Ireland's Fine Gael party will take control of the government after winning in yesterday's elections. A few weeks ago, they were threatening to give haircuts to bank bondholders, but now most "serious" people in government and the media believe this will never actually happen. However, the wildcard in all of this is the Irish people themselves -- they're expecting real change, not half measures. And some of them are openly talking of a "revolution."

It remains to be seen whether the moment of truth has finally arrived for Ireland's bank bondholders. As predicted, Ireland's opposition party, Fine Gael (pronounced "feena gail"), did very well in yesterday's elections and will likely form a coalition government with Ireland's Labour party. As we reported earlier, Fine Gael played to voters' anger over the bailouts by engaging in a good deal of tough talk about unilaterally restructuring the debts of Ireland's bailed out banks.

However, the tough talk will likely turn out to be nothing but talk. Fine Gael's pre-election threats to bank bondholders were promised to be carried out only if they were unable to restructure the terms of the IMF "bailout." Such restructuring would only amount to tinkering around the edges of the agreement, not rejecting it outright. The main point of contention amongst "serious" people has been the 6% interest rate Ireland was saddled with, not the obvious injustice of making the Irish people debt slaves for the benefit of Deutsche Bank and Soc. Gen.

Photo - Campaign gimicks: Fine Gael's Enda Kenny kisses babies and threatens bondholders.

Photo - Campaign gimicks: Fine Gael's Enda Kenny kisses babies and threatens bondholders.

Indeed, as Reuters reported last week, Fine Gael has already backpedaled on its threats to whack senior bank bondholders:

Feb 15 (Reuters) - Ireland's main opposition party withdrew on Tuesday a previous threat to unilaterally restructure bank debt if it wins power, as expected, this month in an election dominated by a controversial EU/IMF bailout.

The centre-right Fine Gael party's election manifesto said imposing losses on senior bondholders in Irish banks would only be extended as part of a European-wide framework and would focus on state-run lenders Anglo Irish Bank [ANGIB.UL] and Irish Nationwide [IRNBS.UL], which are being wound down.

In its banking strategy published earlier this month, Fine Gael warned that if some of its proposals for dealing with the banking crisis were not implemented it could unilaterally impose losses on unguaranteed senior bonds, estimated at around 15 billion euros. [ID:nLDE71318V]

"I don't think there has been a particular softening of our position on banking and on burden-sharing," Michael Noonan, Fine Gael's finance spokesman and a likely contender to be finance minister after the Feb. 25 poll, told a news conference.

"It might be slightly more nuanced."

It's a little-known fact, but "nuanced" is etymologically related to an obscure Old Irish word meaning "empty." As in, "empty promises and idle threats cynically used to fool the Irish people into voting for us, with the hope that we don't actually have to do anything so bold as mess with our banking masters who, if we're being honest, are really in charge of this country."

The Wall St. Journal today ("Irish Voters Reject Government, But Accept Austerity Program") doesn't even entertain the possibility that yesterday's election was a popular rejection of the bailouts, characterizing it instead simply as a rejection of the outgoing ruling party, Fianna Fáil (pronounced "feena fall"):

DUBLIN (Dow Jones)--Irish voters have decisively rejected the political party most closely associated with the rise and fall of the Celtic Tiger economy, but have largely accepted an austerity program intended to repair the government's tattered finances....

"It is fairly predictable that we will have a Fine Gael-Labour coalition," said Diarmaid Ferriter, professor of modern history at University College Dublin.

Ferriter said that the Irish electorate had expressed deep anger about the country's economic crisis not through violent street demonstrations but by casting ballots to drive Fianna Fail from power.

"The answer was in the polling booths," he said.

Labour wants the budget cuts to take place over a longer time frame and a different balance between spending cuts and tax rises. But both parties are committed to renegotiating some of the terms of the bailout package, including lowering the 6.0% interest rate charged by the EU.

It is absolute nonsense to pretend that the election yesterday was an endorsement of the bank bailouts and the austerity measures being put in place to finance them. The very reason Fianna Fáil was booted from power is voter anger over the bailouts and the austerity measures being put in place to finance them.

The notion that Irish voters will be placated by merely symbolic "change," which is what a reduction of the 6% interest rate would amount to, sounds to us like wishful thinking on the part of the ruling class and their handmaidens in the media. What professor Ferriter, for instance, fails to take into account is what the Irish people will do once they realize they have been summarily duped by Fine Gael. That's the wildcard in all of this. At some point, it may not matter what the government wants to do, because the people may force their hand. Can anyone say Egypt? Or Tunisia, Bahrain or Libya? College Green could be the next Tahrir Square.

Photo - Irish writer and newspaper columnist, Bruce Arnold, calls for a "national referendum" on the bailouts.

Photo - Irish writer and newspaper columnist, Bruce Arnold, calls for a "national referendum" on the bailouts.

In this vein, the influential Irish Independent columnist, Bruce Arnold, offers Fine Gael and its leader, Enda Kenny, some sage advice:

Forcing us to sell our national assets to pay off our debt is a polite form of robbery

It is reassuring to know that Enda Kenny, who is likely to be the next Taoiseach, will, in his own words, "hit the ground running". Much of what follows is designed to ensure that he will be running in the right direction.

Arnold continues:

There has to be a European solution and it has to be radical. Nothing that has been said or done by the departments of Foreign Affairs and Finance, not to mention the outgoing ministers who got us into this mess by their craven approach to the EU, indicates any real understanding of how deeply we are in trouble.

The seriousness was recognised by David McWilliams, in his column in this paper on Wednesday, when he pointed out that the interest on our debt could reach €12bn by the end of next year. This would eat up roughly 85pc of income tax revenue. That is an impossible burden and clearly unsustainable. That is just a beginning.

We are required by the EU to take on the debts of the European banks and pay with the sale of national assets, like Greece selling beaches and Portugal selling its unique Port vineyards.

This is a polite form of robbery and runs in the teeth of everything Europe has stood for, in Irish eyes, since we joined the Common Market 40 years ago. Luckily, as McWilliams also says, "there are many more democrats in European politics than there are central bankers".

Arnold gets all the main points right -- the unfairness of the bailout, the undemocratic nature of the bailout decision, and, most importantly, the impossibility of actually being able to pay it off. But here's where the wildcard comes in and things get really interesting:

So let us appeal to [Europe's central bankers] and do so by a national referendum, under Article 27 of the Constitution, where a matter of "such national importance that the will of the people thereon ought to be ascertained" is authorised.

It could be argued that the mandate in this general election obviates such a course. Yet the mandate, as I indicate above, is not that clear cut. Though the enormity of the botched bailout was at the heart of public anger during the campaign, the threat of this to the country's future was vaguely and imperfectly assessed.

The debates on it were on the fringe of the issues, and were largely concerned with the difference between Fianna Fail smugness about us not being able to do anything and opposition tinkering with minor details, like getting a better interest rate on borrowed tranches of money and introducing a share-out with bondholders. Its threat to us is far more serious than that.

The situation involves default and is getting progressively worse. It is still focused on the banks and the haemorrhage of money is growing.

It's clear that Arnold gets it. Tinkering around the edges of the bailout settlement is an inadequate response to both the anger of voters and to Ireland's extremely precarious fiscal situation. It's unlikely that there actually will be a national referendum in Ireland in the way that Arnold calls for, but there is absolutely no doubt, that in such a referendum, the bailouts would be overwhelmingly rejected.

However, if the politicians won't give the people the opportunity to vote down the bailouts -- and there is zero indication that they will -- there remains the distinct possibility that the Irish people will hold their own national "referendum" in the streets of Dublin. We've already seen flashes here and there of bailout anger and a few, large protests over the bailouts, but all of these were before the election that was supposed to change everything. When the people see that almost nothing has changed, and especially when it becomes clear -- as Arnold points out -- that Ireland's very sovereignty and solvency are at stake, things will get very interesting indeed.

Just yesterday I was listening to NPR on the radio and they were interviewing a young unemployed woman in Dublin about the election and what people were most concerned about. Bailouts and austerity were the main focus of the conversation. But at the end of the interview the young woman was asked whether she would be glad if Fine Gael won and a new administration put in place. She half-heartedly said that she would, but then said, with an understated frankness, and just a slight hesitation that suggested she really meant it, "I'd rather call for a revolution, actually -- if I could."

--

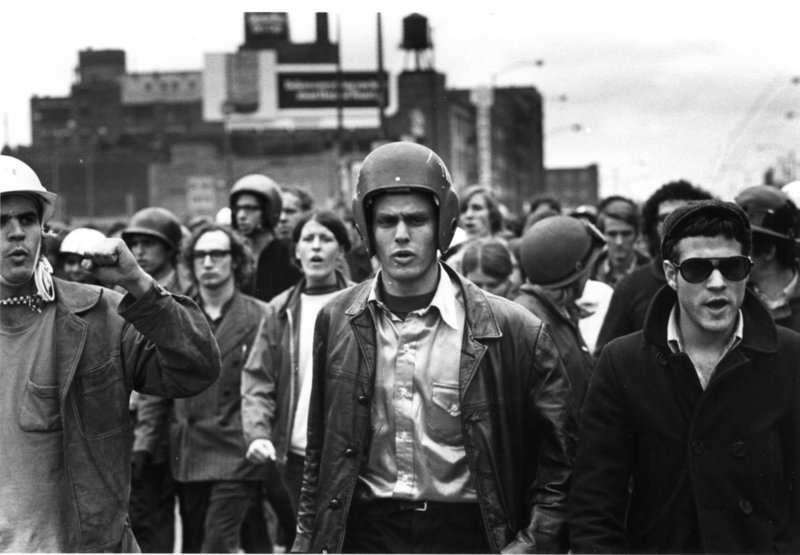

Photo - Days of Rage: Chicago, 1968.

Photo - Days of Rage: Chicago, 1968.

--

Photo - It used to be "Brits Out," but now it's the IMF.