More Than Two-Thirds Of U.S. Corporations Pay No Federal Income Tax

Huffington Post

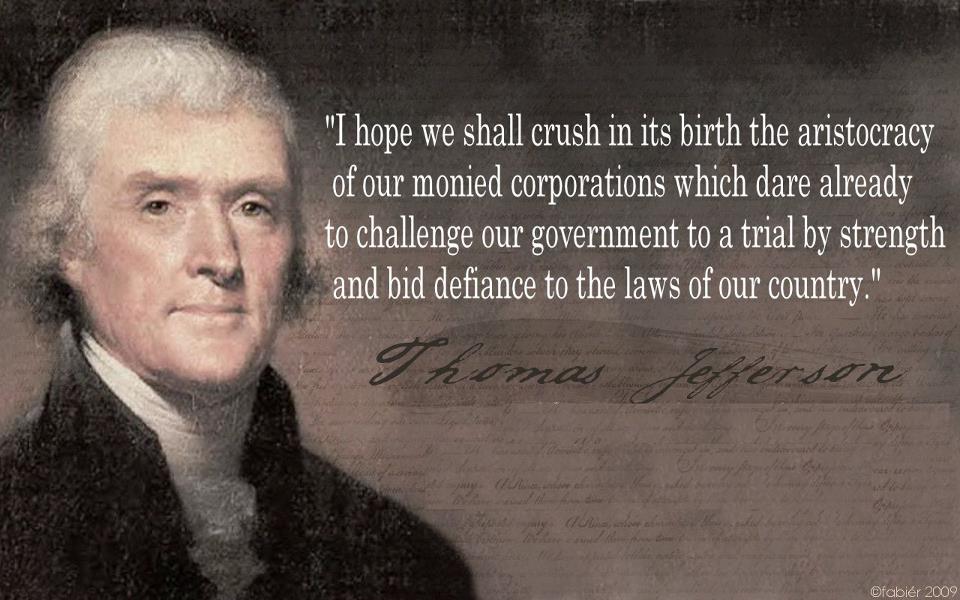

At a time when the federal government is starved for cash -- and facing layoffs and cuts in services across the board -- more and more corporations are sidestepping their traditional tax rate and keeping millions of dollars for themselves.

The number of U.S. corporations structuring their businesses in such a way that they can avoid higher taxes has skyrocketed in the past quarter century, The Wall Street Journal reports.

In 1986, about 24 percent of corporations were what's known as nontaxable businesses -- meaning the companies themselves pay no federal income taxes -- instead passing on the earnings to individual investors to pay taxes on. By 2008, these businesses accounted for about 69 percent of all corporations, a designation that can save companies hundreds of millions of dollars in a single year

Advocates for the business community have expressed frustration with the country's 35 percent corporate income tax rate, calling it unreasonably high. In practice, though, it's common for big businesses to pay much less, thanks to a cornucopia of tax-code loopholes and exemptions won by lobbyists.

The issue of corporate tax participation has become especially pressing in recent years, as the country struggles to manage its ballooning deficits. Corporate taxes for non-financial companies have fallen more than 13 percent since 2007, according to Bloomberg. At the same time, the national debt grew to $15.23 trillion from $9.13 trillion -- a number larger than the economy itself.

According to a recent analysis of nearly 300 Fortune 500 companies by the Citizens for Tax Justice, the average company was paying just 18.3 percent in taxes -- a little more than half the official rate. And by using techniques like industry subsidies, stock option packages, and moving assets overseas where they can't be taxed, 30 companies mentioned in the report -- including Wells Fargo, Verizon, Boeing and General Electric -- didn't pay a cent in federal taxes in 2008, 2009 or 2010, the report found.

This is truly brilliant (you gotta see this):

Supreme Court Covered In Giant Dollar Signs

Nov 8, 2012 at 12:57 PM

Nov 8, 2012 at 12:57 PM

Reader Comments (28)

It's a fact of life. We all would do it. Not paying taxes IS the American dream...so get rid of the FED!

So non-financial companies are paying less and less taxes. The financial companies are swamped with massive tax-payer funded bailouts from the Bush-Obama administration and even some of the non-financial companies; GM, Chrysler, GE, etc. have made deals that get them "big taxpayer money/no taxes due" as well. What surprises me is that any of the Fortune 500 companies "pay taxes" at all; with our government as it is, our "leaders" will "work something out" for anyone.

As our friend, Communismsucks, points out, corporations pay no taxes anyway, the consumers pay all the taxes.

Is the point of the article that our government is an insane mess of crooked, overspending #*^%$%#s? Maybe so, but it's what the voters want or they wouldn't vote the way they do. At least democracies that have reached the stage of greed and corruption the US has don't last very long. Perhaps the next iteration of our country will have better sense. Perhaps.

same material/product in this country. We will immediately gain back American manufacturing/production, farming, mining,etc...

Consumers will pay more for foreign materials and products. Look back to the creation of "WaMart". Cheap chinese products

flooded our market, destroyed our economic mainstream and our mom and pop businesses throughout this nation. Family businesses on every "Main Street" lost/failed and struggle to stay alive. Check your household purchases for country of origin?

Take inventory. Become aware. Are you supporting foreign corporations and foreign countries? Could this or that product, if made in America benefit your countrymen, your neighbor, your family. Would your community circulate currency within its community of citizens?

Will our children and grand children once again have greater opportunities for employment, for family businesses, for real wealth

building and financial security? Listen up all Walmart shoppers, as you think you save on foreign made products, you actually deplete

your own community, your own family, your own children and resources from real opportunities, you pass economic stability from your household to foreign corporations, in foreign countries to foreign households.

Foreign corporations, foreign shareholders, foreign materials and products should be taxed higher and never compete against the citizens of this country.

LugNut,

Since we are all Citizens United I'm all in for my taxes to be 0%

Will we ever get over the idea that we have a right to take the incomes of others using the coercive threats of the government as a collection agency?

Even if you vote on it, it's still theft & immoral.

I understand what you are saying. But let's be honest. Govt. will have to shrink by 95% before we can get rid of income taxes. And that's not going to happen anytime soon, capisce? In the meantime, it should be a fair system, and corporations are using the crony political system to make sure it's not fair.

These politicians that take cash bribes are no better than drug dealers, and both should be in jail. Only public funding of campaigns will fix the system. Yet we R's and D's that soak in the political Kool-Aid just don't get it yet.

How do you build and maintain the national infrastructure and necessary social and defense programs?

I suppose a good start would be to, put toll gates on every federal highway, bridge, and waterway. Coin or credit card operated school entry doors and mandatory service in the active military, government, or in industry building weapons, for every citizen no exceptions and no pay. Cancel all domestic and foreign aid programs and shut down Social Security and Medicare. Make everyone, including veterans and politicians pay for all their medical expenses.

Some taxation is necessary, but it seems to me that corruption, greed, and criminal behavior by our government, the corporations, and the ultra rich 1% have become a black hole, sucking the wealth and livelihoods of the poor and the middle class into their own pockets, delivering nothing in return. The FED makes sure the taxes we pay end up in that hole with everything else, and nothing escapes a black hole, not even light.

Far less taxes then we pay today could fund a government that supports the Constitution and truly works for the protection of the United States and the welfare of the American People. That government could put this country back on the road to prosperity. Sadly we do not have that government.

We have a corrupt Black Hole!!!!!

Next stop $20 trillion.

All aboard.