From Rolling Stone:

In Rolling Stone Issue 1082-83, Matt Taibbi takes on "the Wall Street Bubble Mafia" — investment bank Goldman Sachs. The piece has generated controversy, with Goldman Sachs firing back that Taibbi's piece is "an hysterical compilation of conspiracy theories" and a spokesman adding, "We reject the assertion that we are inflators of bubbles and profiteers in busts, and we are painfully conscious of the importance in being a force for good." Taibbi shot back: "Goldman has its alumni pushing its views from the pulpit of the U.S. Treasury, the NYSE, the World Bank, and numerous other important posts; it also has former players fronting major TV shows. They have the ear of the president if they want it." Here, now, are excerpts from Matt Taibbi's piece and video of Taibbi exploring the key issues.

The rest of the story is below.

In a general sense Taibbi got things right, as long as you understand his caveat that all of the investment banks and even hedge funds created, encouraged and participated in the bubbles he discusses.

Illustration by Victor Juhasz

Illustration by Victor Juhasz

Simply as an example, the internet bubble was inflated and kept alive most egregiously by Mary Meeker at Morgan Stanley, Henry Blodget at Merrill Lynch Frank Quattrone at CS First Boston and Maria Bartiromo of CNBC, though Goldman bankers and analysts were the lead underwriters and syndicate for many of the biggest internet and tech IPOS and secondary offerings of that era. So their hands are stained from each of the bubbles he describes. (Full Disclosure: As a fund manager from 97'-02', I traded all 300 or so of these internet companies and most of them exclusively from the short side, and I can testify first hand that these 4 individuals completely lost their minds. But of these 4, only Blodget has redeemed himself [with his work on behalf of taxpayers at his blog], and he alone should be forgiven.)

He lays it on pretty thick in some spots, which to be fair, is not completely accurate. But 90% correct for a non-financial reporter is pretty impressive. And it's nice for a change to hear things a bit over-exaggerated, but in our favor. So we'll take it.

And since Rolling Stone readers tend to be young music and pop culture fans, they're not going to remember the intricate details of Goldman's blood-sucking escapades anyway. The fact that readers are left with the overall impression that Goldman is mostly evil, is all that matters.

Illustration by Victor JuhaszThe beauty of Taibbi's work is a blended trifecta: he's not a finance guy (which he readily admits and which makes his writing easier to understand for the lay person); he has a huge audience at Rolling Stone (so people hear what he says--especially young people...the importance of which can not be overstated); and lastly that he gets it...he understands the importance of blasting these facts into the public consciousness. It's nice to have him on our side.

Illustration by Victor JuhaszThe beauty of Taibbi's work is a blended trifecta: he's not a finance guy (which he readily admits and which makes his writing easier to understand for the lay person); he has a huge audience at Rolling Stone (so people hear what he says--especially young people...the importance of which can not be overstated); and lastly that he gets it...he understands the importance of blasting these facts into the public consciousness. It's nice to have him on our side.

Oh and one more thing---the guy can freaking write. Witness his handiwork below:

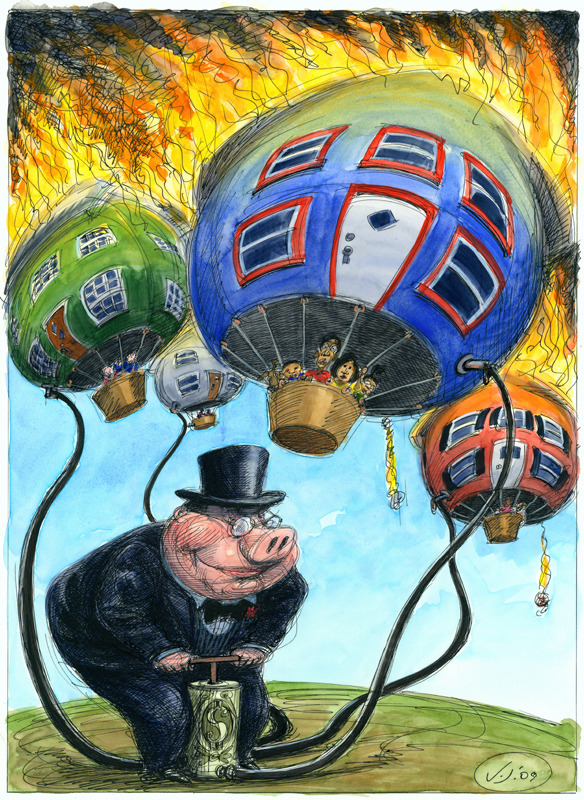

The first thing you need to know about Goldman Sachs is that it's everywhere. The world's most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.

Any attempt to construct a narrative around all the former Goldmanites in influential positions quickly becomes an absurd and pointless exercise, like trying to make a list of everything. What you need to know is the big picture: If America is circling the drain, Goldman Sachs has found a way to be that drain — an extremely unfortunate loophole in the system of Western democratic capitalism, which never foresaw that in a society governed passively by free markets and free elections, organized greed always defeats disorganized democracy.

Winner by (IKO) Intellectual Knockout: Matt Taibbi

Winner by (IKO) Intellectual Knockout: Matt Taibbi

They achieve this using the same playbook over and over again. The formula is relatively simple: Goldman positions itself in the middle of a speculative bubble, selling investments they know are crap. Then they hoover up vast sums from the middle and lower floors of society with the aid of a crippled and corrupt state that allows it to rewrite the rules in exchange for the relative pennies the bank throws at political patronage. Finally, when it all goes bust, leaving millions of ordinary citizens broke and starving, they begin the entire process over again, riding in to rescue us all by lending us back our own money at interest, selling themselves as men above greed, just a bunch of really smart guys keeping the wheels greased. They've been pulling this same stunt over and over since the 1920s — and now they're preparing to do it again, creating what may be the biggest and most audacious bubble yet.

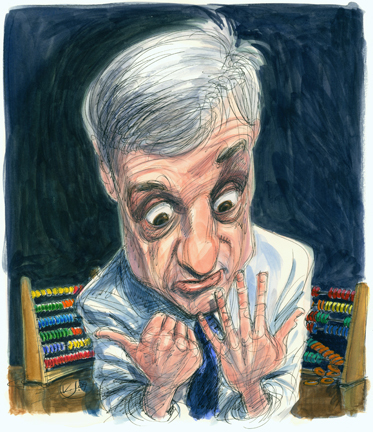

Watch the Taibbi clips and see a few more cartoon illustrations (including an excellent Bob Rubin) by Victor Juhasz.

Go read the whole thing at Rolling Stone.

A follow-up from Taibbi, including Goldman's response.

Victor Juhasz

Victor Juhasz

Illustration by Victor Juhasz

Illustration by Victor Juhasz

Illustration by Victor Juhasz

Illustration by Victor Juhasz