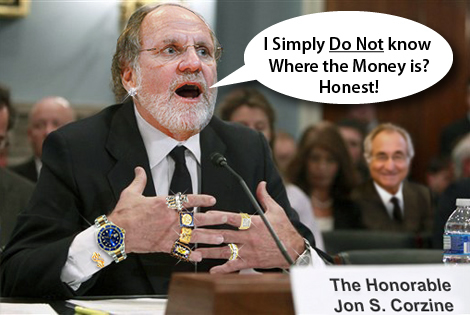

This makes it 3 for 3 in official autopsies that blame Jon Corzine for the collapse of MF Global. However, former FBI Director Louis Freeh's 176 page report released Friday does not use the word "criminal" even once.

[Note: The 2 MFs in the headline are not the same.]

Scroll down for photos.

---

Corzine Slammed in Freeh Report on MF Global collapse

The report by former FBI director Louis Freeh said the failure of MF Global's officers contributed to losses of as much as $2.1 billion and adds to the growing number of reports and investigations pointing to their liability. While the report was sharply critical of Corzine's conduct, it did not focus on one of the biggest mysteries of the MF Global collapse: the misappropriation of funds from customer trading accounts.

Freehe singled out the "failures" of Corzine, former chief operating officer Bradley Abelow and former chief financial officer Henri Steenkamp. The three "contributed to the losses" which the trustee estimates to be between $1.5 billion and $2.1 billion."

"Negligence isn't strong enough to describe the conduct of Corzine and the other officers," said Merrill G. Davidoff, an attorney with Berger & Montague. "I think he is understating the scope of the problem."

Freeh's report does not use the word "criminal."

MF Untouchable lounging on the beach...

Corzine Blamed In MF Global Autopsy

The report mentioned Mr. Corzine's name a total of 284 times—an average of more than once per page—and concluded that he and his management team engaged in "negligent conduct."

The 174-page document, filed shortly after midnight Thursday in a federal bankruptcy court by former Federal Bureau of Investigation chief Louis J. Freeh, represents the most thorough look into management's role in MF Global's failure—and the toughest yet on Mr. Corzine.

The findings in the report could help decide how much money Mr. Corzine and others potentially have to pay to settle private cases from MF Global customers and creditors in coming months. Those settlement talks are heating up, with a meeting scheduled with a court-approved mediator next week, according to people familiar with the plans.

Mr. Giddens said Thursday that distributions now under way will restore 89 cents on the dollar to former MF Global customers who did business on U.S. exchanges. Further distributions are expected in coming months that will boost the total to at least 93 cents on the dollar. Customers on foreign exchanges are expected to get back at least 75 cents on the dollar, up from the current 18 cents, the spokesman said. The increases need court approval.

Creditors have been hit much harder, with recent court documents suggesting that unsecured bondholders could recover just 12 to 42 cents on the dollar, though the rate may rise later. MF Global bonds have recently traded at 70 cents on the dollar, a sign that investors are betting more assets will be recovered for creditors, too.

"This makes it 3-for-3 for official reports that blame Mr. Corzine for the collapse," said James Koutoulas, a lawyer representing the firm's customers.

Mr. Freeh in particular went after Mr. Corzine's healthy appetite for trading. A few months after starting at the firm, Mr. Corzine "started trading on his own" in company accounts that bore his initials, JSC, and became a topic of discussion among employees.

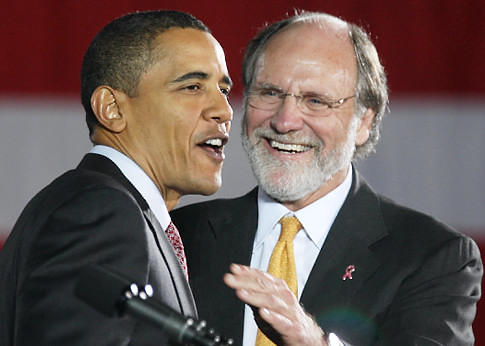

MF Untouchable chilling with Obama...

Statement from Jon Corzine's Lawyer

Corzine says report is a clear case of 'Monday Morning Quarterbacking'

The Trustee’s report, with its allegations of negligent conduct, is a clear case of Monday Morning Quarterbacking. It intentionally ignores the failure of counterparties to fulfill their commercially contracted obligations to MF Global and the profound impact this failure had on MF Global’s customers and other stakeholders.

As we have said before, there simply is no basis for the suggestion that Mr. Corzine breached his fiduciary duties or was negligent. When Mr. Corzine joined MF Global, the firm had lost money in each of the previous three years and in five consecutive quarters. During his entire tenure as CEO, Mr. Corzine worked tirelessly and in good faith to turn the business around. He and the rest of the Board engaged in a rigorous and careful evaluation of the appropriate strategy for the firm. After extensive discussions with the Board, the senior management team and a highly respected management consulting firm, Mr. Corzine set a new, publicly disclosed strategy to replace the existing unsustainable model. The strategic plan, which was approved by the Board, also included review of internal processes and controls by respected consultants and outside auditors. As a result of the new strategy, there was a marked improvement of MF Global’s financial performance.

While Mr. Corzine is disappointed by the Trustee’s report, he is encouraged by the recent settlements with banks and creditors whose conduct contributed to the failure of the firm and delayed the ability of customers to be repaid. Mr. Corzine respects the efforts of both Trustees in this regard and is pleased that the settlements and the proposed plan of reorganization make it probable that customers will receive full recovery of their funds.

MF Untouchable bundling for Obama...

Freeh Report on MF Global

Read this:

More evidence that Jon Corzine is guilty...

Some images by William Banzai...

The #1 Reason That Jon Corzine Is Not In Prison