Bernanke was reportedly downgraded From Triple FFF To 'Unmeasurable' on worries over his sanity in the face of worldwide criticism.

And the score after 2000 years of play is Beijing 1, Washington (-$16.2) Trillion.

---

Scroll down for VIDEO

---

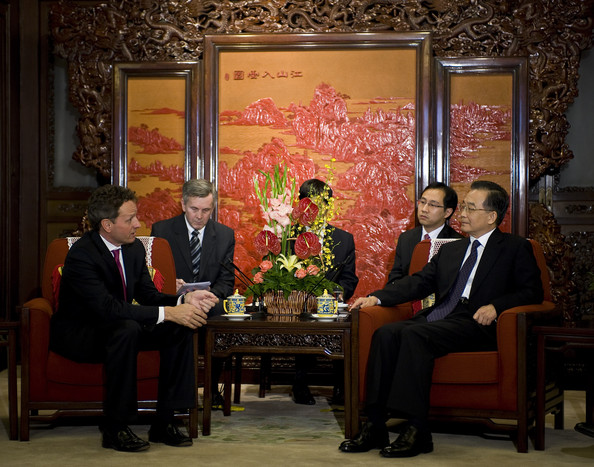

The Chinese rating agency, which hit headlines earlier this year for its AA-view on the United States, is back, with another US downgrade.

From the 10-Page Downgrade Report

The serious defects in the United States economic development and management model will lead to the long-term recession of its national economy, fundamentally lowering the national solvency. The new round of quantitative easing monetary policy adopted by the Federal Reserve has brought about an obvious trend of depreciation of the U.S. dollar, and the continuation and deepening of credit crisis in the U.S.

Such a move entirely encroaches on the interests of the creditors, indicating the decline of the U.S. government’s intention of debt repayment. Analysis shows that the crisis confronting the U.S. cannot be ultimately resolved through currency depreciation. On the contrary, it is likely that an overall crisis might be triggered by the U.S. government’s policy to continuously depreciate the U.S. dollar against the will of creditors.

The total output value of the U.S. financial services industry is composed of two major parts: one is the transferred production value, most of which comes from value distribution of participating in international production. Another part is the inflated value originated from credit innovation, which belongs to bubble value.

In addition, due to the high economic financialization, more than half of the profits in the real economy come from the returns of financial activities. If we exclude the factor of virtual economy, the U.S. actual GDP is about 5 trillion U.S. dollars in 2009, per capita GDP about $ 15,000. Meanwhile, the total domestic consumption was 10.0 trillion U.S. dollars and government expenditure was 4.5 trillion U.S. dollars.

Dagong Global Credit Rating Company

---

Reaction:

Chinese say U.S. as Creditworthy as Costco - WSJ

Taking Dagong’s downgrade at face value, Uncle Sam is now a credit on the level of Costco, based on the big box retailer’s Standard & Poor’s rating. The Treasury can take pride, however, in ranking a notch higher than “Government Sachs,” rated only A by S&P. Fortunately for U.S. taxpayers, who must foot the bill if the federal government’s borrowing costs go up, the market currently puts little credence in Dagong’s A+ U.S. ratings. According to Merrill Lynch, U.S. Treasury debt currently trades at a yield 66 basis points lower than the AAA corporate index.

---

The controversial 'Chinese Professor' TV commercial - See the alternative version below.

---

Which one do you think is more honest?