgage lending.

Absolutely nothing.

Oct 28, 2009 at 3:21 PM

Oct 28, 2009 at 3:21 PM