It's 3:45 am and I decide to check the wires one final time before sleep. Looks like the London Whale hedge prop bet is becoming more painful to JPMorgan's bottom line and Dimon's fragile ego. Pretty solid timing on the leak from JPM insiders as well, as this story will soon to be buried by headlines on Obamacare and Fast and Furious as the House votes on Eric Holder and SCOTUS rules at 10 am EST.

Just two days ago the FT reported that things might be looking up for JPM.

IG9 index trading for bitchez, on sale at Amazon, now.

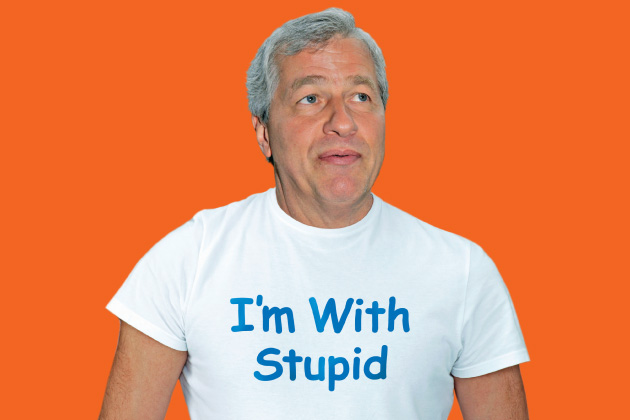

#SucksToBeJamie

---

Losses on JPMorgan Chase’s bungled trade could total as much as $9 billion, far exceeding earlier public estimates, according to people who have been briefed on the situation.

When Jamie Dimon, the bank’s chief executive, announced in May that the bank had lost $2 billion in a bet on credit derivatives, he estimated that losses could double within the next few quarters. But the red ink has been mounting in recent weeks, as the bank has been unwinding its positions, according to interviews with current and former traders and executives at the bank who asked not to be named because of investigations into the bank.

The bank’s exit from its money-losing trade is happening faster than many expected. JPMorgan previously said it hoped to clear its position by early next year; now it is already out of more than half of the trade and may be completely free this year.

As JPMorgan has moved rapidly to unwind the position — its most volatile assets in particular — internal models at the bank have recently projected losses of as much as $9 billion. In April, the bank generated an internal report that showed that the losses, assuming worst-case conditions, could reach $8 billion to $9 billion, according to a person who reviewed the report.

With much of the most volatile slice of the position sold, however, regulators are unsure how deep the reported losses will eventually be. Some expect that the red ink will not exceed $6 billion to $7 billion.