The Japanese economy shrank an annualized 1.1% in Q4 of 2010. Meanwhile, food and commodity prices continue to rise, giving Japan the worst of both worlds in having to contend with both price inflation in food and energy and deflation in asset prices. You may be wondering what happened to "Welcome to The Recovery"? Not to worry -- when the numbers don't add up, you can expect a flurry of metaphors from government officials and economists, both of whom have advocated spending and printing money in prodigious amounts. Masaaki Shirakawa of the Japanese central bank said the 4th quarter dip was just a momentary "pause" on the path to recovery. Taro Saito of Nippon Life said the economy was just undergoing a brief "lull" -- soon we'll "hit bottom," "gain traction," etc. This is just a little "blip," anyway, recovery is just around the corner. Of course, recovery is always just around the corner. Or gosh, maybe it's just a "soft patch."

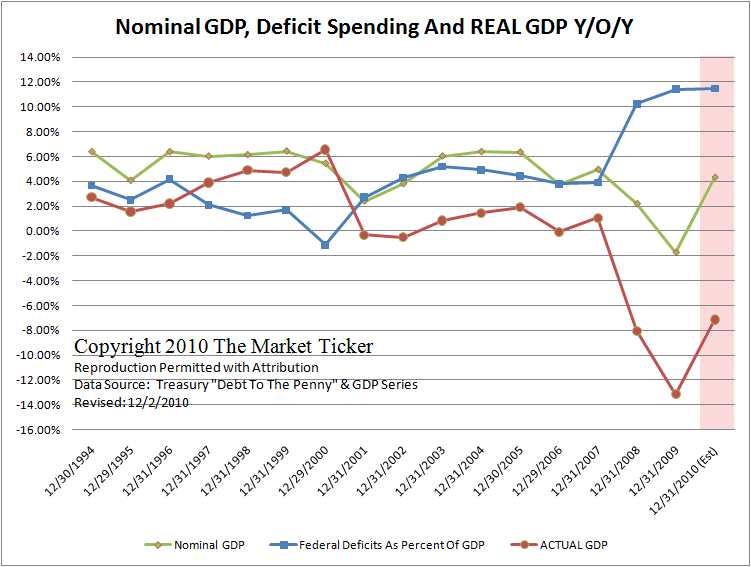

Geithner and Bernanke have been crowing about "recovery" since 2009, but there has been no recovery. We've seen nothing but an insane run-up in stocks and a massive bubble in US government and corporate debt that will NOT end well. See Karl Denninger's great chart:

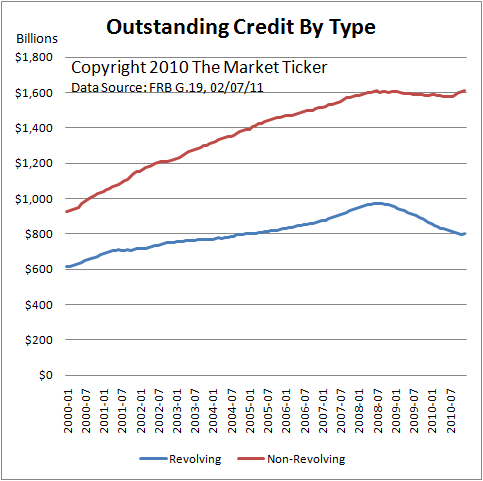

And remember, Japan has been doing this song and dance for over twenty years -- ever since their own stock market and real estate bubbles burst back in 1989-90. Unfortunately, our policy response here in the US, despite protestations to the contrary, is mimicking Japan's. We've bailed out our banks and large corporations, we continue to allow them to lie about asset values. There is virtually no new credit growth outside of the government, and zero interest rates have done nothing but punish savers in favor of the large banks. And see this chart from Denninger (revolving credit looks like Mt. Fuji):

Rather than "recovery," the numbers out of Japan this morning only foreshadow what's likely in store for us, unless the American people get their act together and FORCE Washington and the Fed to stop wrecking the real economy in favor of the banks. Because that's what they're doing, whether they know it or not, which is always an open question.

--

Japan Q4 GDP Slumps on Policy Change

TOKYO (MNI) - The Japanese economy suffered its first contraction in just over a year in the last quarter of 2010 as the government unwinds crisis measures, but the world's third-largest economy is expected to avoid a recession as overseas economies are now on the mend.

Gross domestic product shrank by a real 0.3% on quarter in October-December after a revised 0.8% rise in July-September, hit by what appears to be a temporary dip in spending and slumping exports, Cabinet Office data released on Monday showed.

GDP dropped at an annualized pace of 1.1% in Q4, compared with a revised 3.3% rise in Q3 (revised down from the initial reading of +1.1% q/q, or +4.5% annualized).

But the Q4 drop was smaller than the median forecast by economists for a 0.5% quarter-on-quarter fall, or an annualized rate of 1.9%, with economist forecasts ranging from 0.2% to 0.8% fall, or at an annualized pace of 0.8% to 3.1%.

Japanese financial markets showed little reaction to the GDP data, with the Nikkei 225 Stock Average rising 0.8% this morning and the yield on 10-year JGBs falling half a basis point to 1.300%. The yen moved in a range of Y83.15 to Y83.57 versus the dollar.

"The GDP data confirmed that the Japanese economy was indeed in a soft-patch in the last quarter of 2010, hit by swings in demand for autos following the end to the government's subsidies and a temporary downturn in overseas demand," said Taro Saito, senior economist at NLI Research Institute, a unit of Japan's largest life insurer Nippon Life Insurance Co.

--

Further reading...