Originally published in September 2010.

A new academic paper by economists from MIT and the NY Fed proves that credit markets were NOT "frozen" during the crisis.

--

Monday was the second anniversary of the failure of Lehman Brothers. And it was two years ago tomorrow that Hank Paulson and Ben Bernanke met with the Congressional leadership in a conference room on Capital Hill, telling them that the entire economic system would cease to function if they didn't pass a bailout bill. One of the things Paulson and Bernanke told the members -- something that was repeated over and over, and continues to be repeated -- was that the credit markets were "frozen." Banks, they said, would not lend to each other. If this were true, it would be very bad indeed.

But it wasn't true. The credit markets were not "frozen." Banks were lending to each other. The credit markets were functioning. And now we have a study, by two economists from the NY Fed and one from MIT, that proves it. In "What Happened to US Interbank Lending In the Financial Crisis?," Gara Afonso, Anna Kovner and Antoinette Schoar show that despite claims of a credit "freeze," it never happened. Some theoretical studies, they note, suggest that fear in the interbank markets could be contagious and would lead to a total freeze, but the authors of this study simply looked at the available data. (Crazy, I know.)

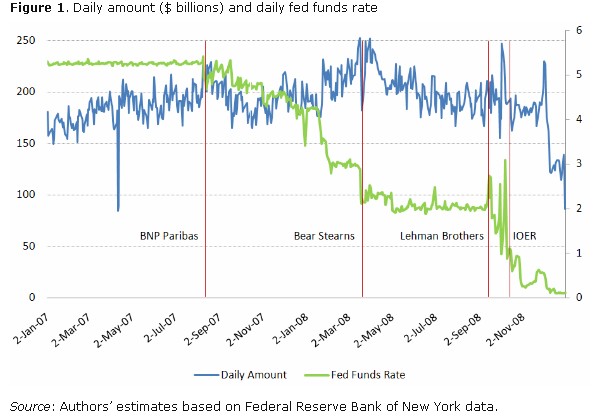

It should be no surprise to regular readers of The Daily Bail, but the NY Fed's own data show that interbank lending during the period from September to November did not "freeze," collapse, melt down or anything else. In fact, every single day throughout this period, hundreds of billions were borrowed and paid back. The decline in daily interbank lending came only when the Fed ballooned its balance sheet and started paying interest on excess reserves.

And yet, even to this day, TARP apologists and their clueless handmaidens in the media continue to talk of a credit "freeze." A credit freeze that didn't happen. As he mindlessly praises the "success" of TARP, Ben Smith of Politico is just the latest media clown to make this simple mistake (and Dan Amira of Daily Intel cites him approvingly). Forget, for just a moment, the fact that TARP, along with an alphabet soup of Fed lending facilities and FDIC guarantees on bank bond issuance, helped to subsidize Jamie Dimon's bonus and Lloyd Blankfein's cappucino machine. One would think that mere curiosity, or even fear of embarrassment, would inspire journalists who bother to write about this stuff to do a little research. Alas, no. Any journalist worth his salt -- heck, any twelve-year old -- could find the Afonso-Kovner-Schoar study with a simple Google search. (Is it any mystery why people who have paid attention over the last two years hold mainstream journalists in contempt?) In any case, for the sake of convenience we've reposted the study here.

##

From VoxEU.org

What happened to US interbank lending in the financial crisis?

Many commentators have argued that interbank lending froze following the collapse of Lehman Brothers. This column presents evidence from the fed funds market that, while rates spiked and loan terms became more sensitive to borrower risk, mean borrowing amounts remained stable on aggregate. It seems likely that the market did not expand to meet additional demand for funds.

Borrowing in the interbank market is the most immediate source of bank liquidity and, aggregate activity in the market can therefore be an important indicator of the functioning of the banking market. Problems in this market can lead to insufficient bank liquidity and thus to inadequate allocation of capital and risk sharing between banks. In addition, the (overnight) interbank rate, known as the fed funds rate in the US, is the main mechanism through which US monetary policy is channelled. This raises the question whether the interbank market mitigate or amplify shocks to individual banks and the banking sector overall.

Many recent economic theory papers predict a market freeze if lenders cannot assess bank-specific risks or fear liquidity shortages. We argue that observed conditions in the overnight fed funds market after Lehman Brothers’ bankruptcy do not support these hypotheses.

...

While we appear to document a functioning fed funds market immediately after the Lehman crisis, we only measure loans that were made, not all the loans that banks might have wanted. Presumably, demand for funds increased at the same time, so unmet demand may have been a problem. There was increased demand for discount window borrowing. However, banks that accessed the discount window were likely to be less profitable. Thus, while we cannot rule out that some banks were screened out of the market, the turmoil in the interbank market cannot have been so big that completely normal and solvent banks had to turn to the discount window for liquidity. This provides further evidence that the interbank market was not completely frozen through the crisis.