For story background, read the following:

---

Reprinted with permission.

ShoreBank Corp., the Chicago lender operating under a Federal Deposit Insurance Corp. cease-and- desist order for 13 months, will be shut and most of its assets will be bought by Urban Partnership Bank, two people with direct knowledge of the matter said.

Urban Partnership, created to make the acquisition, will keep branches in Chicago, Cleveland and Detroit and continue to focus on low-income communities, the people said, speaking anonymously because the matter is private. Urban Partnership will have Tier 1 capital of at least 8 percent and its chief executive officer will be William Farrow, a former executive at the Chicago Board of Trade and Bank One Corp., they said.

“The good news is that the bank, under this new management, will still be there and serving the South Side community,” said Dory Rand, president of the Chicago-based Woodstock Institute, a non-profit that studies community lending. “They have made the South Side a decent place to live and work and do business.”

Investors include Goldman Sachs Group Inc., General Electric Co., JPMorgan Chase & Co., Citigroup Inc. and several philanthropic groups, the people said. ShoreBank raised more than $145 million from the firms in May and the funds were placed in escrow pending a decision by the U.S. Treasury to provide another $75 million in bank bailout funds.

Capital Shrinks

The bank kept losing money and the government elected not to provide more capital, people with knowledge of the rescue efforts said. The private capital will now be used for Urban Partnership, the person with direct knowledge of the matter said.

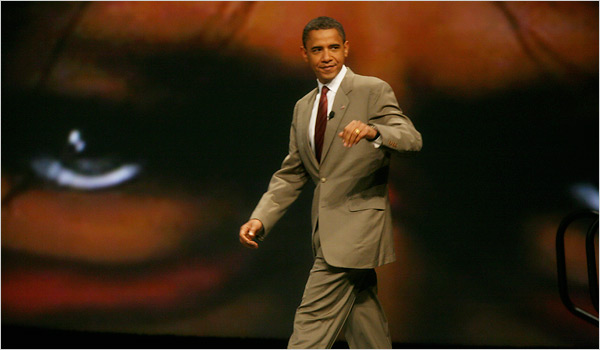

ShoreBank was founded in 1973 in Chicago’s South Side, an area that includes some of the city’s lowest-income neighborhoods. The area is also home to enclaves of wealth such as President Barack Obama’s Kenwood neighborhood, close to the University of Chicago.

The bank’s Tier 1 capital shrank to $4.1 million at the end of June from $26.3 million on March 31 and $43.5 million at the end of last year, according to the FDIC. The bank had “engaged in unsafe or unsound banking practices,” the FDIC said in its order last July. In March, ShoreBank was ordered by the FDIC to boost capital within 60 days, a deadline it missed.

ShoreBank posted a $119 million loss in 2009 and a $39.6 million loss in the first half of this year, according to FDIC figures. It had a net loss of $9.3 million in 2008.

Representative Spencer Bachus, the ranking Republican on the House Financial Services Committee, said in May that firms that had banded together in an attempt to save ShoreBank were making the investments to gain favor the Obama administration.