Here's the question:

Defaulted borrowers spend an average of how many days in their homes after ceasing to make payments? This is a nationwide average. Answer on the inside.

##

From the above article comes this relatively shocking statistic:

Moreover, Freddie says a good 14% of homes that are seriously delinquent are vacant. In such circumstances, eventual recovery values rapidly deteriorate.

Defaulted borrowers were spending an average of 469 days in their home after ceasing to make payments as of July 31, so the financial attraction of strategic defaults increases.

There's much more from the story:

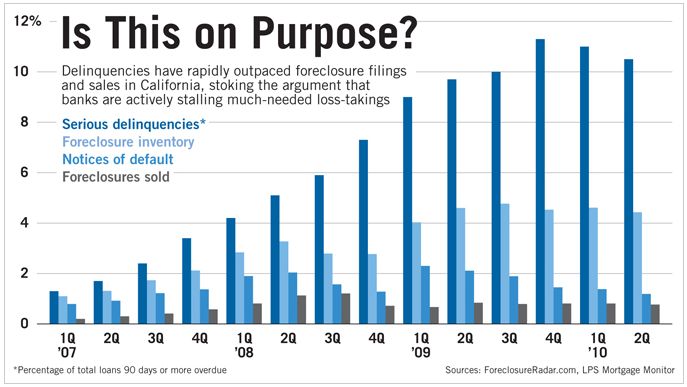

Ever since the housing collapse began, market seers have warned of a coming wave of foreclosures that would make the already heightened activity look like a trickle.

The dam would break when moratoriums ended, teaser rates expired, modifications failed and banks finally trained the army of specialists needed to process the volume.

But the flood hasn't happened. The simple reason is that servicers are not initiating or processing foreclosures at the pace they could be.

By postponing the date at which they lock in losses, banks and other investors positioned themselves to benefit from the slow mending of the real estate market. But now industry executives are questioning whether delaying foreclosures — a strategy contrary to the industry adage that "the first loss is the best loss" — is about to backfire. With home prices expected to fall as much as 10% further, the refusal to foreclose quickly on and sell distressed homes at inventory-clearing prices may be contributing to the stall of the overall market seen in July sales data. It also may increase the likelihood of more strategic defaults.

It is becoming harder to blame legal or logistical bottlenecks, foreclosure analysts said.

"All the excuses have been used up. This is blatant," said Sean O'Toole, CEO of ForeclosureRadar.com, a Discovery Bay, Calif., company that has been documenting the slowdown in Western markets.

"The industry as a whole got into a panic mode and was worried about all these loans going into foreclosure and driving prices down, so they got all these programs, started Hamp and internal mods and short sales," said John Marecki, vice president of East Coast foreclosure operations for Prommis Solutions, an Atlanta company that provides foreclosure processing services. Until recently, he was senior vice president of default administration at Flagstar Bank in Troy, Mich. "Now they're looking at this, how they held off and they're getting to the point where maybe they made a mistake in that realm."

Continue reading at American Banker

Hat tip to Patrick.net

##

Now chek out this story:

Strategic Default & Living For Free: Josh Bartlett Hasn't Made A Mortgage Payment In 32 Months And He Hasn't Been Kicked Out Yet (PBS VIDEO)