Aug. 15, 1971... Tricky Dick abandons the gold standard.

Nixon announces the end of the Bretton Woods International Monetary System 41 years ago today. This was one of the most important decisions in modern financial, economic and monetary history and is a seminal moment in the creation of the global sovereign debt crisis confronting the U.S., Europe and the world in 2012.

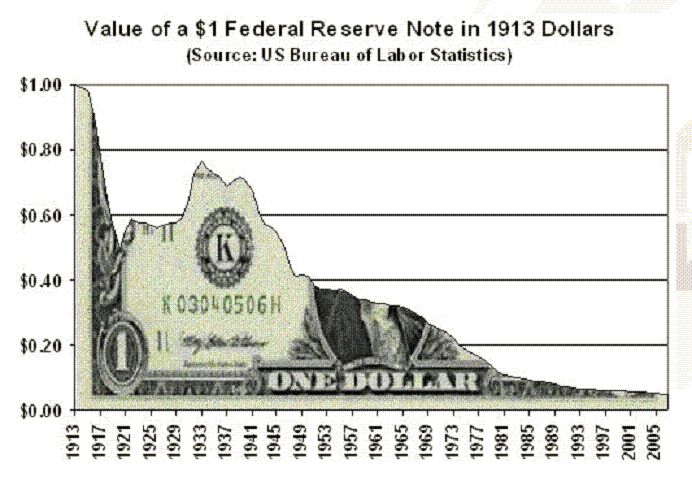

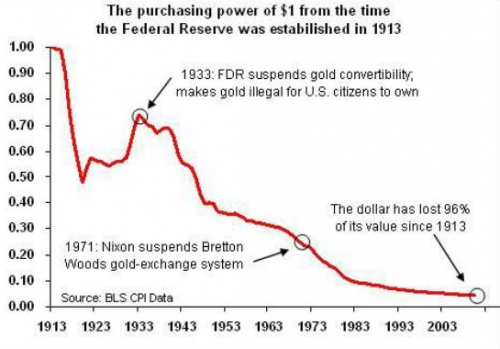

The dollar has since fallen from 1/35th of an ounce of gold to 1/1750th of an ounce of gold.

---

Video text from Youtube page:

On August 15, 1971, President Nixon announced on TV 3 dramatic changes in economic policy. He imposed a wage-price freeze. He ended the Bretton Woods international monetary system. And he imposed a temporary surcharge (tariff) on all imports. The Bretton Woods system was created towards the end of World War II and involved fixed exchange rates with the U.S. dollar as the key currency - but also a role for gold linked to the dollar at $35/ounce. The system began to falter in the 1960s because of an excess of dollars flowing out of the U.S. which foreign central banks had to absorb. A run on gold in 1968 was stemmed by a patch on Bretton Woods known as the two-tier gold system. All of this was ended unilaterally by the Nixon decision.

Profanity Warning:

But highly entertaining.

Related links:

- The Gold Confiscation Act Of 1933

- The Day Richard Nixon Killed the Gold Standard

- CHART - Inflation Adjusted Gold Price (1970-2012)

- We Need A New Gold Standard - Economist James Grant