Economist James Grant provides a very interesting history of the gold-standard in the U.S., going back some 200 years, and lays out his case for a return to a modified version of what served us so well for so long. Your culprits in advance are Wilson, Roosevelt and Nixon.

---

Originally published Nov. 2011.

Reprinted with permission of the author and the New York Times.

NYT - How to Make the Dollar Sound Again

BY disclosing a plan to conjure $600 billion to support the sagging economy, the Federal Reserve affirmed the interesting fact that dollars can be conjured. In the digital age, you don’t even need a printing press.

A general uproar ensued, with the dollar exchange rate weakening and the price of gold surging. And when, last Monday, the president of the World Bank suggested, almost diffidently, that there might be a place for gold in today’s international monetary arrangements, you could hear a pin drop.

Let the economists gasp: The classical gold standard, the one that was in place from 1880 to 1914, is what the world needs now. In its utility, economy and elegance, there has never been a monetary system like it.

It was simplicity itself. National currencies were backed by gold. If you didn’t like the currency you could exchange it for shiny coins (money was “sound” if it rang when dropped on a counter). Borders were open and money was footloose. It went where it was treated well. In gold-standard countries, government budgets were mainly balanced. Central banks had the single public function of exchanging gold for paper or paper for gold. The public decided which it wanted.

“You can’t go back,” today’s central bankers are wont to protest, before adding, “And you shouldn’t, anyway.” They seem to forget that we are forever going back (and forth, too), because nothing about money is really new. “Quantitative easing,” a k a money-printing, is as old as the hills. Draftsmen of the United States Constitution, well recalling the overproduction of the Continental paper dollar, defined money as “coin.” “To coin money” and “regulate the value thereof” was a Congressional power they joined in the same constitutional phrase with that of fixing “the standard of weights and measures.” For most of the next 200 years, the dollar was, in fact, defined as a weight of metal. The pure paper era did not begin until 1971.

The Federal Reserve was created in 1913 — by coincidence, the final full year of the original gold standard. (Less functional variants followed in the 1920s and ’40s; no longer could just anybody demand gold for paper, or paper for gold.) At the outset, the Fed was a gold standard central bank. It could not have conjured money even if it had wanted to, as the value of the dollar was fixed under law as one 20.67th of an ounce of gold.

Neither was the Fed concerned with managing the national economy. Fast forward 65 years or so, to the late 1970s, and the Fed would have been unrecognizable to the men who voted it into existence. It was now held responsible for ensuring full employment and stable prices alike.

Today, the Fed’s hundreds of Ph.D.’s conduct research at the frontiers of economic science.“The Two-Period Rational Inattention Model: Accelerations and Analyses” is the title of one of the treatises the monetary scholars have recently produced. “Continuous Time Extraction of a Nonstationary Signal with Illustrations in Continuous Low-pass and Band-pass Filtering” is another. You can’t blame the learned authors for preferring the life they lead to the careers they would have under a true-blue gold standard. Rather than writing monographs for each other, they would be standing behind a counter exchanging paper for gold and vice versa.

If only they gave it some thought, though, the economists — nothing if not smart — would fairly jump at the chance for counter duty. For a convertible currency is a sophisticated, self-contained information system. By choosing to hold it, or instead the gold that stands behind it, the people tell the central bank if it has issued too much money or too little. It’s democracy in money, rather than mandarin rule.

Today, it’s the mandarins at the Federal Reserve who decide what interest rate to impose, and what volume of currency to conjure.

The Bank of England once had an unhappy experience with this method of operation. To fight the Napoleonic wars of the early 19th century, Britain traded in its gold pound for a scrip, and the bank had to decide unilaterally how many pounds to print. Lacking the information encased in the gold standard, it printed too many. A great inflation bubbled.

Later, a parliamentary inquest determined that no institution should again be entrusted with such powers as the suspension of gold convertibility had dumped in the lap of those bank directors. They had meant well enough, the parliamentarians concluded, but even the most minute knowledge of the British economy, “combined with the profound science in all the principles of money and circulation,” would not enable anyone to circulate the exact amount of money needed for “the wants of trade.”

The same is true now at the Fed. The chairman, Ben Bernanke, and his minions have taken it upon themselves to decide that a lot more money should circulate. According to the Consumer Price Index, which is showing year-over-year gains of less than 1.5 percent, prices are essentially stable.

In the inflationary 1970s, people had prayed for exactly this. But the Fed today finds it unacceptable. We need more inflation, it insists (seeming not to remember that prices showed year-over-year declines for 12 consecutive months in 1954 and ’55 or that, in the first half of the 1960s, the Consumer Price Index never registered year-over-year gains of as much as 2 percent). This is why Mr. Bernanke has set out to materialize an additional $600 billion in the next eight months.

The intended consequences of this intervention include lower interest rates, higher stock prices, a perkier Consumer Price Index and more hiring. The unintended consequences remain to be seen. A partial list of unwanted possibilities includes an overvalued stock market (followed by a crash), a collapsing dollar, an unscripted surge in consumer prices (followed by higher interest rates), a populist revolt against zero-percent savings rates and wall-to-wall European tourists on the sidewalks of Manhattan.

As for interest rates, they are already low enough to coax another cycle of imprudent lending and borrowing. It gives one pause that the Fed, with all its massed brain power, failed to anticipate even a little of the troubles of 2007-09.

At last week’s world economic summit meeting in South Korea, finance ministers and central bankers chewed over the perennial problem of “imbalances.” America consumes much more than it produces (and has done so over 25 consecutive years). Asia produces more than it consumes. Merchandise moves east across the Pacific; dollars fly west in payment. For Americans, the system could hardly be improved on, because the dollars do not remain in Asia. They rather obligingly fly eastward again in the shape of investments in United States government securities. It’s as if the money never left the 50 states.

So it is under the paper-dollar system that we Americans enjoy “deficits without tears,” in the words of the French economist Jacques Rueff. We could not have done so under the classical gold standard. Deficits then were ultimately settled in gold. We could not have printed it, but would have had to dig for it, or adjusted our economy to make ourselves more internationally competitive. Adjustments under the gold standard took place continuously and smoothly — not, like today, wrenchingly and at great intervals.

Gold is a metal made for monetary service. It is scarce (just 0.004 parts per million in the earth’s crust), pliable and easy on the eye. It has tended to hold its purchasing power over the years and centuries. You don’t consume it, as you do tin or copper. Somewhere, probably, in some coin or ingot, is the gold that adorned Cleopatra.

And because it is indestructible, no one year’s new production is of any great consequence in comparison with the store of above-ground metal. From 1900 to 2009, at much lower nominal gold prices than those prevailing today, the worldwide stock of gold grew at 1.5 percent a year, according to the United States Geological Survey and the World Gold Council.

The first time the United States abandoned the gold standard — to fight the Civil War — it took until 1879, 14 years after Appomattox, to again link the dollar to gold.

To reinstitute a modern gold standard today would take time, too. The United States would first have to call an international monetary conference. A chastened Ben Bernanke would have to announce that, in fact, he cannot see into the future and needs the information that the convertibility feature of a gold dollar would impart.

That humbling chore completed, the delegates could get down to the technical work of proposing a rate of exchange between gold and the dollar (probably it would be even higher than the current price of gold, the better to encourage new exploration and production).

Other countries, thunderstruck, would then have to follow suit. The main thing, Mr. Bernanke would emphasize, would be to create a monetary system that synchronizes national economies rather than driving them apart.

If the classical gold standard in its every Edwardian feature could not, after all, be teleported into the 21st century, there would be plenty of scope for adaptation and, perhaps, improvement. Let the author of “The Two-Period Rational Inattention Model: Accelerations and Analyses” have a crack at it.

The FED should be required to have a living will.

---

"Here's the book on Alan Greenspan. He thinks what everyone else thinks, but one fiscal quarter later."

---

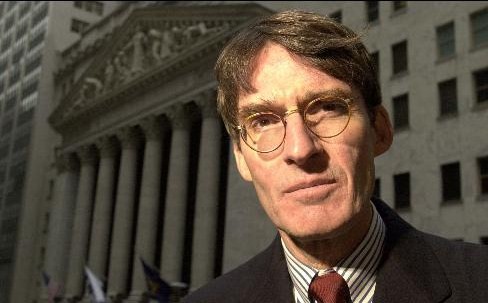

Grant annihilates Greenspan & Bernanke.