By Eliot Spitzer, William K. Black and Frank Partnoy

Originally appeared at the Huffington Post

-----

In a December New York Times op-ed, we called for the full public release of AIG email messages, internal accounting documents and financial models generated in the last decade. Today, a Bloomberg story revealed that under Timothy Geithner’s leadership, the Federal Reserve Bank of New York told AIG to withhold details from the public about its payments to banks during the crisis. This information was discovered when emails between the company and the Fed were requested by representative Darrell Issa, ranking member of the House Oversight and Government Reform Committee.

The emails requested by Issa span five months beginning in November 2008. The Fed’s request to suppress this information would not have come to light without the release of these emails. If five months of emails reveal information key to our understanding of the aftermath of the crisis, imagine what 10 years of emails could contribute to our understanding of its causes. We believe the AIG emails and other internal company documents are the ‘black box’ of the financial crisis. If we understand the failure of AIG, we will more fully understand the crisis - what caused it and more importantly how to prevent it from happening again.

As such, today we are renewing our request for the full public disclosure of all AIG documents. We believe the government should put these documents on-line, thereby establishing an open-source investigation that would allow journalists and citizens the opportunity to piece together the story of what happened at AIG and in so doing more fully understand what happened in the broader financial collapse. AIG — and more specifically its credit-default swaps exposure — was an important contributing factor to the crash of the financial markets. What sets this company apart from others that played a role in the crisis is that we, the taxpayers, own it. As we noted in our original piece, US taxpayers bought 80% of AIG when they bailed the company out with $180 billion last year. As owners of the company, taxpayers are also owners of AIG. As owners of the company we can demand the release of these documents.

The taxpayer’s stake in AIG is held by the A.I.G. Credit Facility Trust, whose three trustees are Jill M. Considine, a former chairman of the Depository Trust Company and a former director of the Federal Reserve Bank of New York; Chester B. Feldberg, a former New York Fed official who was chairman of Barclays Americas from 2000 to 2008; and Douglas L. Foshee, chief executive of the El Paso Corporation and chairman of the Houston branch of the Federal Reserve Bank of Dallas. We call on these three officials (interestingly all former Fed officials) to immediately release the documents we request.

The value of these documents, if it were ever in doubt, was certainly proved by today’s revelations.

Release the emails.

-----

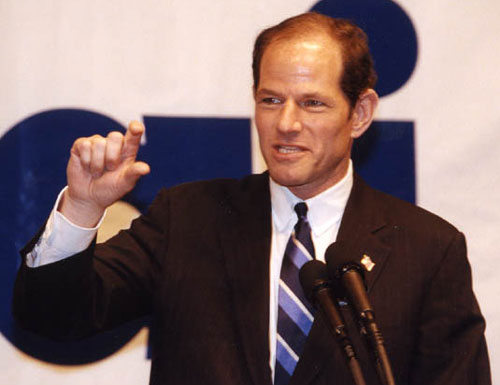

Eliot Spitzer is the former governor of the state of New York. He blogs for Slate and contributes guest posts to New Deal 2.0.

Roosevelt Institute Braintruster William K. Black is an Associate Professor of Economics and Law at the University of Missouri-Kansas City. He is a white-collar criminologist and was a senior financial regulator.

Frank Partnoy is the George E. Barrett Professor of Law and Finance and is the director of the Center on Corporate and Securities Law at the University of San Diego. He is one of the world’s leading experts on the complexities of modern finance and financial market regulation.