The only problem I see with John Carney's analysis is the political risk that Obama would face in signing such a bill. The American people, and most certainly the righteous economic blogosphere, are watching this story too closely for it to slip through as an unnoticed rider attached to larger legislation.

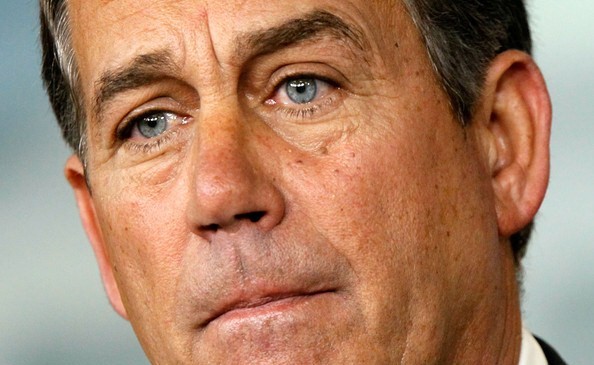

So it will be scrutinized, and objections will be raised from all sides, especially the progressives, and Obama will not sign it. That's our only chance, because John Boehner and Harry Reid have the banking lobby on speed dial with a campaign contribution account attached.

I touched on these rumors yesterday at the bottom of the Matt Taibbi story.

---

Background:

---

Guest post from John Carney

When Congress comes back into session next week, it may consider measures intended to bolster the legal status of a controversial bank owned electronic mortgage registration system that contains three out of every five mortgages in the country.

The system is known as MERS, the acronym for a private company called Mortgage Electronic Registry Systems. Set up by banks in the 1997, MERS is a system for tracking ownership of home loans as they move from mortgage originator through the financial pipeline to the trusts set up when mortgage securities are sold.

The system has come under scrutiny by critics who charge MERS with facilitating slipshod practices. Recently, lawyers have filed lawsuits claiming that banks owe states billions of dollars for mortgage recording fees they avoided by using MERS.

If courts rule against MERS, the damage could be catastrophic. Here’s how the AP tallies up the potential damage:

- Assuming each mortgage it tracks had been resold, and re-recorded, just once, MERS would have saved the industry $2.4 billion in recording costs, R.K. Arnold, the firm's chief executive officer, testified in 2009. It's not unusual for a mortgage to be resold a dozen times or more.

- The California suit alone could cost MERS $60 billion to $120 billion in damages and penalties from unpaid recording fees.

- The liabilities are astronomical because, according to laws in California and many other states, penalties between $5,000 and $10,000 can be imposed each time a recording fee went unpaid. Because the suits are filed as false claims, the law stipulates that the penalties can then be tripled.

Perhaps even more devastatingly, some critics say that sloppiness at MERS—which has just 40 full-time employees—may have botched chain of title for many mortgages. They say that MERS lacks standing to bring foreclosure actions, and the botched chain of title may cast doubts on whether anyone has clear enough ownership of some mortgages to foreclose on a defaulting borrower.

Now it appears that Congress may attempt to prevent any MERS meltdown from occurring. MERS is owned by all the biggest banks, and they certainly do not want it to be sunk by huge fines. Investors in mortgage-backed securities also do not want to see the value of their bonds sink because of doubts about the ownership of the underlying mortgages.

So it looks like the stage may be set for Congress to pass a bill that would limit MERS exposure on the recording fee issue and perhaps retroactively legitimate mortgage transfers conducted through MERS private database.

Self-styled consumer advocate Neil Garfield says the legislation is already being drafted:

- After years of negative judicial decisions about the use of a straw-man on mortgages, MERS was about to lose its existence as well as its credibility. But now all of that is set to change as Wall Street money is pouring into the coffers of those who are receptive (i.e., almost everyone in Congress). The legislation is already being drafted under the interstate commerce clause to ratify MERS and everything it did retroactively. It appears that the Obama administration is ready to pardon all the securitization deviants by signing this bill into law. This information is corroborated by several people who are in sensitive positions — persons who would be the first to know such proposals. Fortunately, there are some people in Washington who have a conscience and do not want to see this happen.

Garfield is overstating things a bit. In truth, the results of the legal challenges to MERS have been mixed. But it is very plausible that the banks might want to put to rest any ongoing uncertainty about the legality of MERS. I wouldn't be at all surprised if Congress manages to pass a bill that bails MERS out of its legal issues.

##

Watch an interview with the CEO of MERS...

More detail on this clip is here:

---

Important background:

Several recent stories from John Carney are immediately below in comments.