Bloomberg

By William D. Cohan

The Securities and Exchange Commission, it seems, has finally lost its mind.

Motivated by what I consider pure maliciousness, the SEC initiated a “cease and desist” administrative proceeding it deemed “necessary for the protection of investors and in the public interest” against Egan-Jones Ratings Co., a privately owned, 20-person firm based in Haverford, Pennsylvania, and against its principal owner, Sean Egan.

Egan-Jones, founded in 1995, is one of nine ratings companies that the SEC has accredited as “nationally recognized,” allowing the firm to rate the debt of sovereign nations, companies and asset-backed securities, among others. Notably, it is the only one of the nine that gets paid by investors instead of by the issuers of securities.

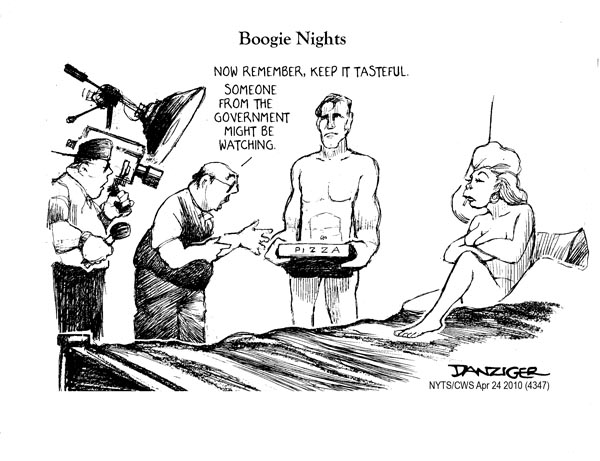

The bigger and better-known ratings companies -- Standard & Poor’s (owned by McGraw-Hill Cos. (MHP)), Moody’s Corp. (MCO) and Fitch Ratings Ltd. -- are paid by the Wall Street banks that underwrite the debt securities of corporate issuers. That is, the companies are beholden to the sellers of the products they are supposed to pass judgment on, not the buyers. That’s akin to allowing the Hollywood studios to pay the nation’s film critics for their opinions.

Shopping Around

We all saw the result in 2007 and 2008. A major cause of the financial crisis was that S&P, Moody’s and Fitch, while being paid hundreds of millions of dollars by Wall Street, gave AAA ratings to complicated, risky securities that turned out to be anything but AAA. If a big bank didn’t like a proposed rating, it just shopped the deal until it found a firm that would provide something it liked better.

Who can forget this memorable April 2007 instant-message exchange between two S&P analysts, Rahul Dilip Shah and Shannon Mooney?

“Btw, that deal is ridiculous,” Shah wrote to Mooney about some mortgage securities they were asked to rate.

“I know, right . . . model definitely does not capture half the risk,” she replied.

“We should not be rating it,” he answered.

“We rate every deal. It could be structured by cows and we would rate it.”

You would have thought that after the crisis exposed this kind of abhorrent behavior -- to say nothing of the obvious conflict of interest -- the SEC would have considered scrapping the issuer-pays model on ratings. You might have even thought the SEC would have sued S&P, Moody’s and Fitch for their reckless conduct.

Alas, such obvious steps are out of the question at an SEC headed by Mary Schapiro, who previously led the Financial Industry Regulatory Authority, Wall Street’s self-financed, self-serving watchdog organization. (When Schapiro left Finra, it gave her a $9 million bonus).

True, for a while, the SEC put on a good show of wanting to reform the ratings companies. It held round-table discussions with interested parties to discuss rectifying the horrific shortcomings of S&P, Moody’s and Fitch. Robert Khuzami, the SEC’s chief enforcement officer, suggested in an interview with Reuters a year ago that the SEC was considering a lawsuit against S&P for its role in the financial collapse. But in the end, nothing changed. The issuer-pays model is still the dominant architecture for the ratings firms.

Continue reading at Bloomberg...

---

Egan Jones: "Central Banks Are Manipulating The Markets" (CNBC, Sep. 18)

Sean Egan, President of Egan-Jones Ratings Company says that added liquidity from QEternity is pushing up commodity prices and hurting consumers - CNBC.

Egan-Jones is the most aggressive and independent of all the ratings agencies, has been the lead agency in downgrading the U.S. twice in the past 18 months, and might just do it again if Congress doesn't get serious about annual $1.5 trillion deficits.