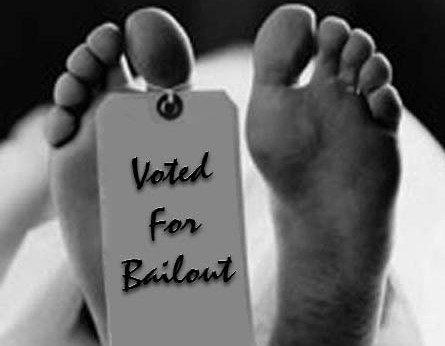

Political suicide.

I covered the substantial outrage yesterday. I can't imagine the anger responsible renters must be feeling as they are now being asked to bailout the irresponsible mortgage holders who lived an extravagant lifestyle fueled by house-ATM withdrawals. One woman took out $2.7 million in cash from a house that is worth less than $1 million today.

Her details are here:

---

Program announcement from HUD.

#

FHA SHORT REFINANCE OPTION NOW AVAILABLE

Effort designed to encourage principal write-downs for responsible borrowers

WASHINGTON - In an effort to help responsible homeowners who owe more on their mortgage than the value of their property, the U.S. Department of Housing and Urban Development today will begin providing an additional refinancing option for underwater borrowers. Originally announced in March, this enhancement of Federal Housing Administration (FHA) refinance program will offer certain 'underwater' non-FHA borrowers who are current on their existing mortgage and whose lien holders agree to write off at least ten percent of the unpaid principal balance of the first mortgage, the opportunity to qualify for a new FHA-insured mortgage.

The FHA Short Refinance option is targeted to help people who owe more on their mortgage than their home is worth – also known as being 'underwater' - because their local markets saw large declines in home values. As announced earlier this year, this change as well as other programs that have been put in place will help the Obama Administration meet its goal of stabilizing housing markets by offering a second chance to up to 3 to 4 million struggling homeowners through the end of 2012.

Participation in FHA's short refinance program is voluntary and requires the consent of all lien holders. To be eligible for a new loan, the homeowner must owe more on their mortgage than their home is worth and be current on their existing mortgage. The homeowner must qualify for the new loan under standard FHA underwriting requirements. The property must be the homeowner's primary residence and the borrower's existing first lien holder must agree to write off at least 10% of their unpaid principal balance. In addition, the existing loan to be refinanced must not be an FHA-insured loan, and the refinanced FHA-insured first mortgage must have a loan-to-value ratio of no more than 97.75 percent and a combined loan-to-value ratio no greater than 115 percent.

To facilitate the refinancing of new FHA-insured loans under this program, the U.S. Department of Treasury will provide incentives to existing second lien holders who agree to full or partial extinguishment of the liens. To be eligible, servicers must execute a Servicer Participation Agreement (SPA) with Fannie Mae, in its capacity as financial agent for the United States, on or before October 3, 2010.

For more information on FHA Short Refinance option, read FHA's mortgage letter.

#

Source: HUD