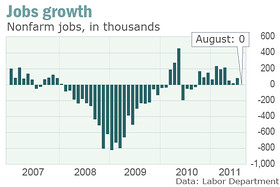

WASHINGTON - The U.S. economy did not add any jobs in August, a weak performance that casts a cloud over the sputtering recovery, economic data showed Friday.

Nonfarm payrolls were unchanged in August, lower than the 53,000 gain expected by economists surveyed by MarketWatch and the weakest performance in nonfarm payroll since a decline in September 2010.

David Resler, chief economist at Nomura Securities International Inc., who had expected a weak report, blamed it on a “financial wall of worry” in early August.

The unemployment rate held steady at 9.1% in August, as expected.

---

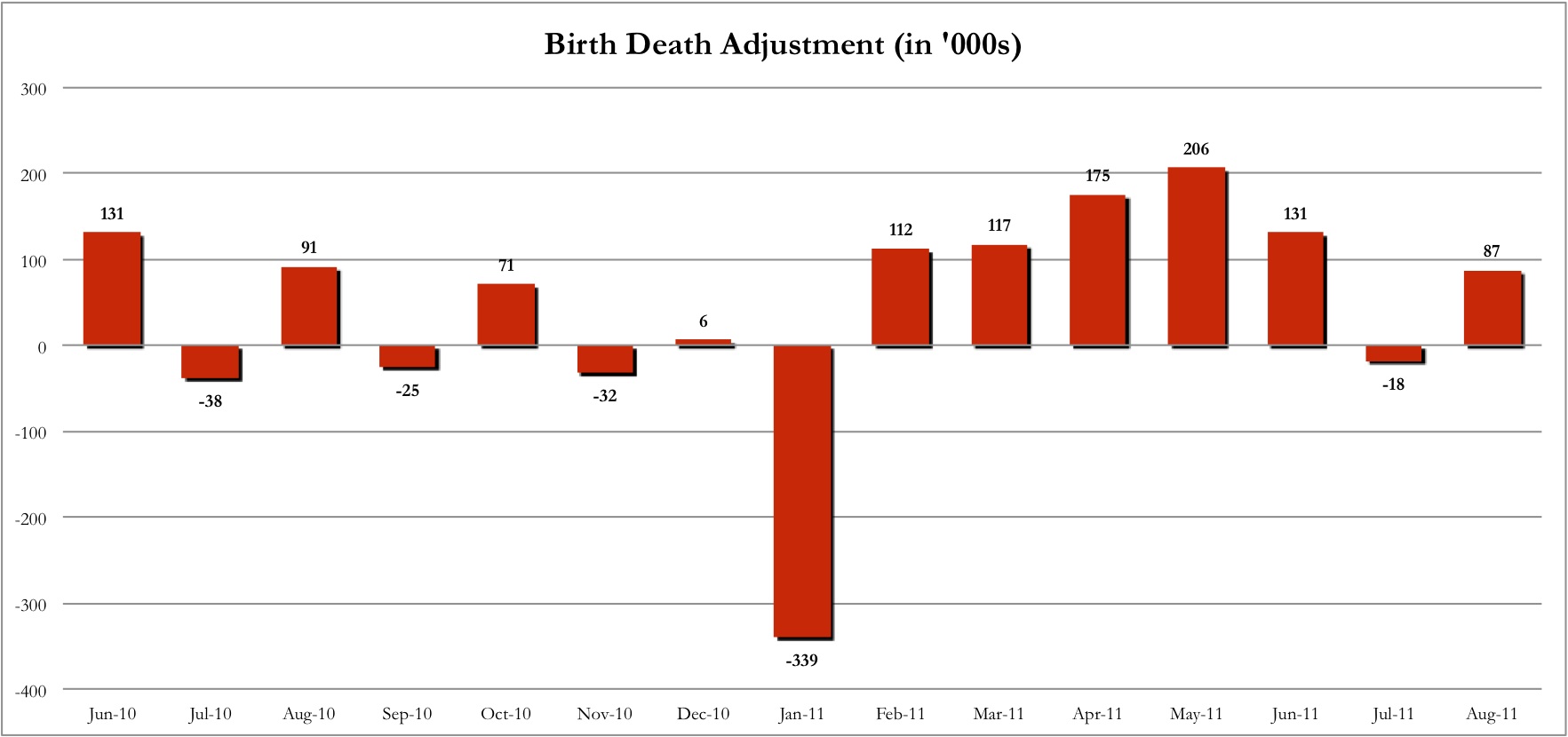

Below are the birth-death adjustments to the monthly payroll numbers courtesy of ZH, which points out that 491,000 jobs in the past 12 months are due to flawed stats.

Read the full report from the Bureau of Labor Statistics.

---

Reaction:

Reuters - Wall Street Economists React To Jobs Numbers

Excerpt

SAL ARNUK, CO-MANAGER OF TRADING AT THEMIS TRADING IN CHATHAM, NEW JERSEY.

"In a nutshell, this is the great goose egg economy -- a big zero, a big nothing -- and this better be one hell of a speech next week. There is a plethora of bad news. You have what is going on in Greece, you have lawsuits potentially coming today or Tuesday against the banks. You have the Fed in a Wall Street Journal article overnight asking Bank of America if they are going to be OK if things get really bad. There are a lot of confidence issues in the marketplace, the jobs number only made things worse and people wonder about this jobs number and its correlation with Philly Fed. That is scary. My only question is why the market isn't down more?"

DOUGLAS BORTHWICK, MANAGING DIRECTOR, FAROS TRADING, STAMFORD, CONNECTICUT

"These days finding green shoots is like squeezing water from a stone. With the number coming in at 0, and the prior revised 32,000 lower, the Fed has gained greater political ability to enact a version of QE3 at their meeting in September. We see this as terrifically bearish for the dollar, bullish for gold and bullish for euro/dollar. QE3 will accomplish two things - assets in the U.S. will be further inflated, and the weaker dollar will help U.S. multinationals as their foreign earnings will inflate on the weaker dollar."

Continue reading at Reuters...